[Spring GPS 2025] No Pain, No Gain

James Schofield - Jun 23, 2025

A quick refresher on the concept of time horizons and how it relates to your portfolio construction.

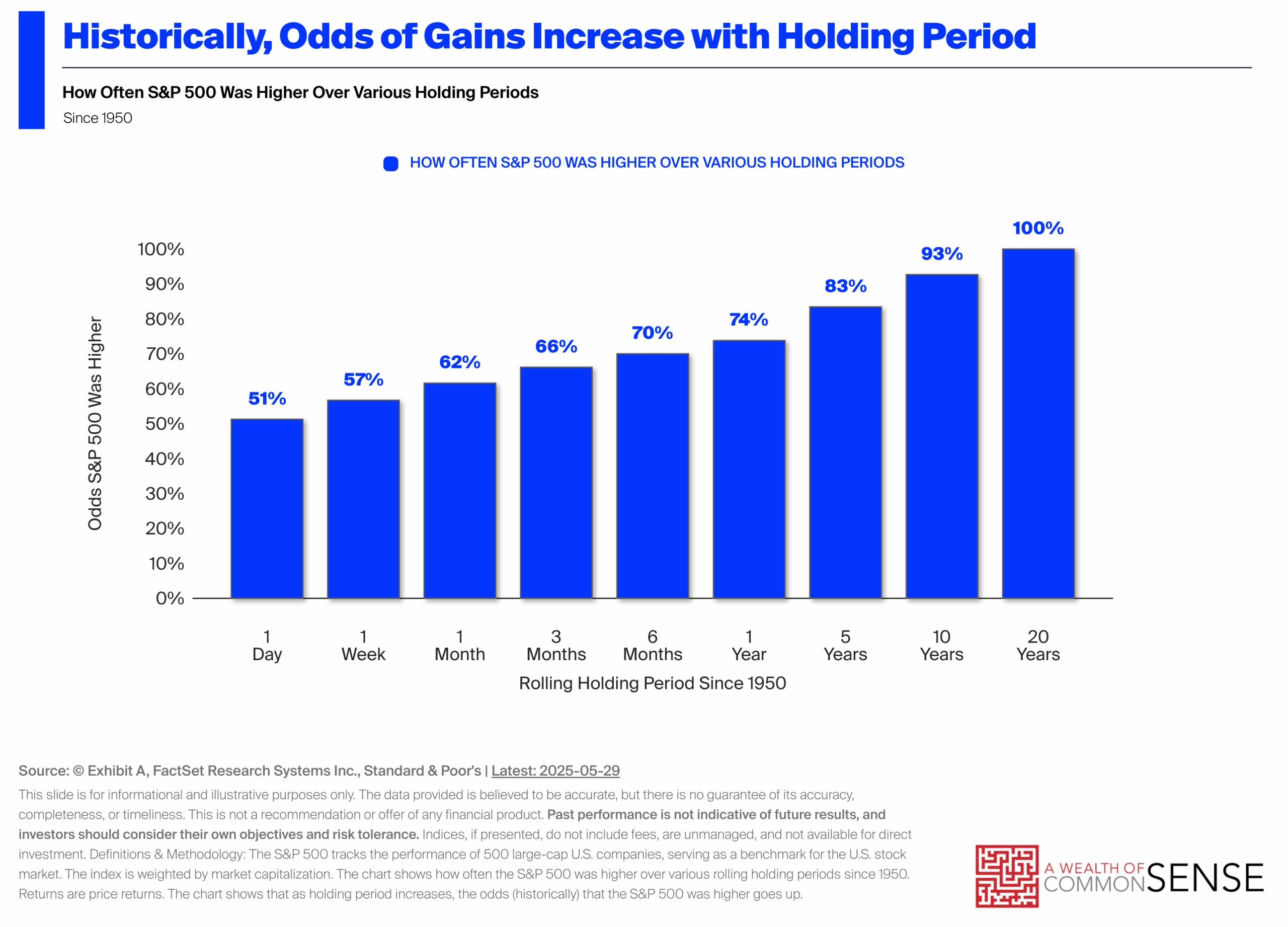

We often discuss risk tolerance in terms of your time horizon as an investor. The following charts do an excellent job of illustrating why your time horizon is crucial when constructing portfolios. The chart below shows that for 100% of rolling 20-year holding periods since 1950, the S&P 500 return was positive. But as you shorten the holding period, the probability of having a positive return decreases. Charts like this should give you confidence even amidst the volatility we’ve experienced so far in 2025.

