[Fall 2023 GPS] Real Talk on Real Estate

James Schofield - Dec 04, 2023

In this section of the Fall GPS, we review the current landscape for real estate investments.

Real Estate: Navigating Challenges and Embracing Opportunities

Commercial Real estate investments have been a consistent pillar in our clients’ portfolios. Positioned as a unique asset class, real estate shares similarities to bonds; Property owners collect streams of income i.e. rent, and bond investors collect coupon payments associated with the bonds they own. Real estate also exhibits a notable correlation with stocks, often mirroring the movements of the equity market.

In the current economic landscape, investors are confronting various risks within the commercial real estate market. The secular shift towards remote work has translated into higher vacancy rates for office buildings, compounded by rise in interest rates. Owners of office properties, who traditionally use significant amounts of floating rate debt for property acquisitions, are struggling with lower revenue due to increased vacancies, and elevated expenses because of higher debt servicing costs.

While acknowledging the challenges faced by office real estate, it is important to recognize the diverse sub-categories within general real estate industry. Notably, the office category constitutes less than 16% of the broader real estate sector. Despite the current challenges in the office space, there are flourishing segments within real estate, with residential apartments emerging as a beacon of growth, particularly in Canada, where higher property values are pushing would be buyers into the rental market.

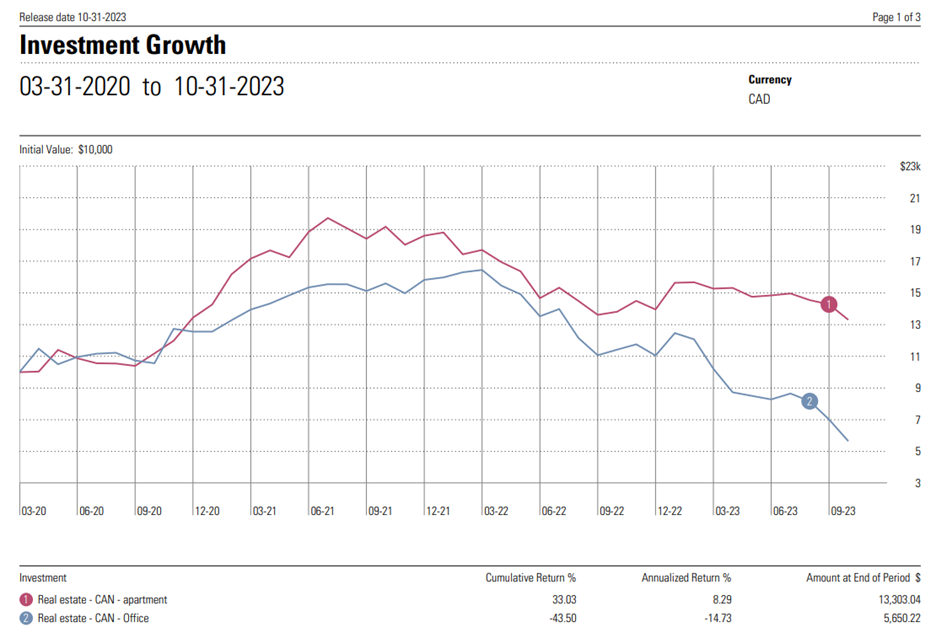

Highlighting this category divergency the chart below shows an annualized return of 8.29% from April 1, 2020, to October 31, 2023 for Apartment REITs in Canada vs. a negative -14.73 annualized return for office real estate in Canada over the same time period.

