Critical Illness Insurance 101

James Schofield - May 24, 2023

If the purpose of life insurance is to cover your family if you die, critical illness insurance is meant to cover you if you live.

Critical Illness (CI) Insurance provides coverage against specific life-threatening diseases. If you become sick with an illness covered by your policy and survive the waiting period, you will receive a lump-sum cash payment, which you can use in any way you wish. This way, you and your family can focus entirely on your recovery and not your finances.

Facing a critical illness can be emotionally and physically devastating, as treating it takes time and money. Such illness often leads to high and unexpected costs that may not be covered by provincial or employee health plans, creating a sudden financial burden on you and your family. When diagnosed with a critical illness, you will likely have to miss work for treatments, and your partner may have to take time off to take care of you. This leads to both:

- Loss of family income;

- Increase in expenses due to frequent trips to the hospital, high cost of medical testing, medications and/or procedures required for a complete recovery.

Families may be forced to use long-term savings built up for children’s education or retirement to overcome these expenses. Critical illness insurance and the financial protection it provides can be a key piece of your financial plan.

If the purpose of life insurance is to cover your family if you die, critical insurance is meant to cover you if you live.

What is the definition of a critical illness?

Usually, a basic CI policy covers for four basic and most common illnesses; life-threatening cancer, stroke, heart attack, and coronary bypass surgery. Some insurance companies include more conditions in their basic coverage, such as aortic surgery, major organ transplant, and major organ failure (on a waiting list). An enhanced CI policy covers between 24-26 critical illnesses. There are some policies that will offer a partial payout in some cases of illness where treatment is less severe and very effective in managing the illness. Statistically, cancer is by far the most common, but 80-90% of critical illnesses fall within the top four

What Policies and options are available?

Today, critical illness insurance is offered with a broad range of plan types and optional riders. There are also special features such as Health Service Navigator® (HSN) or Best Doctors®; both offer a trusted medical second opinion service.

Policies can be term or permanent with term policies offered in 10 and 20 years, to age 65 or to age 75. Permanent policies can be paid over life (to age 100) or over 10, 15, 20 years. The shortened period can be advantageous for individuals interested in permanent coverage, who want to fully pay for the policy while working. The following is a list of riders available in the market today, but it should be noted that not all these riders are offered by all insurance companies:

- Second Event*,

- Return of Premium on Death,

- Return of Premium with Early Surrender Option,

- Return of Premium at Expiry,

- Waiver of Premiums on Disability or Death (when the owner and the insured are not the same person),

- Children's Rider (covers more illnesses than the original policy but up to a certain age),

- Long-term care (LTC) conversion option.

*For second event rider, part of the coverage can stay in place in certain circumstances related to the conditions of heart attack, stroke, and life-threatening cancer.

The LTC conversion option provides the option to convert all or a portion of the critical illness coverage to long-term care insurance between ages 60 and 65, without medical underwriting.

Who should consider CI Insurance?

One of the reasons most people do not purchase CI is because statistically, most people won’t become critically ill and with that being the case, someone faced with the decision may see the premiums as wasted. Like term-life insurance, many people feel that if they never make a claim, premiums are wasted.

One of the differences between critical illness and term life insurance is that you can pay an additional amount on a CI policy for something called a return of premium (ROP) rider, which means that if you never make a claim, the insurance company will return your premiums to you. If this sounds too good to be true… it isn’t, but the disadvantage is that you don’t receive a return of premium with interest, so you’re forgoing the opportunity to earn a return on the capital you used towards the CI policy. For conservative investors keeping way more cash on hand than even the rainiest day would warrant, CI can be a great way to give this cash a more useful purpose. Instead of earning 0.5% in a “high” interest savings account, you could purchase a CI policy with return of premium at expiry (ROPX) or, where the premiums are returned at the end of the policy term. In other words, the closer your opportunity costs get to zero, the more it makes sense to find a better way to utilize your cash. In this case, you are using your extra cash to hedge against the risk of being afflicted with a critical illness.

One way to frame the “buy or don’t buy decision” is to look at the cost of treatment at a specialized health facility (like the Mayo clinic); the total cost of travel and treatment could easily climb to $150 K. For most families or individuals an unexpected expense of $150 K would be financially devastating. Even for families fortunate enough to have this amount available, an expense of that magnitude could be detrimental to future financial plans like post-secondary education and retirement. In contrast this this, $4,000 of annual premiums would be much more affordable.

