Guided Planning Solutions - Spring 2023

James Schofield - Apr 11, 2023

In this edition of Guided Planning Solutions, we delve into the First Home Savings Account, the 2023 Federal budget, and of course, the financial markets' "March Madness". Sit back, grab a cup of tea, and enjoy reading...

As the winter fades away and the sun's warmth starts to spread its magic, we welcome you to the Spring edition of our newsletter.

In this edition of Guided Planning Solutions, we delve into the First Home Savings Account, the 2023 Federal budget, and of course, the financial markets' "March Madness". Sit back, grab a cup of tea, and enjoy reading. We appreciate your continued support and feedback, and look forward to hearing from you.

First Home Savings Account (FHSA):

The Canadian Government introduced the Tax-Free First Home Savings Account (FHSA), a new registered savings plan designed to help Canadians save for their first home. This account will be available to our clients in July/August; and we will contact our eligible clients to start the process. To be eligible, you must be:

- A Canadian resident,

- At the age majority; either 18 or 19, depending on the province, to under 71 years old,

- A first-time home buyer, which means you and your current spouse or common-law partner must not have owned a home that you lived in as your principal place of residence, at any point during the portion of the calendar year before the account was opened and in the four preceding calendar years.

Contributions & Withdrawals

- Your contributions made to an FHSA are tax deductible, unless when you make a transfer from your RRSP to your FHSA, as this transfer cannot be claimed as a deduction.

- FHSA contributions can be up to $8,000 a year with a lifetime limit of $40,000.

- Unused FHSA contribution room may be carried forward. The maximum FHSA contribution room you can carry forward to a subsequent year is $8,000.

- If you cannot, or you decide not to claim some or all of your available contributions as an FHSA deduction in the year, you can carry forward that amount and may be able to claim your unused FHSA contributions as an FHSA deduction in a future year.

- Contributions you make to an FHSA during the first 60 days of the year cannot be deducted on your income tax and benefit return for the previous year, unlike contributions to an RRSP.

- After you open an FHSA, the total of your unused FHSA contributions available to be deducted in a future year will be provided to you on your CRA notice of assessment or reassessment.

- Qualifying withdrawals from the FHSA are tax-free, including from investment income, like with a TFSA. Qualifying withdrawals are strictly for buying your first home and can be a single withdrawal or a series.

- For an FHSA withdrawal to be a qualifying (i.e., non-taxable) withdrawal, the taxpayer cannot be a homeowner but must have an agreement to buy or build a home in Canada by October 1 of the following year.

- You must close your account by the end of the year following the year your first qualifying withdrawal is made.

- The FHSA has a lifespan of 15 years. After that time, if the funds are not used to purchase a home, they can be transferred to an RRSP or RRIF without affecting your RRSP contribution room.

- Alternatively, funds can be withdrawn, but it would not be a tax-free qualifying withdrawal. You would include the withdrawal in your income and pay tax at your marginal tax rate.

FHSA & HBP:

- The Home Buyers' Plan (HBP) is a program that allows you to withdraw funds from your RRSP tax-free to buy or build a first home.

- The withdrawal limit of $35,000 and the withdrawn amount must be paid back into the RRSP within 15 years to avoid tax implications.

- Clients can use the FHSA in addition to Home Buyers' Plan (HBP), which means couples can have up to $150K towards their first-home purchase (assuming no growth of investments).

Parents & Spouses:

- Clients can personally provide funds to their spouses so that they can contribute to their FHSA. Contributing? Spouses can then claim tax deductions for contributions made.

- Parents can not contribute directly to their adult child's FHSA. But they can gift the money to their adult children, who can then use it to contribute to their FHSA. Their adult children then get a tax deduction for those contributions, and their qualifying withdrawals will be tax-free.

- No attribution rule applies to funds gifted to spouses to contribute to their FHSA. There's generally no attribution on funds gifted to an adult child.

FHSA & Death:

- An individual can name their spouse as the successor holder of their FHSA, allowing the account to stay tax–free after the individual's death.

- The transfer does not affect the spouse's own FHSA contribution limits.

- When the FHSA beneficiary is not the deceased spouse, the money must be withdrawn and given to the beneficiary.

- The account holder's terminal return will not include the value of the plan, but the beneficiary will need to pay tax on it.

