Declines All Around, but Opportunities to Be Had

Connor Morris - May 26, 2022

Central banks have the delicate task of reducing inflation without triggering a recession. With further rate hikes possible in an already difficult market, caution is key. Here’s where we see opportunity in the current investment landscape.

So far, 2022 has presented a difficult market to invest in, with significant declines in both bonds and equities. The biggest concerns have been central banks beginning to raise interest rates and risk of recession, although there are no signs that we have entered a recessionary period yet. The two events are actually correlated, meaning higher rates will typically raise the likelihood of recession. We believe central banks have a very short window to raise rates as borrowers’ ability to pay higher rates is low.

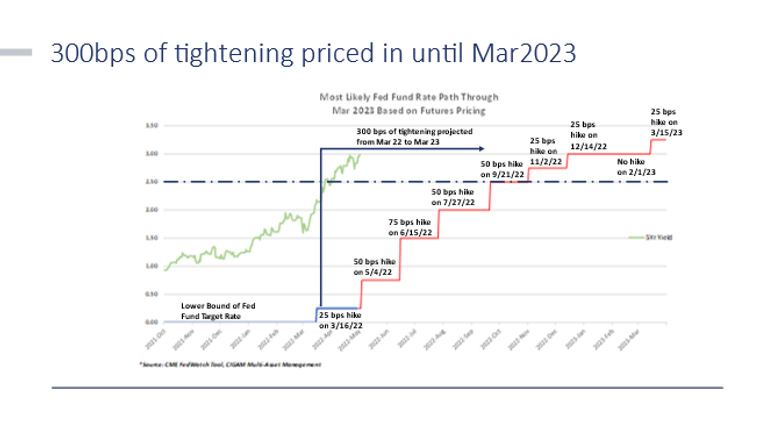

The markets are now pricing for (i.e. expecting) a total interest rate hike of 300 basis points by the US Federal Reserve within the next 12 months. If it is fulfilled, this will be one of the most rapid hiking cycles in recent memory. The terminal rate will also be higher than that for the previous cycle. Since global debt is significantly larger, a high terminal rate will likely have significant negative implications on spending and could cause a recession. We believe a more realistic path is a series of hikes to 250 basis points, allowing economies and inflation to cool gradually. If the Fed were to apply this strategy, this would mean that bonds are already oversold at current prices and investors could earn a decent income, plus capital gain.

Source: CME FedWatch Tool, CIGAM Multi-Asset Management

Following the outbreak of the COVID-19 virus, central banks did everything possible to restore business and consumer confidence and support prices. We had an unusual period where risk was low and returns were exceptional. The longer those conditions last, the higher inflation will climb and the longer disruptions to economies will persist. It is necessary for central banks to “step back” but now investors are concerned they could overcorrect and cause a recession.

First, it is important to note that recession is normal. It helps to re-price risks and reset the economic system. Without recession, we would have too many risk takers, lack of competition, low efficiency, and a widened wealth gap. Also, recession makes investing in equities more challenging as some investors will experience losses. We expect central banks to be cautious and avoid triggering a sudden or deep recession.

With this backdrop, we are finding plenty of investment opportunities to keep us excited. Technology innovation trends will continue and may only slow if a recession causes a temporary setback. As a result of price correction since mid-2021, many tech companies are very attractively valued. We are also seeing opportunities to own Canadian energy companies that are generating large cash flows as the world looks for alternative sources to Russian oil. Cenovus Energy Inc., which is held in our portfolio, recently announced plans to triple their dividend and aggressively buy back shares. While electric cars will one day replace gasoline vehicles and reduce demand for oil, the cash flows energy companies could generate before then will be very rewarding to shareholders.