[Fall 2025 GPS] Markets: AI bubble?

James Schofield - Dec 10, 2025

Is there an AI bubble in the stock market or not? Does it matter?

The existence or non-existence of an AI bubble in the stock market is a subject of ongoing debate among investors and analysts. Although valuations for prominent AI-centric technology companies have increased, there are compelling arguments on both sides on whether the market is in a bubble.

Indicators of Speculative Bubble Dynamics

Some analysts claim that the swift and focused increases in the stock prices of companies within the AI space are eerily similar to past market bubbles, notably the dotcom boom. The "Magnificent 7" (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla), currently account for around 37% of the S&P 500's total market value. The magnitude of investment in AI infrastructure is unparalleled; cloud capital expenditures are projected to increase fourfold from 2023 to 2026. Specific data metrics, such as the Buffett Indicator (market capitalization divided by GDP), have surpassed levels observed during the dotcom bubble, suggesting potential overvaluation. There are concerns about whether the current rate of AI investment will deliver the expected economic rewards, and what it would mean for markets if future earnings fall short of expectations.

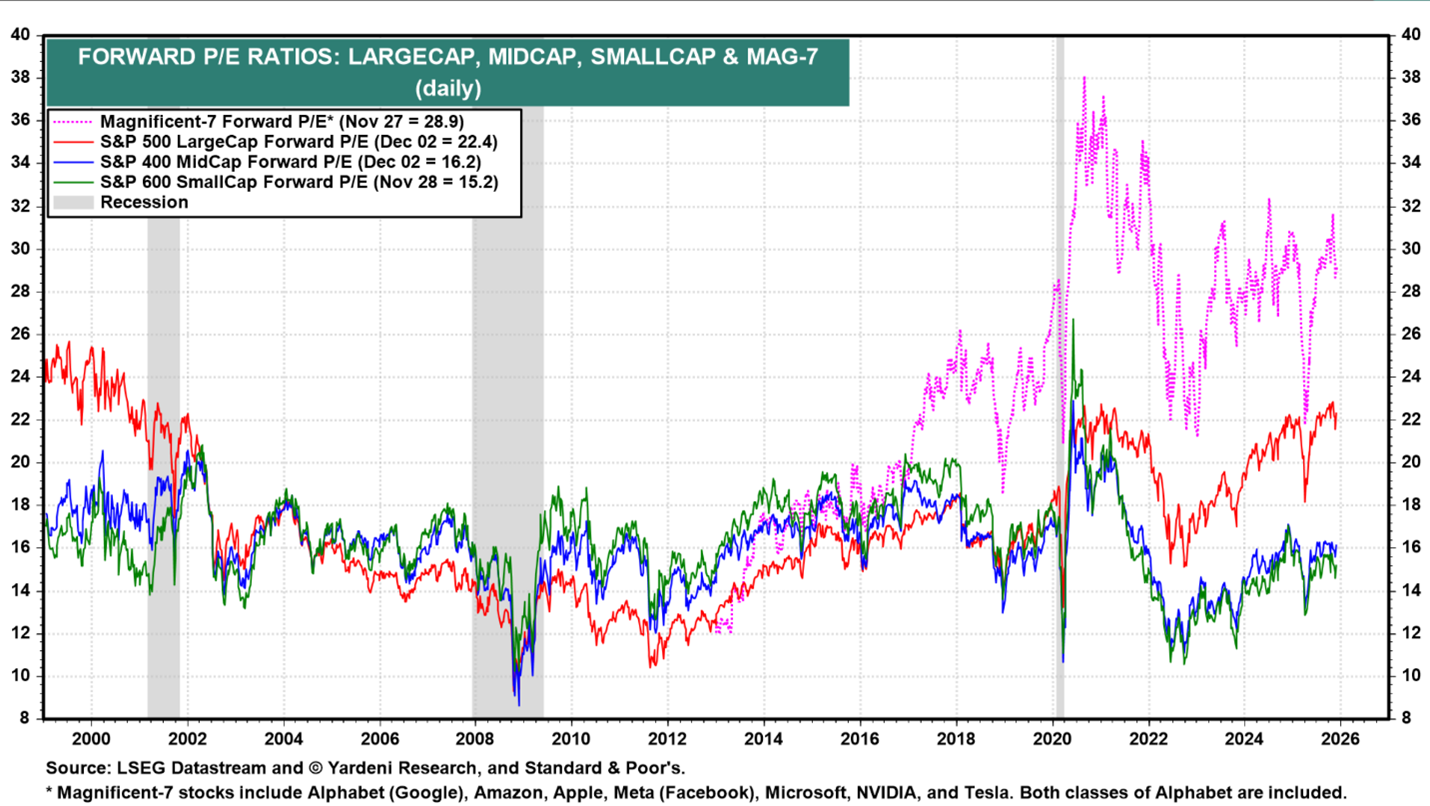

The chart above shows that the relative valuation gap between the Magnificent 7 companies (pink line) and the rest of the market has seldom been wider. The last time the gap between large-cap (red line) and mid/small-cap stocks (green and blue) was this wide was 1999.

Arguments Opposing an AI Bubble

In contrast to the late 1990s, the majority of today’s AI leaders are highly profitable and have sound balance sheets. Valuations, though high, remain well below levels of the dotcom peak. The current forward earnings multiple for the S&P 500 Information Technology Index is approximately 30x, compared with 55x in 2000. The present AI surge has been propelled more by institutional investment and strategic capital allocation than by speculative enthusiasm from retail investors. AI is currently enabling measurable productivity gains, and many anticipate broader adoption and future financial benefits.

