[Fall 2024 GPS] Special Report: U.S. Elections

James Schofield - Nov 04, 2024

Americans head to the polls to select their new President on November 5. But how will the outcome affect markets and your investments?

On November 5, American voters will select a new President. Many investors wonder how markets will react on the days following the results. Below is a snapshot of each candidate’s platform:

Trump: 1) Extend Trump 1.0 personal income tax cuts set to expire at the end of 2025, 2) reduce the corporate tax rate from 21% to 15%, 3) implement aggressive tariffs, and 4) much stricter immigration policy.

Harris 1) Extend personal income tax cuts, for lower earners, 2) increase the corporate tax rate to 28%, 3) implement various incentives for families and small businesses, and 4) adopt a stringent yet less aggressive approach to trade and immigration.

Let's examine some of these proposals.

Tariffs:

Both candidates indicated that they believe tariffs are essential to protect national industries. Many economists believe this could re-ignite inflation, making the job of the Federal Reserve (the FED) more challenging in the short term. Tariffs are unlikely to spark sustained inflationary pressures in the economy, though they may increase inflation in the first year they are imposed, the effect will not be permanent, as inflation is a year-over-year metric.

Fiscal Policy:

The U.S. is estimated to have its largest deficit on record, at 7% of the 2024 GDP, significantly more than the 50 year average, of ~3.7%and it seems unlikely that the next government will improve this. On the contrary, Trump proposes extending many provisions in his tax cuts introduced in 2018, and he intends to eliminate taxes on Social Security benefits and lower the corporate tax rate to 15%. These measures are expected to increase the deficit, despite the aggressive tariffs he plans to introduce.

Similarly, Harris promised to expand the child tax credit, strengthen the earned income tax credit, provide down payment assistance for first-time homeowners. These initiatives would increase the deficit as well. She plans to boost the corporate tax rate to 28%, which is unlikely to offset the impact of her tax-credit initiatives.

Investment Implications:

Though election results and possible policy changes may influence specific industries. Historical data suggest that the economy's present situation and future direction are more important for the financial markets than the party in power. Businesses should benefit from the Trump administration's focus on decreasing corporate tax rates and regulations. While the Harris administration's plan to raise corporate taxes, maintain regulation, and support labour unions could hurt business profits. These reforms may boost worker and labour rights, but lower earnings and investors’ desire to own stocks.

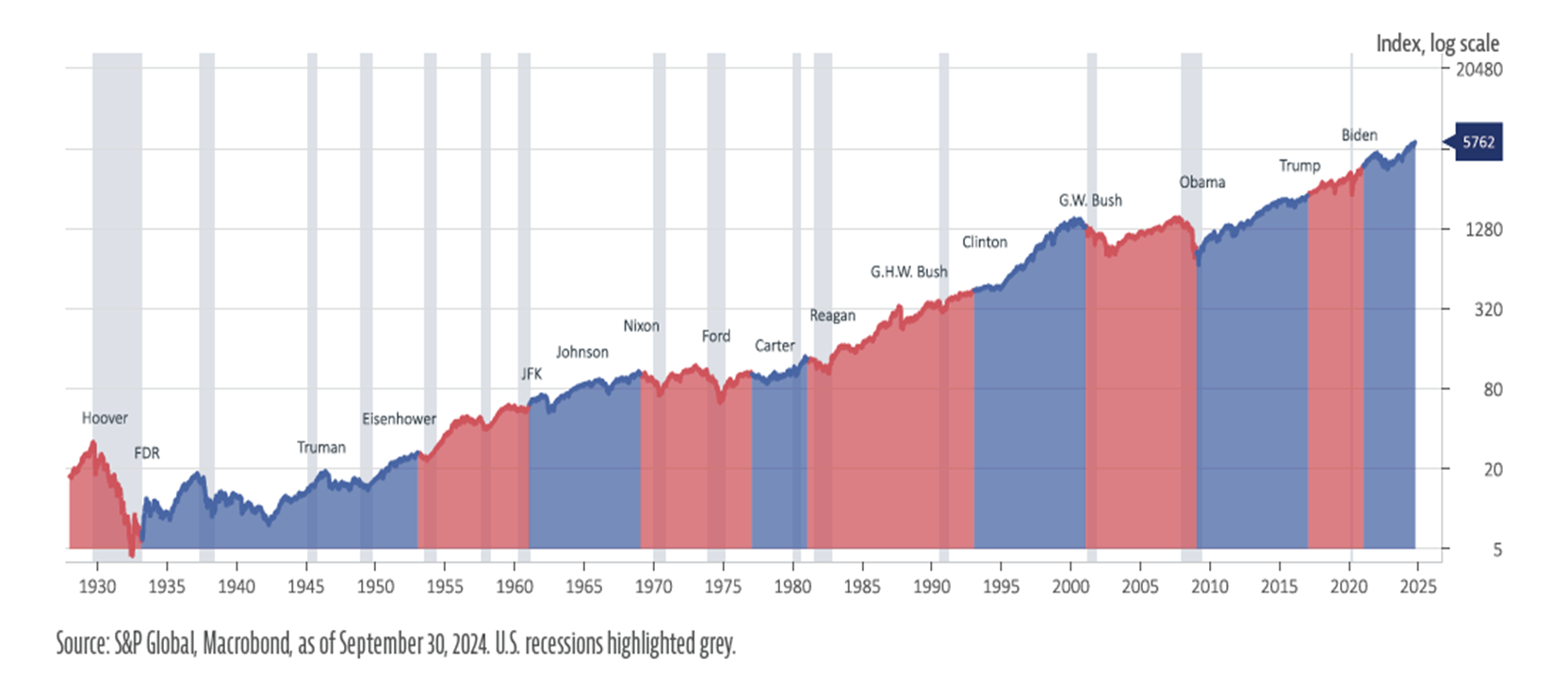

A long-term chart of the S&P 500 and presidential parties shows no noticeable difference in performance between Republican and Democratic presidents. Instead, monetary policy, economic growth, labour markets, corporate profits, and equity valuations are much better indications of future returns.

Chart 1. S&P 500 Price Return (President and their parties highlighted)