Market Pulse - The week in review

Duncan Presant - Feb 08, 2023

As expected, the Federal Reserve increased their target interest rate by 25 basis points (bps) to 4.75%.

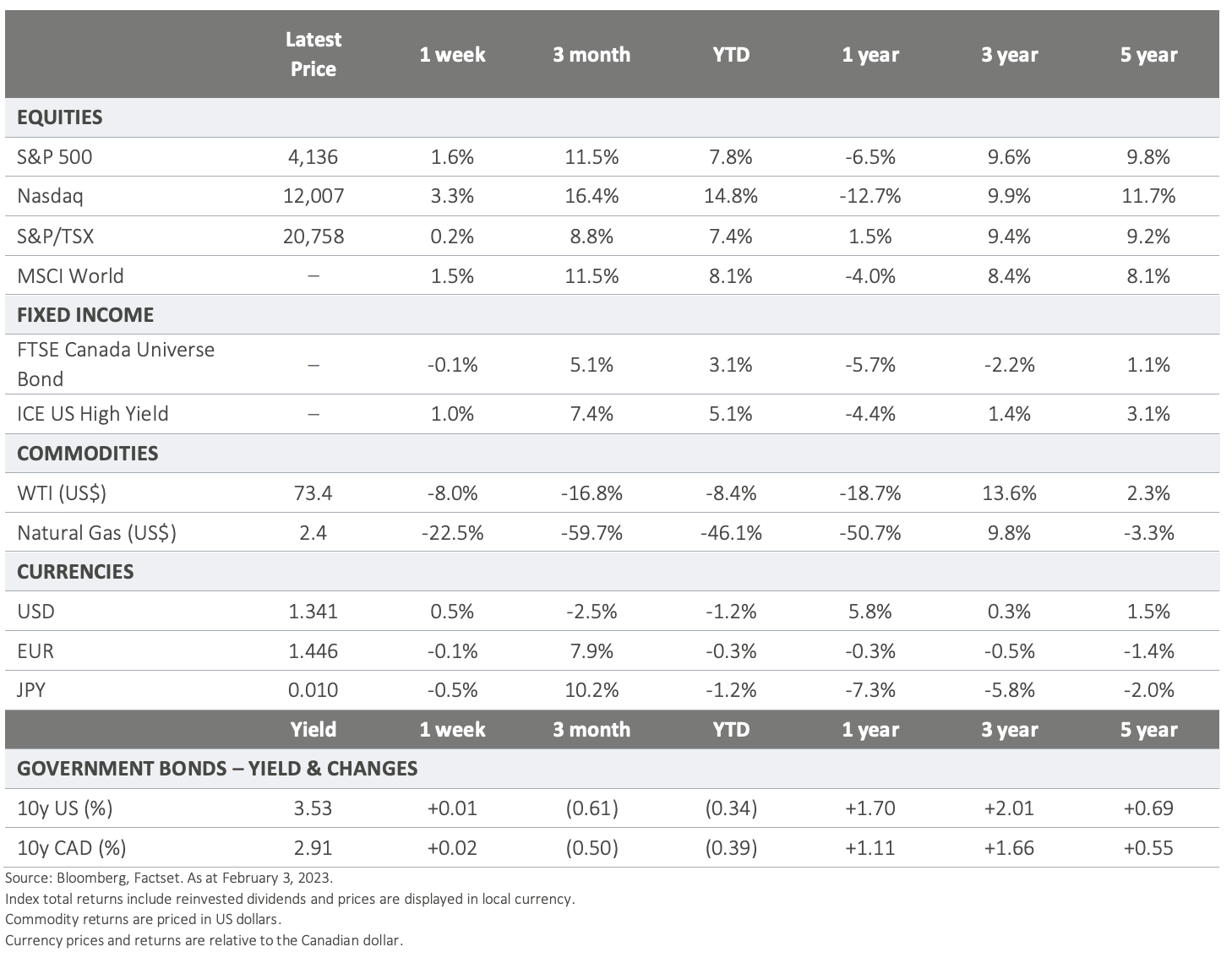

As expected, the Federal Reserve increased their target interest rate by 25 basis points (bps) to 4.75%. The surprise came from the press conference, where Chairman Powell’s tone changed noticeably from previous meetings, as he indicated they are near the end of the tightening cycle with most probably only one or two hikes of 0.25% to come. Despite uncertainty in the economic outlook, Chairman Jay Powell believes a "soft landing" for the economy, avoiding a significant slowdown, is still attainable. Markets have responded very positively, as equities, particularly cyclicals and technology, have rallied and US yields have fallen.

▪ Friday’s job numbers in the US came up much stronger than expected, with a net creation of more than 500 000 jobs in January and a falling unemployment rate. While employment is usually lagging the economic cycle, the continued strength is nonetheless supporting the view that the economy is still strong. This has a mixed impact on markets; reduced hopes of monetary policy accommodation have a negative impact on valuations, while economic resiliency is looking good for company earnings. Overall, we think this is a positive development, especially if inflation readings continue to fall over the next months, as we expect them to.

▪ In Europe, the central bank also raised rates by 50 bps to 2.5%, in line with expectations. The European Central Bank outlined further rate hikes are still to come including their intention to raise by another 50 bps in March. Christine Lagarde did acknowledge the economy appears more resilient than initially thought in December. The decline in energy prices is the primary cause for lower inflation and a less dire outlook for continent. Their outlook for both growth and inflation have become more balanced. This is largely reflected across European asset prices including the currency, which is up nearly 8% relative to the Canadian dollar since December 1st.

▪ Not to be outdone, the Bank of England joined the party and raised interest rates by 50 bps to 4%. However, UK inflation remains quite elevated, and the economic outlook rather week. Lower goods and energy prices have helped in a meaningful way but rising inflation from tight labour markets, rising wage pressures and the service sector is persistent. Nonetheless, UK policymakers now expect a shallower economic downturn compared to their outlook of a few months ago.

▪ The speed at which investors responded to the Fed signaling an end of the tightening cycle has been quite remarkable. While we were and remain relatively optimistic on equity markets on a medium-term horizon, we believe it is premature to suggest the rotation from defensives to cyclicals that played out late this week is the definitive start of a new trend. Nonetheless, it does show pent-up risk appetite and willingness among investors to re-engage. The trajectory of the economy remains uncertain, and though the Fed stirred up some optimism, we would caution about getting too far over one’s skis. Bond yields, in particular, look like they might have readjusted lower too rapidly.

ON DECK FOR NEXT WEEK:

▪ After a busy couple weeks of central bank policy announcements, we can expect a quiet week on the data front in both Canada and the US. One noteworthy event will be the release of the Canadian employment report for January on Friday.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS:

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2023. All rights reserved.