[Summer 2024 GPS] Manager Spotlight: CI Global Leaders

James Schofield - Aug 16, 2024

In this edition of the Summer 2024 GPS, we introduce the CI Global Leaders which has been a mainstay in our clients' portfolios for the past decade and more.

In our last few editions of our GPS, we highlighted some of the Large US growth stocks driving the market’s performance in 2023. Many of these companies have continued to carry the market in 2024, with the S&P 500 reaching new all-time highs on more than 30 trading days. This has led many investors to conclude that stocks are overvalued. While traditional metrics suggest that this is true, it is important to note that some of your portfolio managers specialize in investing outside of the US and have done so effectively throughout their long careers. The CI Global Leaders fund (formerly Black Creek Global Leaders) has been a mainstay in our clients’ portfolios for over 10 years and the managers Bill Kanko and Heather Pierce continue to find great opportunities investing in high quality companies outside of North America.

The Global Leaders fund invests in companies with strong market positions, enduring competitive advantages, and competent management teams. Their focus on value leads them to invest in many great businesses that most investors have never heard of. While the fund has lagged its benchmark over the last 18 months as markets have continued to make new all-time highs driven by the largest companies in the market, Global Leaders disciplined approach to stock picking has paid off over longer periods. The team runs highly concentrated portfolios of 25-30 stocks at any given time. Investors concerned about US market valuations can take comfort in the fact that this fund looks nothing like the US market. Sixty-six percent of the fund is invested internationally in mostly medium-sized companies which the managers believe are undervalued. Whereas most funds initiate an investment in hopes of generating short-term returns, Global Leaders takes a longer-term (7-10 year) view of the companies they invest in, realizing that it can be difficult to make predictions about stock performance for 1-3 years, but well-run, high-quality companies tend to outperform over longer time horizons. One such example is Misumi Group, a leading provider of industrial products for manufacturing automation. Though the stock is down since the team purchased it in mid 2022, Misumi is likely to benefit from ongoing trends towards increased automation and precision manufacturing.

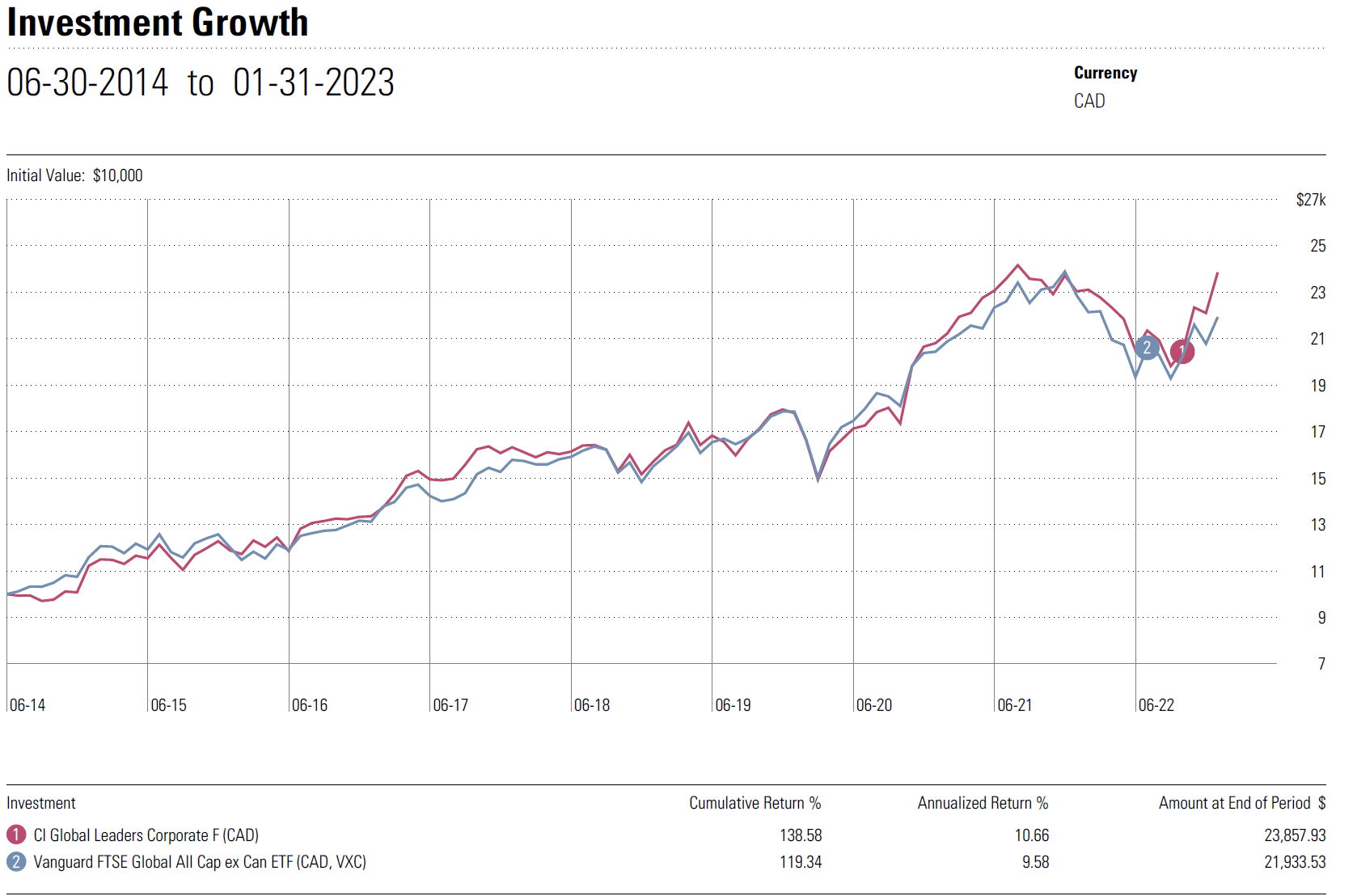

Experienced investors know that it has been nearly impossible for portfolio managers to beat their benchmarks over the last 10 years, so it is particularly impressive that Global Leaders managed to do so up until 2023 without owning any of the largest companies propelling the market to new highs.[i] We have said in previous newsletters that we think diversification is one of the keys to successful investing. The Global leaders fund looks very different than the other funds in your portfolio. With their international-first and disciplined approach to valuing companies, we expect they will continue to prove why they are a core position in our portfolios.

[i] Source: Morningstar Advisor Work Station