RRSP versus TFSA: Did you ever have to make up your mind?

DA Marketing - Dec 30, 2019

Learn about the number one factor that determines whether an RRSP or a TFSA delivers the best performance for retirement savings.

Identify your objectives

Since an RRSP is designed for retirement savings, we’re only comparing the two vehicles in regard to long-term savings for retirement income. This makes it very important to identify short-term, medium-term and long-term goals in your financial plan. Choose the TFSA to meet any goals that call for withdrawing funds before retirement. An exception might be saving for a first home with the intention of using the RRSP’s Home Buyers’ Plan. If a down payment is one of your financial goals, talk to us about whether you should use a TFSA, RRSP or both vehicles in your situation.

The long-term savings decision

Once you feel confident in designating a certain amount to retirement savings, you’re ready to make the RRSP versus TFSA comparison. Determining which vehicle is better from a performance perspective revolves around one factor – your marginal tax rate, or tax bracket:

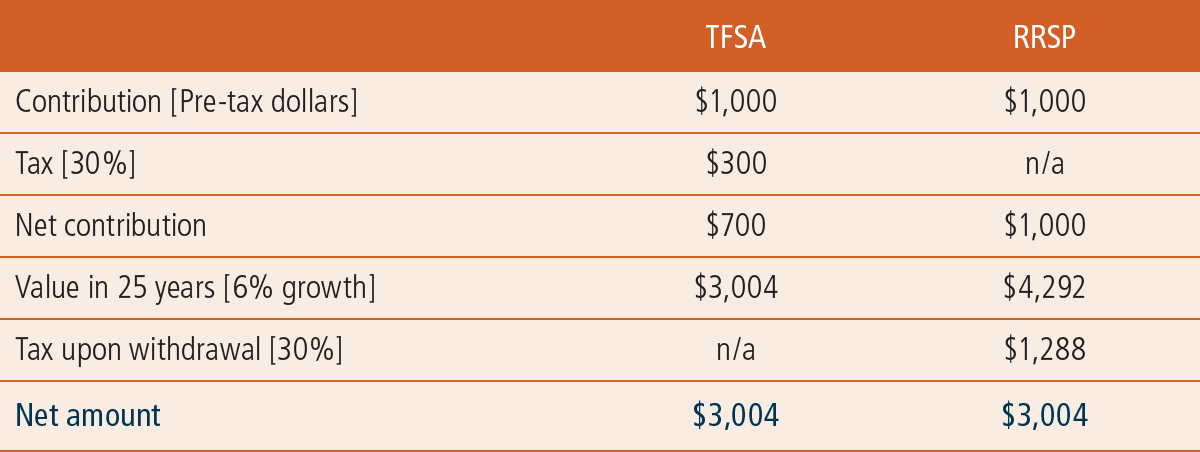

- A TFSA and RRSP perform equally when your marginal tax rates are the same at the time you contribute and when you withdraw funds in retirement.

- An RRSP comes out ahead when your tax bracket is higher upon contributing and lower when withdrawing.

- A TFSA wins out when your tax bracket is lower upon contributing and higher in retirement.

It’s important to note that the above comparisons are based on any RRSP tax refunds deposited into the RRSP. Also note that some guesswork is involved, as you need to forecast your marginal tax rate in retirement. All of this is a process we can do together. And we’ll be sure to factor in Canada Pension Plan (CPP)/Quebec Pension Plan (QPP) and Old Age Security (OAS) benefits, as these amounts can move a low marginal rate up to the next tax bracket.

Three effective strategies

Hedge your bets. Deciding between a TFSA and an RRSP is a challenge if there is difficulty forecasting your tax bracket during retirement. A solution is to hedge your bets – simply divide your annual contributions between a TFSA and an RRSP.

Adapt to change. You can invest in a TFSA during years you’re in a lower tax bracket, then switch to RRSP contributions if increased annual income pushes you to a higher tax bracket. Remember, you were still building RRSP contribution room during your income-earning years. In some cases, an individual may wish to redeem TFSA assets, contribute the funds to an RRSP, and benefit from a significant tax refund.

More than math. You may have a psychological reason for choosing one vehicle over another. For example, someone who lacks financial discipline may worry about using a TFSA for retirement savings because it’s so easy to withdraw funds. This person may choose an RRSP because early withdrawals are subject to both withholding tax and income tax, and contribution room is lost permanently.

If you or a family member ever wants guidance in choosing between a TFSA or RRSP, please consult us. We’ll show you how performance compares at retirement and discuss other personal factors that may affect your decision.

TFSA and RRSP Comparison

When marginal tax rates are equal upon contribution and withdrawl. Amount of TFSA net contribution reflects that TFSA contributions are made with after-tax dollars. RRSP contribution amount and calculations assume that any RRSP tax refund is deposited into the RRSP.