Ontario and Federal Budget

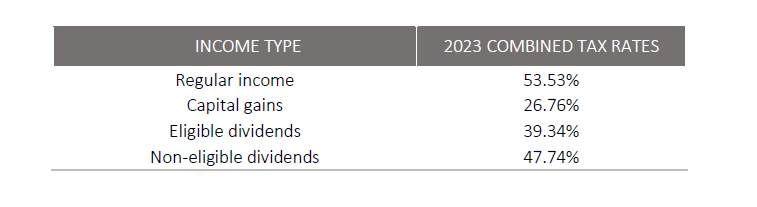

The two budgets did not propose increases or decreases to personal or corporate income tax rates for 2023. Most of the tax brackets and other amounts have been indexed by 6.3% and 6.5%, federally and provincially, respectively, to recognize the impact of inflation. The table below shows the 2023 combined federal and provincial highest marginal tax rates for various types of personal income (In Ontario).

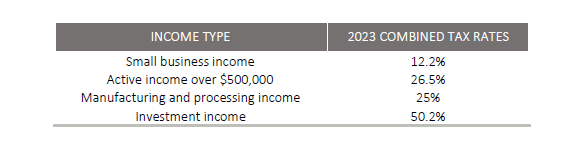

The table below shows the 2023 combined federal and (Ontario) provincial corporate income tax rates for various types of income earned by a Canadian Controlled Private Corporation (CCPC).

The federal budget did include a new grocery rebate, changes to Registered Education Savings Plans and Registered Disability Savings Plans, and an updated alternative minimum tax regime for high-income individuals. We will explain below the new withdrawal rules for the Registered Education Savings Plans as they pertain to many young families.

When a Registered Education Savings Plan (RESP) beneficiary is enrolled in an eligible post-secondary program, government grants and investment income can be withdrawn as Educational Assistance Payments (EAPs) to assist with post-secondary education-related expenses. EAPs are taxable income to the RESP beneficiary. Currently, the EAP withdrawal limit for the first 13 weeks of enrollment is $5,000 for full-time students ($2,500 for part-time students). With the new budget, the permitted EAPs in the first 13 weeks of enrollment increased from $5,000 to $8,000 for full-time students (from $2,500 to $4,000 for part-time students).

March Madness

World stock markets finished the first quarter of the year higher, but the path from January 1 to March 31 was not a straight line. Markets started the year with solid returns. In The U.S., a lower-than-expected inflation report drove the S&P 500 higher, and globally, China re-opening fueled higher expectations for global GDP in 2023, pushing equities higher. A higher inflation report from the U.S. in February spooked investors, anticipating further rate hikes from the Federal Reserve. Then came March Madness; on March 10, Silicon Valley Bank, one of the most prominent lenders in the start-up ecosystem, collapsed because of an asset-liability mismatch; watch this video for more information. The fallout resulted in a (Government seizure?) of Silicon Valley Bank (SVB) and Signature Bank, the private-sector bailout of the U.S. regional lender First Republic Bank and the takeover of the troubled Swiss bank Credit Suisse by its rival, UBS.

To clarify, the collapse of SVB was a confidence crisis created by a liquidity issue, not another "2008" situation. The latter was a legitimate solvency issue. In comparing 2008 and 2023, there are two main differences: a) The speed at which the government agencies intervened this time (three days) to bring confidence back to the markets and b) Better capitalization of the banking sector now compared to 2008. Today's banking regulations impose a much more conservative balance sheet management, meaning banks are required to have more depositors' money on hand. There are exceptions, but we no longer face the same systematic risk as 2008-09.

In any case, the stress in the banking system is not good for stock markets, even if it is limited to small regional banks, and it's difficult to anticipate how these events will play out in the short term because the market is not driven by fundamentals, but sentiment (fear and greed?). If depositors continue withdrawing from small banks, it can trigger a domino effect, and further cracks can start to show up. Policymakers are likely to take additional steps, including a possible blanket guarantee of all small commercial bank deposits, to restore confidence in the system.

These cracks in the financial system made the job of the U.S. Federal Reserve more difficult, as they added a third dimension to an already complex puzzle. In addition to the dilemma between (i) lowering inflation and (ii) maintaining a healthy labour market, they are now faced with increased risks to (iii) financial stability.

