[Fall 2025 GPS] FHSA

James Schofield - Dec 10, 2025

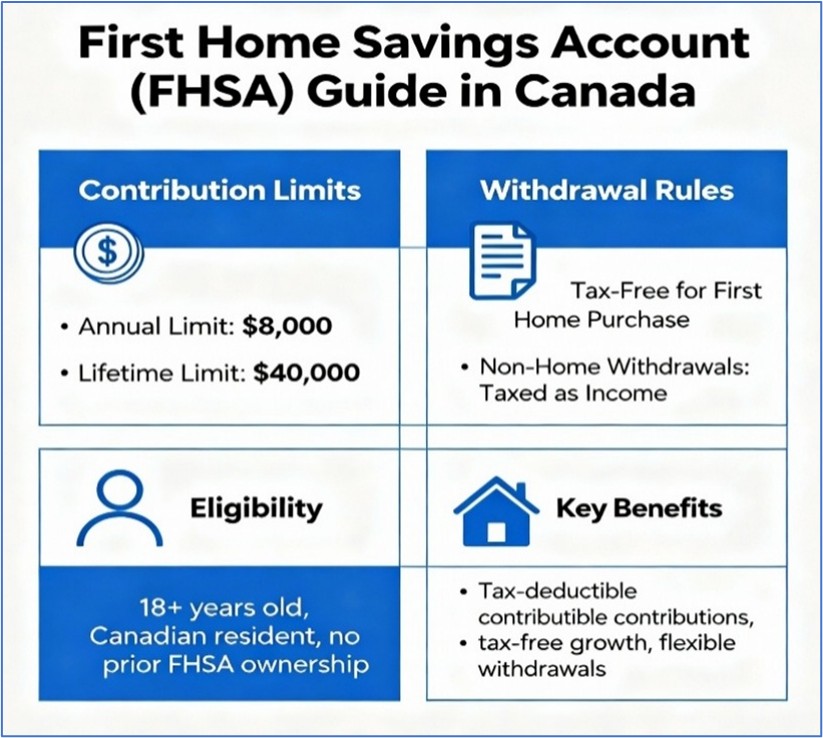

A refresher course on the First Home Savings Account (FHSA) introduced since 2023

The First Home Savings Account (FHSA) was introduced in 2023, and though it should have become a vital resource for anyone purchasing their first home, it is not yet well-known or popular among young Canadians. In our 2023 Fall GPS, we introduced the new FHSA to you, and after two years, we feel that the account needs another introduction.

The FHSA is an account designed for first-time homebuyers. You can deposit up to $8,000 annually, up to a maximum of $40,000, in an FHSA beginning at age 18. The account offers many benefits. Your contributions are tax-deductible, to start. Another is that the account's investment returns are fully tax-shielded. Finally, withdrawals will also be tax-exempt if used to buy a qualifying home.

Did you know that:

- A couple may have more than $200,000 to contribute to a first house: $60,000 per spouse through the RSP Homebuyer Plan and $40,000 per spouse from FHSAs.

- If cash is short, you can transfer money from your RSP to FHSA. These contributions will not be tax-deductible because they were already deducted as RRSP contributions.

- If cash is short, and as there is no minimum holding period for contributions into an FHSA, and assuming a house purchase is imminent, you can use a line of credit to fund your FHSA, get the tax deduction, withdraw funds right away and pay off the loan.

- You can postpone the tax deduction indefinitely, so basically, wait until your income and thus your tax bracket are higher.

- If you end up not buying a house, you can transfer the FHSA balance into your RRSP, regardless of how much RRSP contribution room you have. This can be done up to 15 years after the FHSA account is opened.