[Fall 2023 GPS] All Eyes on Inflation

James Schofield - Dec 04, 2023

In this edition of the fall GPS, we examine the inflationary environment of the past two years and how government policies have and will affect the market going forward.

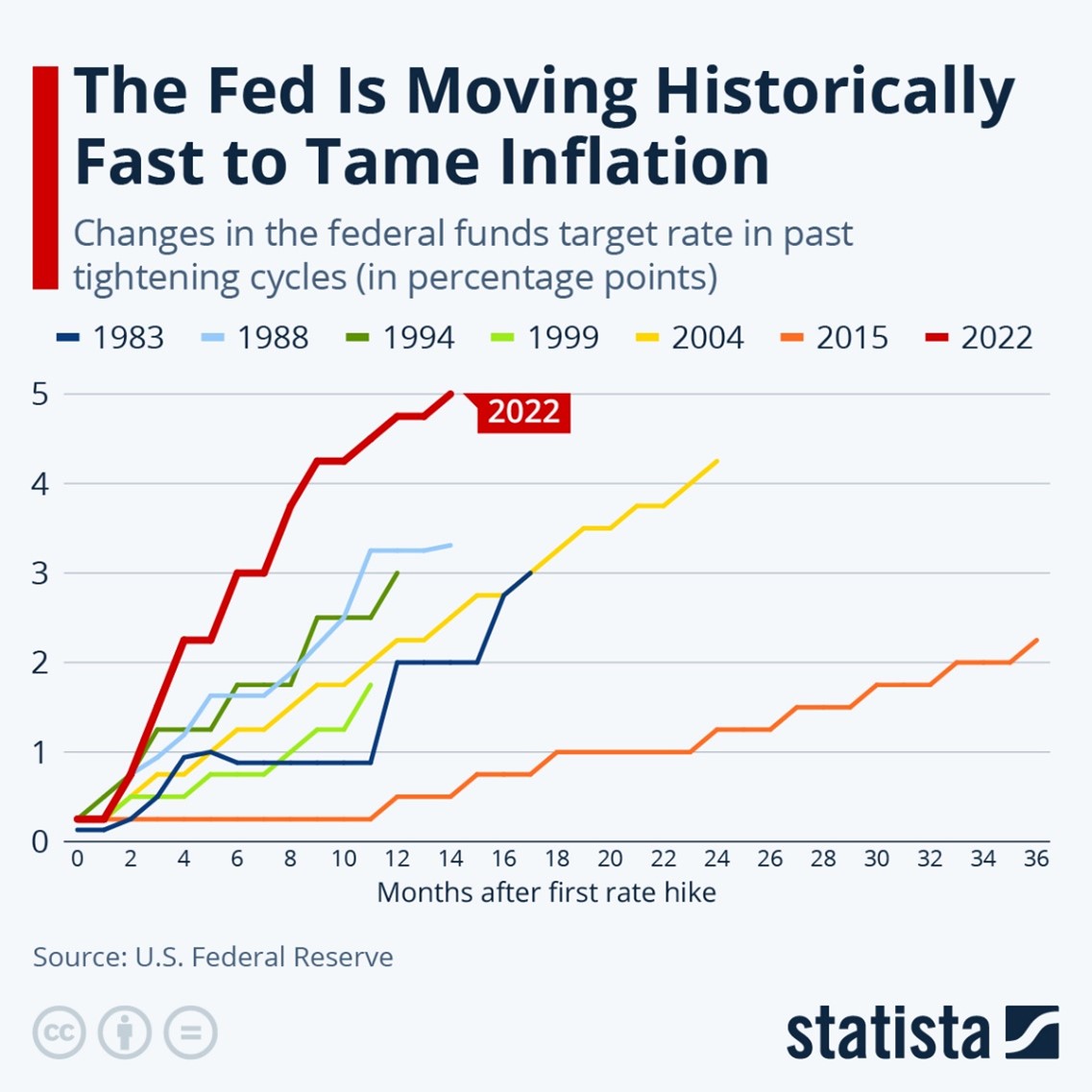

Since the beginning of 2022 the focus of US Federal reserve and Bank of Canada has been to bring inflation down, by increasing interest rates at a record pace, however hiking interest rates to tame inflation is a bit like trying to find the perfect temperature in a shower you’ve never used before with a 30 second delay – right now, central banks, are struggling with the delay; trying not to overcorrect from hot to cold. They hiked interest rates at a record pace in 2022 (see the red line in the chart below). The bank of Canada key policy rate is now at 5%; it’s highest level in 22 years. Because interest rates have an inverse relationship with bond prices, 2022 was a painful year for conservative investors, with bond prices reacting more negatively than stocks to the pace of rate hikes, but as we’ve mentioned in the past, increases in interest rates are necessary for better future returns on your fixed income (bond) investments. If central banks need to lower rates within the next few years to jump start a slowing economy, the fixed income part of your portfolios will shine, while if rates stay the same, bonds should still provide mid single digit returns.

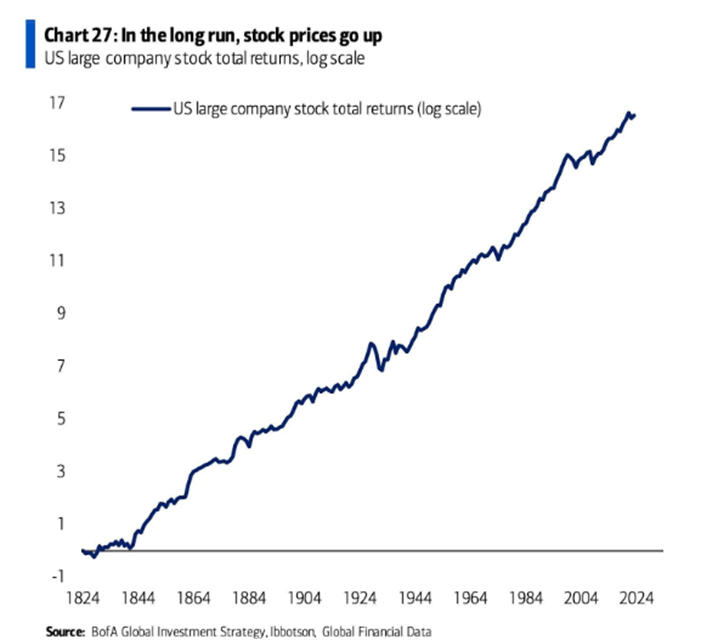

The stock market tends to be forward looking and based on the S&P 500’s performance in November (up 7.92% so far, it is anticipating a drop in interest rates. Going into 2023, most economists expected a recession in the US, and it hasn’t happened yet. With these predictions, many market participants had muted expectations for stock markets in 2023, however the S&P 500 is up almost 20% year to date, the NASDAQ 100 is up 45% and international markets are up over 15% in Canadian dollars - 2023 has served as a timely reminder of the perils trying to time the market. Whenever we see markets perform so well over a short period of time, we wonder if it is justified, but this time, most of the growth is coming from the seven largest tech companies in the world, The Magnificent Seven. Aside from these companies, stock valuations are relatively cheap. Price to earnings, while not a perfect measure, has been a reliable measure of relative value for markets. The Magnificent Seven have a forward price to earnings ratio of 33.5 while the rest of the index has a P/E of 18.3[i]. Regardless of how stocks behave in the short-term, we’re highly optimistic that stocks are still the best investment for building wealth, long-term.

[i] https://www.reuters.com/markets/us/wall-streets-magnificent-seven-face-moment-truth-earnings-season-arrives-2023-10-19/