Inflation:

As indicated in our last newsletter, service inflation is still rising, fueled by historically low unemployment and wage growth (a tight labour market). In the U.S., this is primarily due to a labour shortage as more people reach retirement age, and many retire early. In response, employers are forced to raise wages to attract workers. Europe faces a similar challenge, but the cause of its labour shortage is different. The public sector grew tremendously during the pandemic leaving a smaller pool of workers in the private sector. Another factor shaping inflation is deglobalization. The pandemic exposed weakness in global supply chains. Russia's invasion of Ukraine and growing geopolitical tensions are bringing national and economic security front and center. Whether for food and energy or computer chips, companies and countries are all looking to ensure they are not dependent on supply chains exposed to geopolitical tensions. Increasingly, they want to source essential goods "at home" even if it means higher input costs and prices for consumers. As a result, we believe inflation is more likely to stay closer to 3% - 4% in the next few years, above central bank targets for even longer than expected.

Recession:

Our base case is the same as in our previous GPS; Developed economies will experience a mild recession in the second half of 2023, with no rate cuts before 2024. One factor shaping the potential recession is how high central banks will push interest rates. The trade-off between crushing economic activity or living with inflation is now impossible to ignore as economic damage and financial cracks emerge. Despite these cracks, the U.S. Federal Reserve, the European Central Bank, and the Bank of England raised rates. Even the Swiss National Bank lifted rates by 0.5% just days after facilitating a takeover of long-troubled Credit Suisse.

However, we expect major central banks to move away from a "whatever it takes" approach, stopping their hikes and entering a more nuanced phase, focusing less on the relentless fight against inflation, to be able to lower rates. On March 22, the U.S. Federal Reserve Chair Jerome Powell said that Silicon Valley Bank's collapse and the banking system upheaval it triggered "are likely to result in tighter credit conditions for households and businesses, which would, in turn, affect economic outcomes." In other words, lenders will become much more conservative in making new loans, creating a headwind for economic activity, and thereby lowering inflation.

Your Portfolio

In our last newsletter, we wrote a long section about "Your Portfolio" here on pages 4 -6, which is still very relevant today. Your portfolio can be divided into three main components: bonds, value, and growth stocks. Given the current environment, your portfolio managers continue increasing their exposure to high-quality, profitable companies and highly-rated bonds. Below is a brief commentary on each component:

Bond investors experienced swift and deep declines in their portfolios in 2022 since the Bank of Canada, Federal Reserve, and other major central banks aggressively hiked interest rates to fight inflation. This pushed bond prices down while increasing their yields. Bond yields will remain relatively high, at least through the first half of 2023, providing attractive returns for bond investors. Furthermore, a recession will increase the prices of longer-duration, higher-quality bonds. Essentially, the opposite of what happened to bonds in 2022, when yields rose, prices declined. So, in 2023 bonds will come back strong and provide downside protection.

Value stocks are back in favour since last year. The 1940s, 1970s, and 2000s in the U.S. were examples of an inflationary environment favouring value equities. Value-oriented equities, in general, tend to do better than their growth-oriented counterparts because they are less sensitive to interest rates. In other words, in a higher-rate environment, investors prioritize current earnings over the promise of future earnings. Generally, value stocks pay dividends, and these dividends provide cash flow to your portfolio, buffering downward movement to the share price. When the stock market is moving down or sideways, dividends contribute more to a stock's total return.