Present Risks and Forecast

Recent volatility and significant declines—such as the 20% dips in Oracle and Meta—suggest emerging market skepticism. If the rise in AI-related profits stagnates or capital expenditure diminishes, investors may swiftly reevaluate their AI allocation, leading to further falls in a market correction. Numerous experts perceive the current situation as possibly overextended, yet fundamentally unlike previous bubbles owing to the financial robustness and scale of the market’s current leaders.

Our view

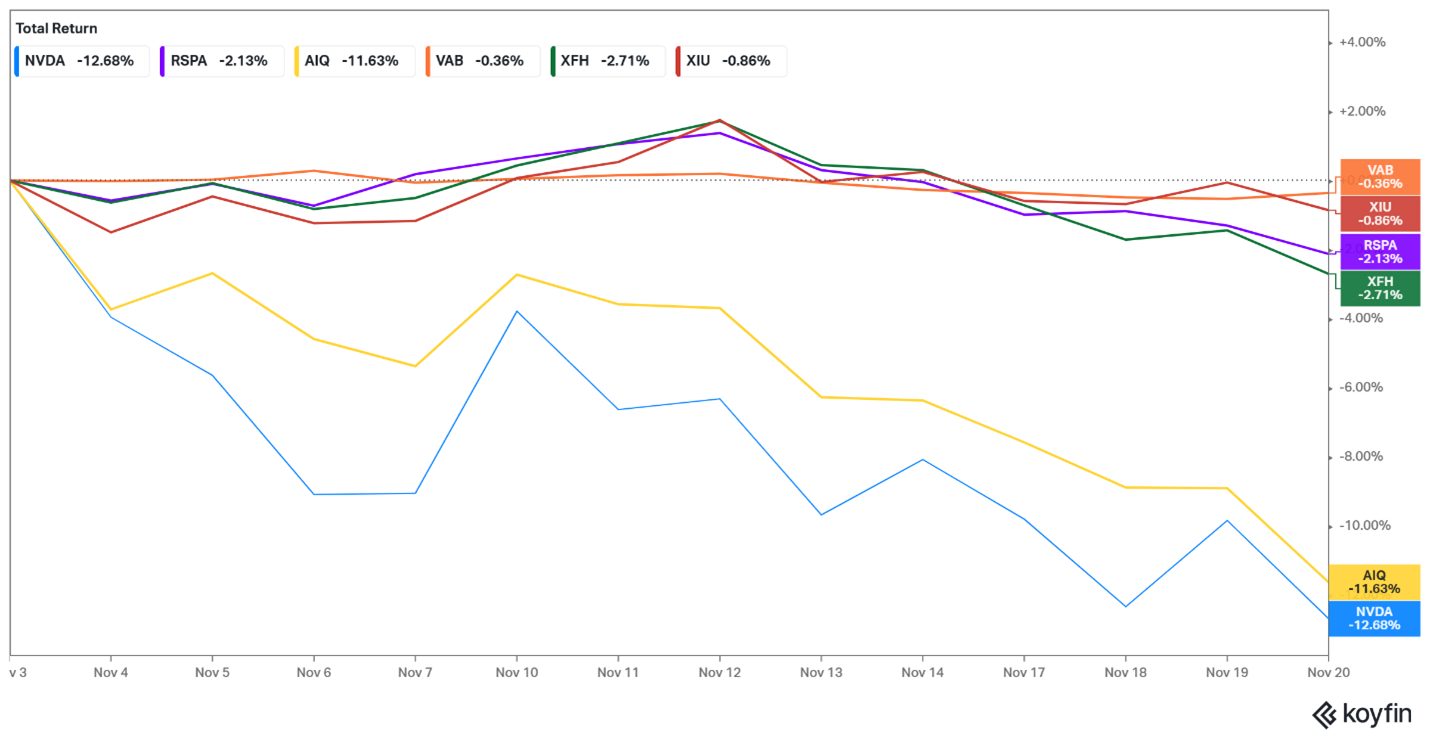

Even if valuations are near all-time highs for parts of the market, it’s essential to understand that there are still parts of the market that are not as expensive compared to historical valuations. There are great companies whose stocks are down in 2025. Part of your portfolio managers’ job is to identify undervalued companies to invest in, which is what they’re doing right now.

The chart above shows the performance of securities and indices through the recent market decline from November 3, 2025, to November 20th. You’ll notice Nvidia and AIQ (an AI ETF) were both down over 11%, while International stocks, the equal-weighted S&P 500, the TSX, and the US aggregate bond index were all down less than 3%. Your portfolios bear much closer resemblance to the orange, red, purple, and green than they do to the yellow and blue.

Portfolios: Are your managers worried?

One of the core holdings in your portfolios is “CI Munro Alternative Global Growth Fund”, a fund managed by Munro Partners, an investment firm based in Australia. Nick Griffin, the founding partner and chief investment officer, recently appeared on a podcast discussing markets and opportunities.

Nick believes the current bull market, driven by the AI revolution, is only in its early stages and could last a decade. He argues that trillions will be spent on building AI infrastructure, benefiting a wide range of companies tied to this megatrend. There will still be significant investments made in clean energy, semiconductors, data centres, and related technologies. At the centre of this development are firms such as TSMC, Nvidia, and significant hyperscalers. Industry-wide use of AI will necessitate new computing infrastructure while also benefiting suppliers and enablers.

Instead of a bubble, Nick’s sees AI as the catalyst for more growth—a structural shift akin to the iPhone era, not merely speculative hype. In contrast to the dotcom bubble, valuations have not yet reached all-time highs, and the businesses driving this expenditure have strong cash flows that are not excessively leveraged. Finally, he sees US–China tensions and reliance on Taiwan (TSMC) as real risks, but believes a significant disruption is unlikely since all sides are motivated to keep supply flowing.

Nick’s approach is optimistic and forward-looking—he encourages participating in secular growth trends rather than sitting on the sidelines in fear of bubbles.