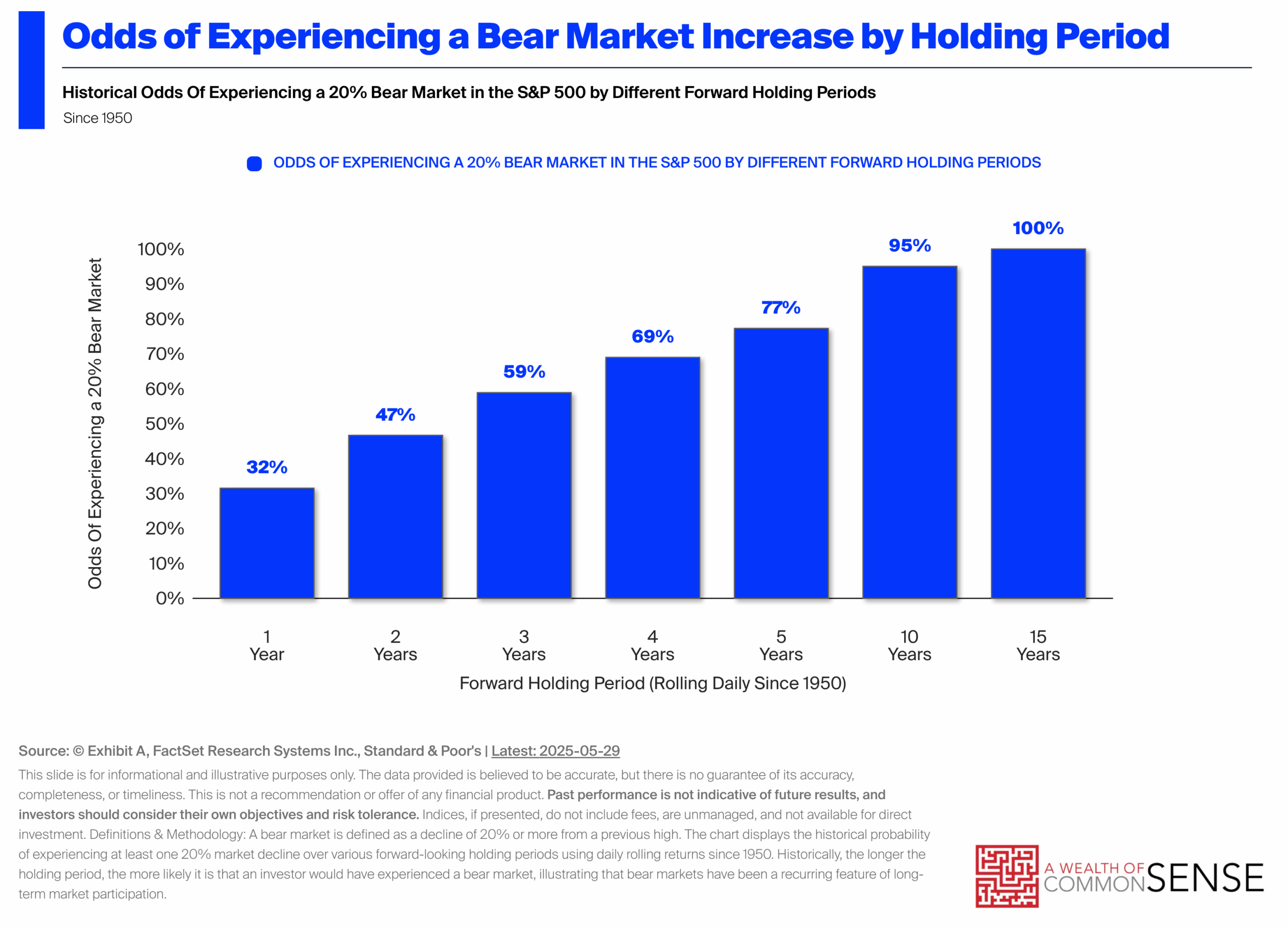

Understanding that the longer you stay invested, the higher the probability of a positive result is one thing, but an equally important statistic for investors to be aware of is that with a longer time horizon, you’re almost sure to experience significant declines in your portfolio at some point. That probability increases with your time horizon. The chart below shows that for 15-year rolling periods since 1950; the S&P 500 has had a 20% drawdown 100% of the time.

The overall takeaway is that to enjoy the benefits of investing, you must be prepared to endure occasional setbacks. The further you are from needing to rely on your investments to support your lifestyle, the more risk you should be willing to assume, all things being equal.