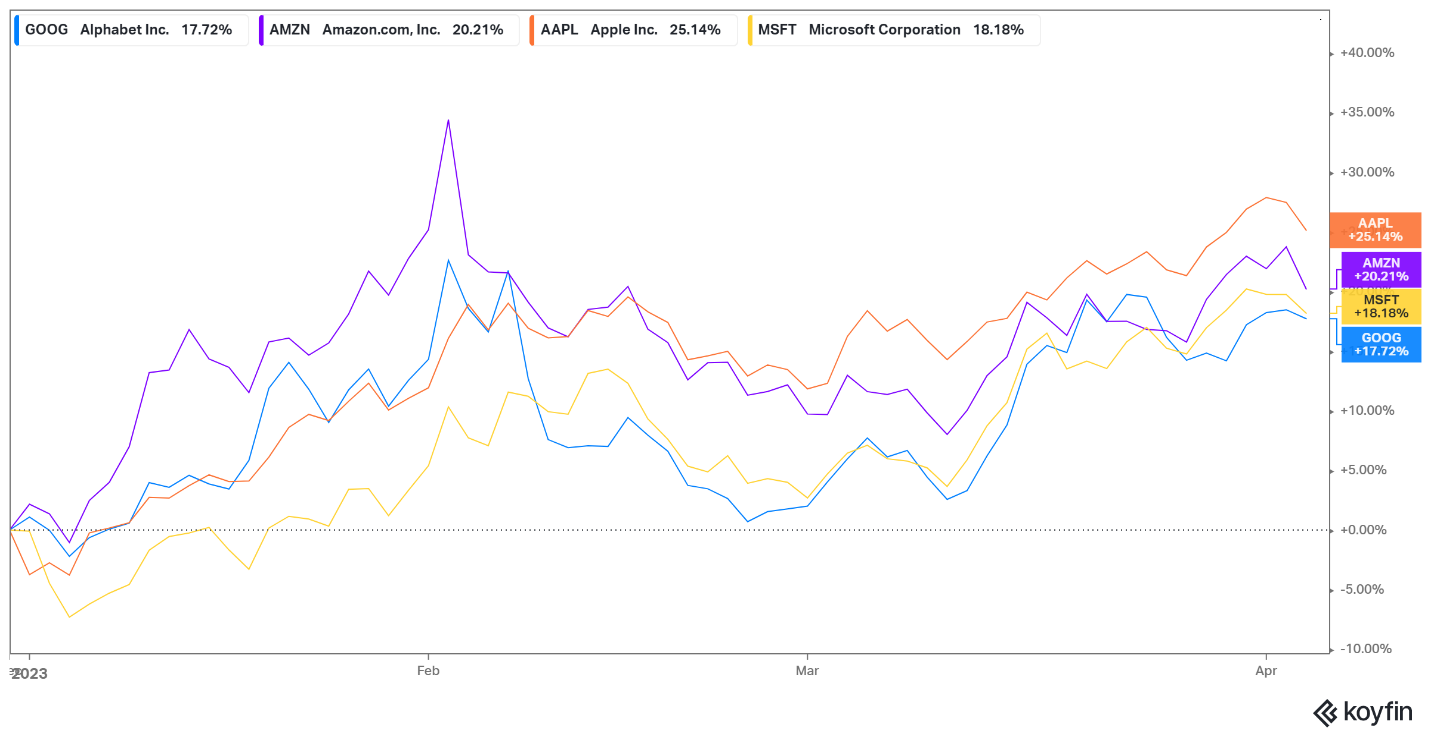

We have tilted your portfolios toward "Growth companies", which led to higher returns during the 2010 decade. In 2022 the iShares Russell 1000 value outperformed the Russell 1000 growth, by nearly 22%, leading many investors to believe that 2022 was the start of a shift to value outperforming growth for the foreseeable future. We prefer not to focus on short-term returns, but it is worth mentioning that growth has outperformed value by ~14% year-to-date, using the same indexes above. Although we think there is a place for value stocks in a properly diversified portfolio, we're still excited for the future of many high-quality, growth companies, and because so many growth stocks were punished in 2022, they practically became value stocks and presented great opportunities for your portfolio managers. Figure 1 below shows the percentage price movement of the top four stock holdings in your portfolios: Microsoft, Apple, Amazon, & Alphabet in 2022.

Figure 1

These companies are all wonderful businesses with excellent balance sheets and high returns on invested capital. In hindsight, these companies' stock prices had gotten ahead of themselves going into 2022, but they are still among the best businesses in the world and have several competitive advantages. Figure 2 shows the percentage change for the same four companies in 2023.

Figure 2

Google's (blue) stock declined ~38% in 2022, and even though it is up nearly 20% this year, it is still 41% away from its peak in 2021. There are no guarantees that any stock will get back to its all-time high, but in the case of the four named above, we believe there's still tremendous growth potential ahead, even if lower GDP and a possible recession cause growth to slow in the short-term.

What's new?

We wanted to let you know that after enjoying one year with her beautiful first-born daughter, Vera, Meredith Haggart will return to the office on May 1.

Please check out our latest blogs here. The topics include charitable donations at death, beneficiary review and income splitting.

We look forward to seeing you all again in the office, but in the meantime, as always, please let us know if there is anything we can do to help or explain things further.

Thanks for reading, and all the best!

James, Ahmed, and Steve

Assante Capital Management Ltd.

James Schofield, B.A., CFP®, CIM | Senior Financial Advisor | |Ext. 228| jschofield@assante.com

Ahmed El-Shaboury PhD, CFP®, CIM, CLU | Associate Advisor |Ext. 236| email: aelshaboury@assante.com

Steven Hughes, CFP®, CIM | Associate Advisor |Ext. 229| email: steven.hughes@assante.com