ROP or Not?

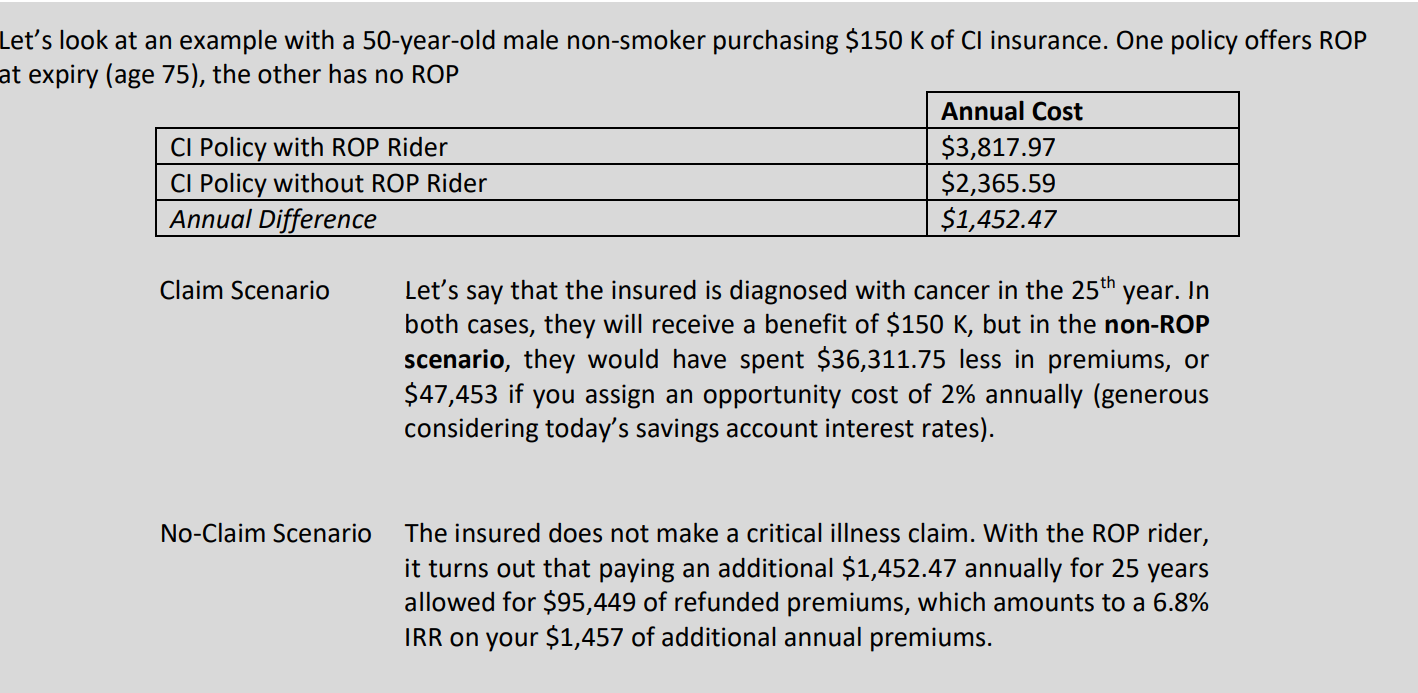

Insurance companies and agents have debated the merits of the return of premiums component of CI policies for years; detractors argue that if you purchase the rider and make a claim, you would have been better off without the rider, and if you don’t make a claim, you would be better off if you hadn’t purchased any CI in the first place, as you could have used the money for something else. We look at it differently; if you buy CI with ROP and have to make a claim, you’re not going to think about the extra cost of the ROP rider - you’ll just be glad you have the insurance, whereas if you don’t make a claim, and didn’t buy ROP, you may be missing out on tens of thousands of dollars in unreturned premiums. To illustrate this point, let’s look at a real example with internal rates of return (IRR), to find out the cost/benefit of ROP.

A 6.8% guaranteed IRR is a solid return in almost any investing context, but even better if provides the ability to make a $150 K claim in the event that you have a critical illness any time within that 25-year time period. When you subtract the total additional premiums from the total opportunity cost, you realize that it only cost $11,141.76 over 25 years or $446/yr.

We could be wrong, but we think if you gave most people the option to spend $446/yr (or $37/month) to reserve the right to receive $150 K in the unlikely event that they become critically ill, most people would gladly pay that monthly fee.