How to Think About Your Flexible Compensation Options

James Schofield - Sep 08, 2022

Shopify is pioneering a new approach to flexible employee compensation, and other companies may soon follow suit. We show you how to make the most of such opportunities to extract optimum benefits.

Shopify is arguably the most innovative businesses in Canada, and now they are taking a radically different approach to employee compensation; offering employees a choice between cash-salary or company stock. They’re the first company I’ve heard of to offer this choice, but others may follow their lead. Compensating employees with stock helps create alignment between employees and employer, because when the company performs well the employees will benefit, but if you’re given the choice of cash or stock, how do you decide how much of each to take? In this article, we’ll look at some basic frameworks to help you decide.

The first consideration is your required cash-flow: How much income do you need to cover all of your monthly expenses? Once you know that amount, you should choose a cash-salary that provides that amount (at least). Keep in mind, the salary amount on your employee compensation portal is gross income; taxes will be withheld from your monthly salary. For example, if your expenses are $6 K/month, you’ll have to select at least ~$100 K as a gross income to account for taxes, CPP, and EI premiums. If your total income is higher, you should assume even more tax will be withheld at source. For example if you choose $100 K of restricted share units (RSUs) $100 K of cash salary ($200 K total), you would be in a higher marginal tax bracket than if you’re total income was $100 K, therefore your employer may withhold $37 K, leaving you with $5,250 net monthly. [i]

Once you know the level of minimum salary you require to cover monthly expenses, you should consider how much equity to select. If you’re risk averse, you may want to skew more towards salary because it will be consistent and predictable. If you choose RSUs, think about why you’re making that choice. In other words, only take more than the minimum required equity if your confident in the company’s future.

For RSUs, when they vest, the shares’ value will be added to your income, so there are no tax advantages to keeping them once they’ve vested. If the share price rises between the grant date and the vesting date, you may want to sell them right after vesting. The main point is that if you’re choosing RSUs, it’s best to have a plan for when you’ll sell them. Setting a price that you’ll sell for or a deadline date that you will sell can help you take emotion out of the decision.

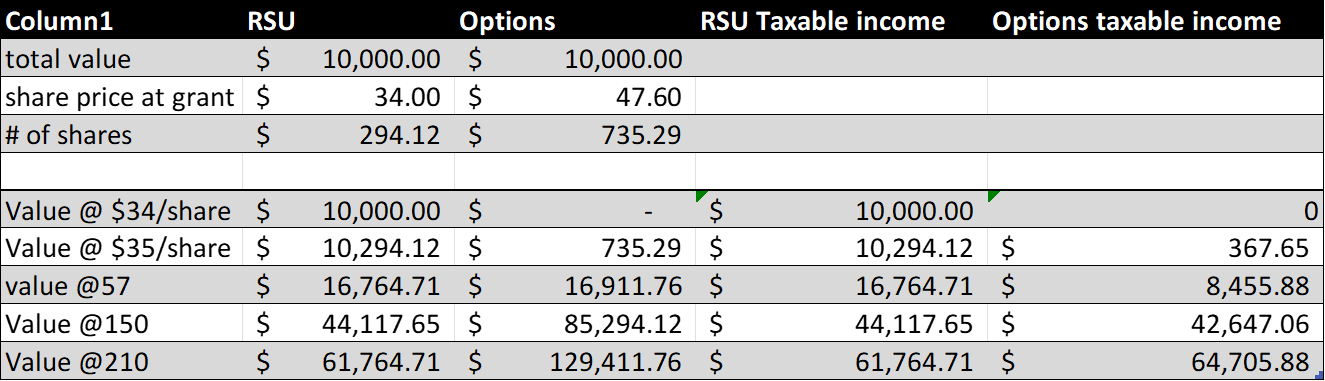

Once you’ve decided how much of your compensation to take as equity, the next question is should you take RSUs, stock options (ESOs) or a mix? This is a question of risk tolerance. The stock options have more upside, while the RSUs are worth whatever the share price is on the vesting date. The chart below will give you a sense of the risk reward comparison between RSUs vs. Stock options.

Using $34 as the example above, allocating $10,000 to RSU will give you 294 shares, with options, you’ll receive 2.5 times that number in options[ii], but the stock will need to appreciate by 40% to be worth $10 K. Using the example of $34/share, the chart above shows that $57 is roughly the breakeven point, beyond which options are the better choice, so the shares would have to increase by ~68% for the options to produce a better pre-tax outcome than the RSUs. Continuing down the chart, you’ll notice that as the share price increases, the options become much more valuable than the RSUs.

There is also a tax advantage to the stock options vs. RSUs. For stock options the difference between the market value and the strike price is usually taxed at a 50% inclusion rate[iii]. If you look at the bottom row, you’ll notice that even though the options are worth more than twice the RSUs, the taxable income is almost the same. The downside of options is that if you leave the company before the options exceed the strike price, they are worthless. Technically you will have 90 days after your last day to exercise the options, so they may never have any value.

Conclusion

A flexible compensation program can be great for employees, but you should ensure you choose enough salary to cover your regular monthly expenses before taking equity. From there, you’ll have to assess your confidence about the company’s future, the amount of time you expect to stay with the company, and your risk tolerance when deciding how much of your remaining compensation to allocate toward equity, and more specifically stock options vs. RSUs