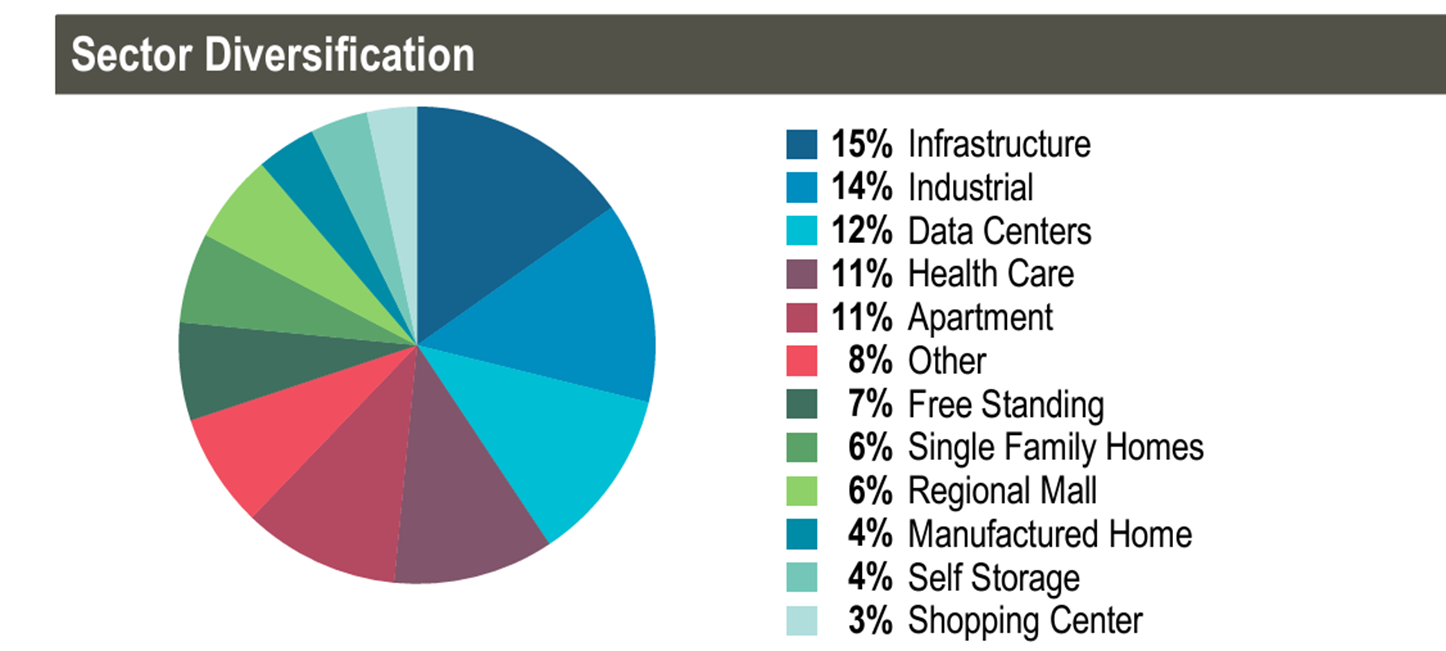

It may be surprising to many of you that the Real-Estate fund in your portfolio has a significant position in residential real estate, either in apartment buildings or single-family homes. Here is a look of how the fund is diversified over several sectors as of the end of September 2023:

There are a total of twelve sub-classes, and the residential real estate position is significant. But, as we mentioned several times in our meetings, the fund is being painted with the same brush as pure office-space investment funds.

The recent upward trajectory of interest rates, occurring for the first time in many decades, has led to a general sense of pessimism toward the asset class. Recognizing the tendency of investors to react strongly to prevailing economic trends, we firmly believe that opportunities are available within various segments of commercial real estate. We believe real estate, which has seen improved valuations with the correction in share prices, offers attractive return potential relative to broad equities. Slowing inflation and still healthy demand should provide a more supportive backdrop for REITs as we approach the end of the Fed hiking cycle. While growth will likely decelerate, cash flows should generally remain sound as supply stays in check. Further, an end to central bank tightening, which we expect in the coming months, tends to be followed by notable strength in listed real estate performance.

While real estate has exhibited higher volatility than usual over the past three years, and the future remains uncertain, we maintain confidence in the enduring appeal of real estate as a valuable component within diversified portfolios. Our confidence in the ability of our fund managers to identify and capitalize on mispricing’s within the real estate market underscores our optimistic outlook.