Market Pulse

Duncan Presant - Nov 23, 2022

THIS WEEK’S RECAP:

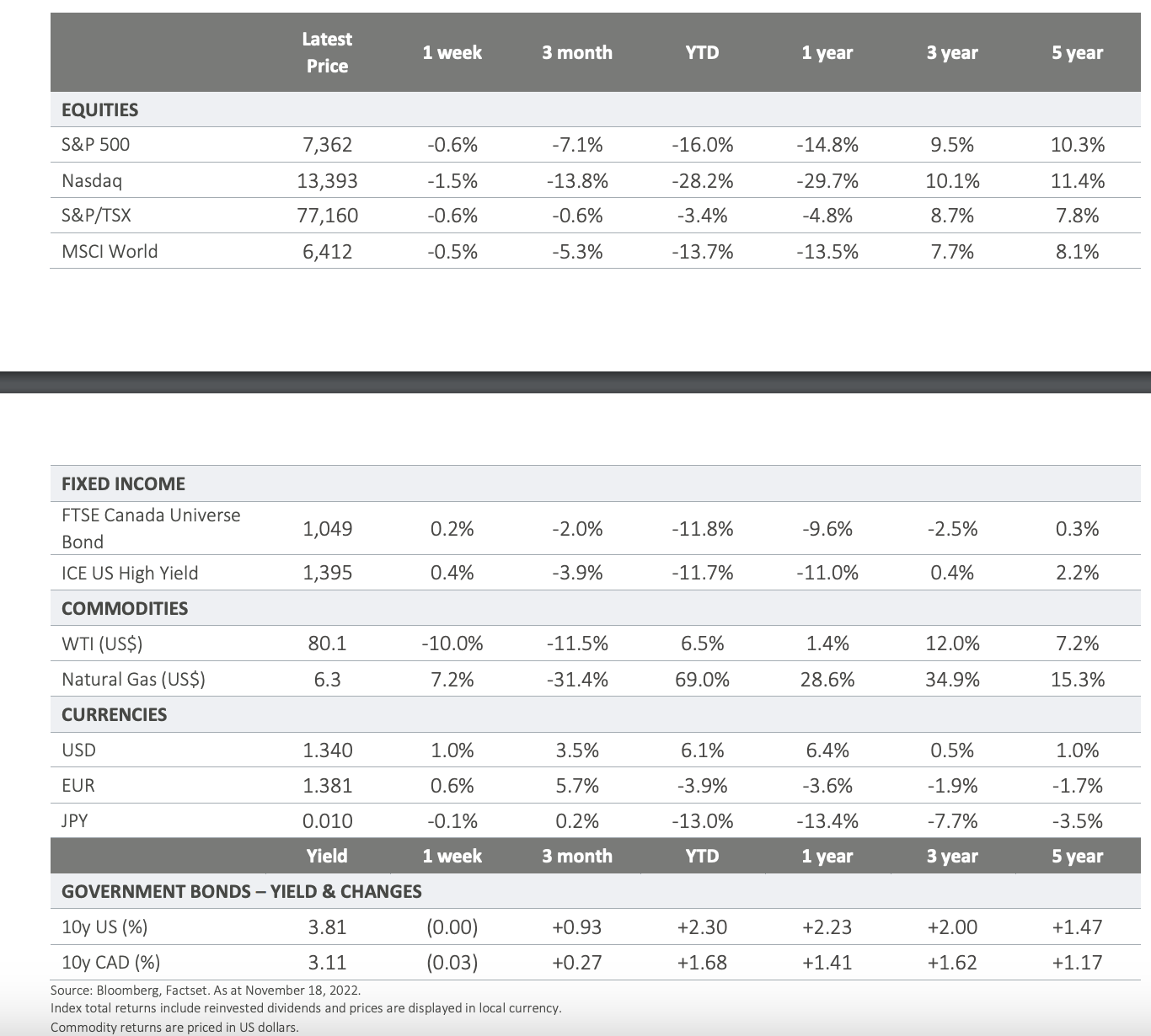

▪ Despite the widespread market relief rally that resulted from the softer October CPI and this week’s PPI number reinforcing the thesis that inflation is now trending down, Federal Reserve speakers were vocal throughout the week about the need for further rate hikes to avoid inflation becoming firmly entrenched in the economy. This rhetoric curbed overall market enthusiasm and equity markets finished the week slightly lower, while rates increased on the front end of the curve.

▪ On the FX front the US dollar index has tumbled 6% so far this month, providing an opportunity for the Canadian dollar to rally +5% from the year’s low (seen in October). These moves were largely driven by a belief that US interest rates have finally peaked. However, we would argue this thinking is premature, and do not expect material USD weakness over the near-term.

▪ Canadian Consumer Prices were elevated again in October, driven by a 9.2% rise in gasoline and higher heating costs. Though food prices rose again, it was the smallest increase in four months – a positive sign. Excluding food and energy, consumer prices have started to turn lower. Overall, inflation remains uncomfortably elevated when considering all components (including food and energy), and the Bank of Canada is expected to carry on with further tightening, although at a slower pace.

▪ US consumption remains alive and well – retail sales for October reflected another month of healthy demand, rising 1.3%.

▪ At the G20 meetings, a conciliatory tone was evident from the onset with leaders from China and the US leading the discussions. Importantly, leaders agreed to a joint declaration condemning war in Ukraine: “The use or threat of use of nuclear weapons is inadmissible… diplomacy and dialogue are vital”.

▪ Despite all the volatility and uncertainty we are still facing, we believe it is important to point out that this year’s painful market dynamics have created a much more interesting landscape for investors. Whether it is through credit, high yield and income strategies, investors now have access to strategies that can diversify their portfolio while offering interesting prospective returns. We are moving away from binary markets where outcomes were driven almost exclusively by risk on/risk off regimes, and we believe this enable the construction of more robust portfolios.

ON DECK FOR NEXT WEEK:

▪ US Thanksgiving is on Thursday of this week, which will limit market activity and economic releases. We will nonetheless receive the FOMC minutes on Wednesday, which should provide some insights on the future path of monetary policy.

▪ The economic calendar will also be light in Canada, with only September retail sales number released on the 22nd .

▪ We will continue to monitor the development on the cryptocurrency front following FTX’s filing for bankruptcy. The recent events are likely to result in significant regulatory pressure on the space. We expect the impact on traditional financial markets to stay limited.