[Summer 2025 GPS] US Economy: Sending Mixed Signals

James Schofield - Sep 22, 2025

A quick review of the persisting unpredictable conditions in the U.S. and what this means for your portfolio.

The US remains economically and politically unpredictable, a trend we expect to continue until at least 2029. Despite ongoing inflation and a cooling job market, the US economy is still growing, albeit more slowly. Recent payroll data shows significantly weaker job creation, with broader concerns tied to immigration policy and demographic shifts rather than economic fundamentals.

Tariffs announced in early August have added more uncertainty. While the long-term impact on inflation and consumption is unclear, any sustained price increases tend to affect lower-income households disproportionately. In addition, the recent massive payroll revisions that made waves after President Trump ousted the head of the Bureau of Labour Statistics meant that the US economy only added 19,000 and 14,000 jobs in May and June, respectively. Another weak gain of 73K recorded in July indicates a broad slowdown in job growth for the overall labour market. These numbers would be worrisome in isolation, but the root causes of this weak labour market seem to be linked to Trump's immigration policies and the continued wave of baby boomer retirement. With this in mind, the weak jobs growth may not warrant a substantial shift in monetary policy (a decrease in interest rates), as spurring economic growth may not increase job growth. The decision about whether to lower interest rates is further complicated by inflation, which is once again rising in the US.

So, why does the US stock market keep going up amid this economic uncertainty? Is it hype around the possibilities of artificial intelligence, hopes of an interest rate cut, or the expectation that President Trump's policies will balance the budget and bring manufacturing back to the US? We believe it is all these factors, with a bigger focus on AI and rate cuts. The US stock market rallied on August 22nd after the US Federal Reserve chairman, Jerome Powell, noted that downside dangers to the labour market are rising, and this could warrant a policy change, meaning a rate cut in September. The primary engine behind the US stock market's remarkable rally in 2025 has been the rise of AI. Major tech companies leading the AI space include Nvidia, Microsoft, Meta Platforms, and Broadcom. Nvidia alone now represents 8% of the S&P 500's market capitalization, an all-time high for a single stock. Together, the top 10 companies account for 40% of the market cap and 30% of the earnings of the S&P 500, underscoring how dependent the market has become on a narrow slice of companies. The chart below shows that the share of market cap of the top 10 companies is outpacing the earnings contribution of these companies.

https://blogs.cfainstitute.org/investor/2025/04/02/market-concentration-and-lost-decades/

These companies continue to deliver real earnings growth, outpacing the rest of the market. But this level of concentration raises two important questions for investors: Can the extraordinary growth continue? Will massive investments in AI and digital infrastructure justify their current valuations? Currently, big Tech companies are spending at unprecedented levels on AI infrastructure, energy, and human resources to keep their growth going. In Q2 2025, Meta, Google, Microsoft, and Amazon spent just under $100 billion on capital expenditures, more than double the cap-ex spend in the same quarter two years earlier. This is an unusual shift for what was once a capital-light sector.

The challenge with AI is that some companies are profitable, while others are not. Chipmakers and the companies that build and run datacenters are profitable. While other companies that offer those services to customers and businesses (customer of the datacenters and chipmakers) still do not have profitable business models, this presents a challenge because a company spending billions of dollars on AI without achieving profitability implies that its stock valuation is based on future profitability, which may never happen.

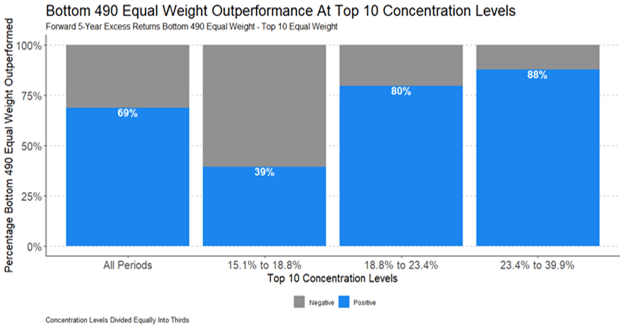

So, how does this all fit into your portfolio, and specifically, into the US equity sleeve of it? The challenge (and opportunity) as we advance is to balance the allure of mega-cap momentum with the discipline of diversification. In concentrated markets, history suggests that resilience often comes from the rest of the market, not the companies making headlines daily. Valuation gaps between the top 10 stocks and the rest of the market are widening, creating attractive entry points. Active management and exposure beyond mega-cap tech may prove critical in the next phase of the cycle. The chart below shows that historically, the bottom 490 companies in the S&P 500 outperform the top 10 88% of the time once concentration levels between 23.4 and 39.9% are reached. Right now, we’re much closer to 39% than 23%.

