Philosophy

Our Philosophy: We believe that Investors deserve transparent, valuable & comprehensive financial advice (delivered in a way that they understand) that helps grow and preserve their net worth.

Investments, wealth planning and financial advice can be confusing. Our experience in the financial services industry has shown us that generally, this is by design, so that investors don’t question the advice given.

We aim to break that mould and deliver transparent advice that provides real value to clients, encouraging questions and educating our clients along the way.

We joined CI Assante Wealth Management to be able execute on this philosophy, and deliver an impeccable level of service and value to individual investors, families and corporations.

Approach

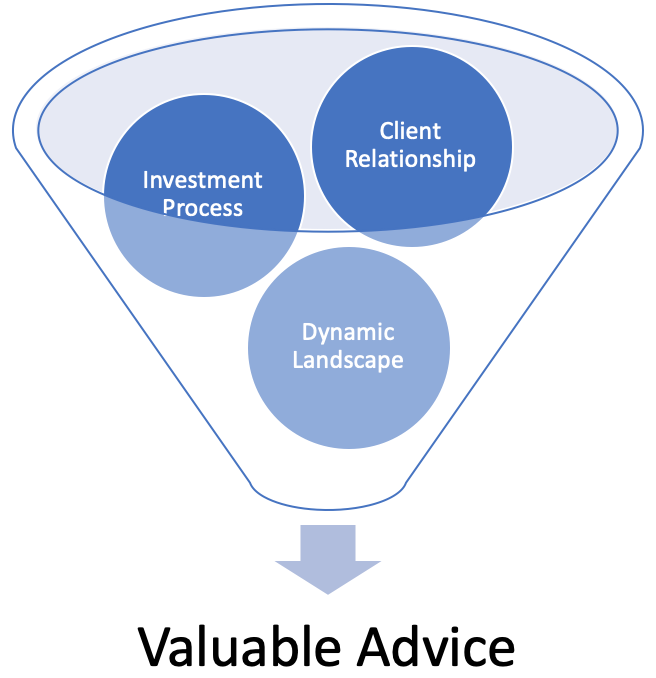

In order to execute on our philosophy, we focus on Client Relationships, our unique Investment Process, and understanding the dynamic financial landscape we all exist within. When these factors combine, our approach delivers valuable advice to our clients.

Client Relationship

We work for our Clients.

Our relationship with Clients must be transparent, honest and built on trust. We build trust, and deliver transparency by:

- Explaining concepts & recommendations in a way that you understand it

- Making sure you understand all the costs of investing

- Making sure you understand how we are paid as your advisor

- Educating clients about the “why” and “how,” not just the “what”

- Providing comprehensive – not one-dimensional – financial advice

- Having open and honest two-way communication, addressing concerns and questions

Investment Process

When we meet, we will go into detail on our investment process and how clients benefit from our expertise. Our investment process focuses on:

- Understanding you as a unique Client – your goals and concerns

- Providing objective, independent analysis of investments and strategies

- Continuing research and scenario analysis of market events and potential outcomes

- Understanding market forces and potential impacts to your plan & strategy

- Ongoing feedback loop and review of strategies and recommendations to make sure they remain suitable for you

Dynamic Landscape

Human beings and the financial markets have common ground: both have constantly changing variables. This poses unique challenges to both Advisors and Investors; you need an Advisor who confronts and adapts to change on your behalf. We do this through:

- Understanding that dynamic markets call for dynamic strategies

- Continuing Professional Education – always improving our skillset, knowledge and understanding of the industry and marketplace to better serve clients’ needs

- Consume research and analysis from many sources to access differing viewpoints and opinions

- Taking a multi-faceted approach with Clients – strategies and recommendations factor in many dimensions of your personal situation

- Understanding the changing client scenario – communication and Client-Advisor dialogue allows for comprehensive planning and advice

- We discuss a range of financial topics (tax, estate, investment planning, debt planning, retirement, pension, corporate management, business transition, insurance, etc.) and how they may impact your plan and goals