Energy Gridlock: The Sign of Economic Slowdown?

Connor Morris - Oct 27, 2021

Global energy issues have caught investors’ attention over the past month. Find out how we got here and whether the shortages are the sign of a broader economic slowdown.

Global energy issues have caught investors’ attention over the past month. China is rationing electricity, power plants in India are running out of coal and Europeans are paying sky-high prices for natural gas. While North America is in better shape, the global issues are contributing to higher energy prices here, including at the gas pumps. So, how did we get here and will it cause a broader economic slowdown?

The kink in the hose

The reasons for the shortages range from bad luck to bad policies. In Europe, calm winds have curtailed wind turbine electricity supply across the continent, whereas China’s problems stem from their reduction of coal imports from Australia. Other factors include a reduction in coal, oil and gas extraction caused by the pandemic and government policies to combat climate change.

A retro revival?

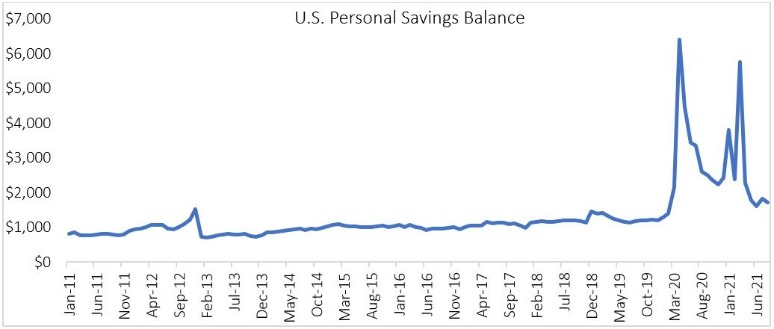

There are concerns that higher energy prices will start to constrain overall consumption and economic growth like it did in the 1970s. In our opinion, the comparisons to the 1970s are not well-founded for a few reasons. Firstly, the share of energy in consumers’ consumption baskets has fallen from 11% in 1960 to just 3% today. Secondly, consumers are still sitting on a pile of savings built up during the pandemic that could be released if the need arises.

Source: U.S. Bureau of Economic Analysis. As of August 31, 2021.

The root of the issue

The real reason we don’t foresee a 1970s-like recession is that most of these supply issues are solvable. In Europe’s case, they can import more gas from Russia, although politicians are probably reluctant to approve a pipeline that could be used as a political weapon. In China’s case, they can import more coal to ease the supply crunch. In India, they are ramping up domestic production targets.

In addition, higher energy prices increase the incentives for energy production, which will help balance supply. While we don’t expect a broader economic slowdown due to higher energy prices, we still believe the Organization of the Petroleum Exporting Countries’ (OPEC) supply discipline and recovering demand will keep the price of oil elevated into next year.

Our portfolio positioning on energy

As you know, we take a long-term view when it comes to our positioning strategy but do make tactical adjustments as opportunities arise. Therefore, we continue to hold an overweight position in the energy sector, which has benefitted our portfolio returns. More broadly, our call to overweight equity and simultaneously underweight bonds continues to reward investors. We maintain our core view that the COVID-19 situation will continue to improve, driving a strong recovery across many sectors.

For more information on our portfolios and investment strategies, visit our managed solutions page on the new ci.com website.