https://blogs.cfainstitute.org/investor/2025/04/02/market-concentration-and-lost-decades/

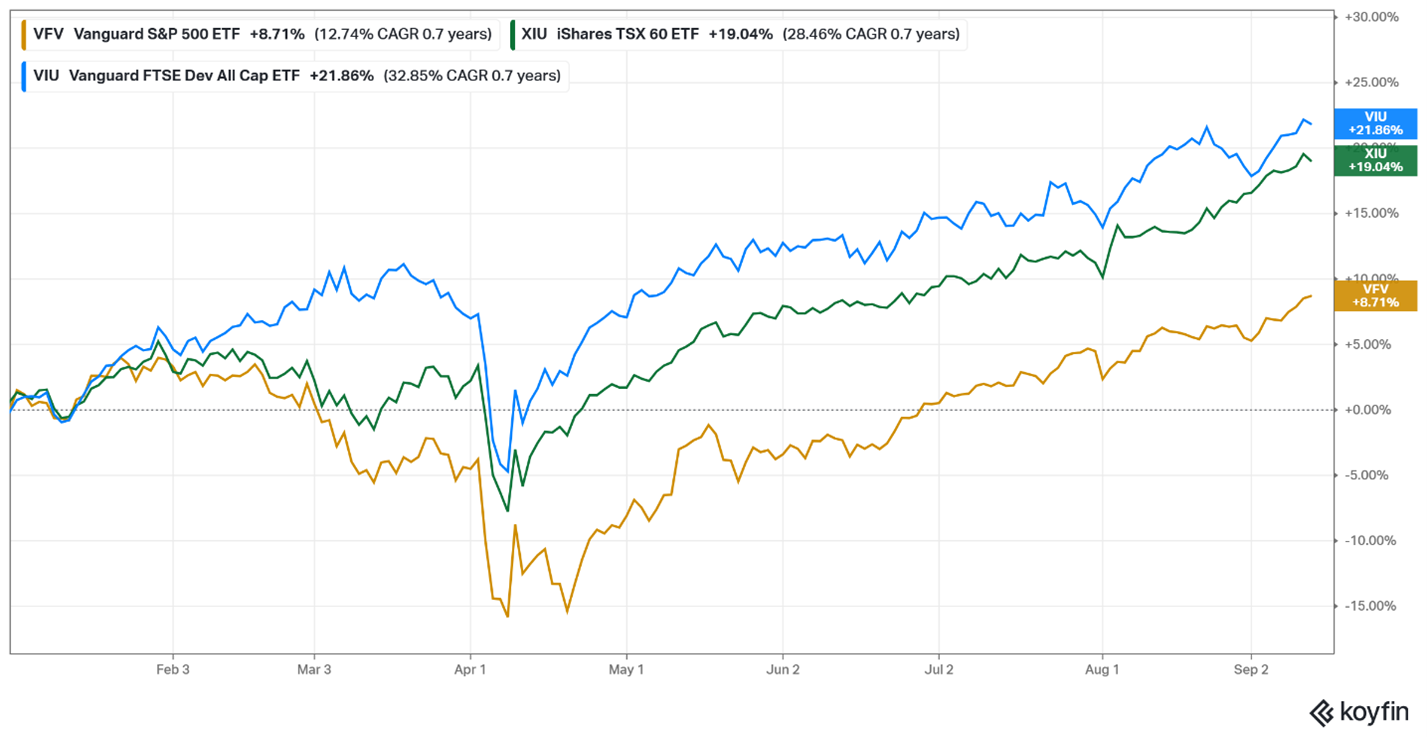

In 2025, your Portfolios have performed well for one key reason: International and Canadian markets have outperformed US equities. Within the equities piece of the portfolio, we typically have equal amounts of Canadian combined with international stocks compared to US. This decision can feel like it’s holding your portfolio back when US markets are leading the way, but in years like 2025, we’re reminded why diversification is critically important. The US market was down over 11% from the end of January to the end of April, whereas the stock market excluding the US market was down less than 3% over the same period.

The chart below shows the growth of the international market (blue line), the Canadian market (green line), and US Market (yellow line) since the beginning of 2025.

https://app.koyfin.com/home