Market Pulse - The week in review

Duncan Presant - Mar 01, 2023

Inflationary pressures in Canada continue to abate with annualized headline CPI for January dropping to 5.9%, down from the June 2022 peak of 8.1%.

THIS WEEK’S RECAP:

▪ Inflationary pressures in Canada continue to abate with annualized headline CPI for January dropping to 5.9%, down from the June 2022 peak of 8.1%. However, there was an uptick in the month-over-month figures, largely attributed to rising mortgage interest costs and higher prices at the gas pumps. This shows that the path to a more acceptable level of inflation is not a straight line.

▪ The concurrent selloff across global bonds of late has been largely driven by positive surprises across various economic indicators and hawkish central bank rhetoric (with the notable exception of the Bank of Canada). Economic expectations coming into 2023 were heavily skewed for a significant slowdown; the economy is slowing down but probably not as much or as quickly as feared.

▪ An important leading economic indicator, the Purchasing Managers Index (PMI) reflected a common theme across major economies. Preliminary February surveys revealed incremental improvements, particularly in services while manufacturing has rebounded from the lows but remains contractionary.

▪ One part of the economy that remains a concern is housing. This week we saw another month’s worth of data reconfirming exceptionally slow turnover in the Canadian housing market. In the US, home sales and mortgage application data showed a very similar story. Policymakers are keenly aware of the impact of higher interest rates on household balance sheets, particularly north of the border. This will keep the Bank of Canada from raising rates unless inflation unexpectedly reverse course, which is not our base case.

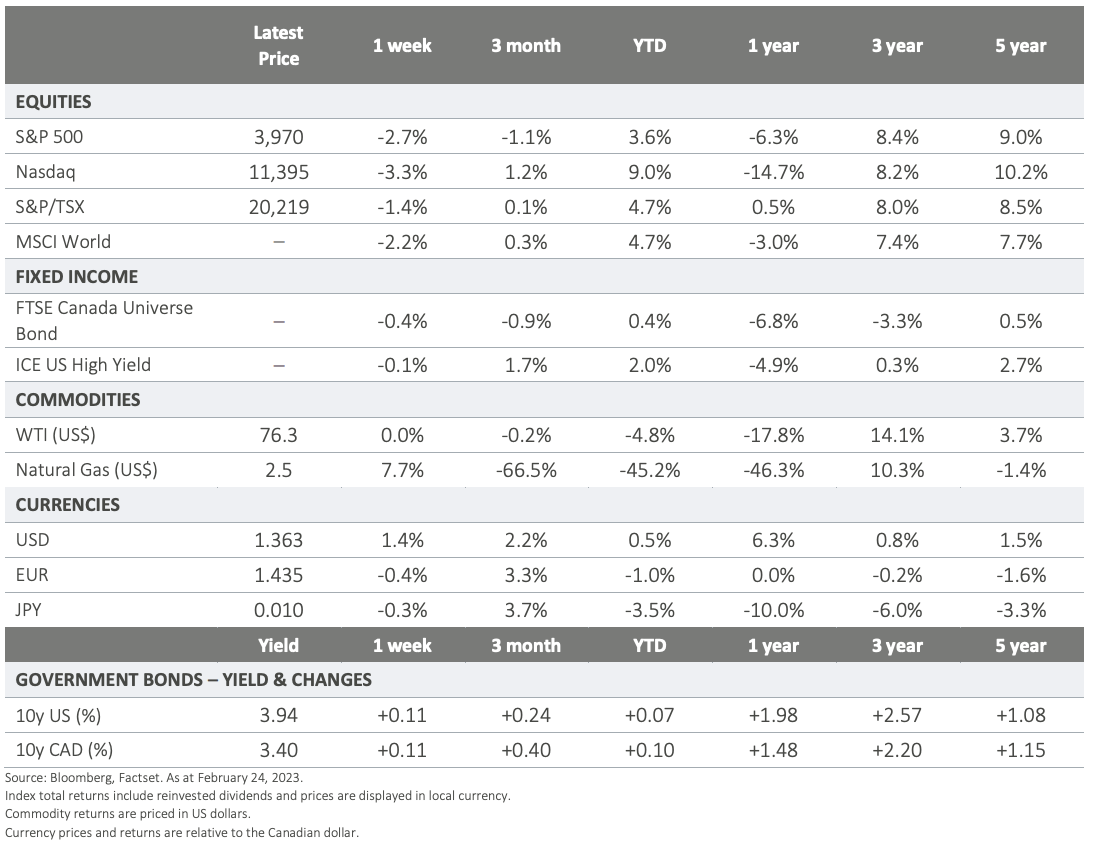

▪ On the currency front, the US dollar recovered its year-to-date losses against most major currencies. Higher US yields and a softer equity backdrop have helped the greenback recover. Our call on the Loonie remains benign, with little fundamental nor technical reason to expect a major breakout in either direction over the near-term.

▪ The economy is slowing down, but not too rapidly, and inflation continues its downward trend; that combination is potentially quite constructive for markets. The challenge will continue to come from the fact that the corridor is relatively narrow between a first scenario where inflation remains too high (and leads to higher rates), the second positive scenario we just described (limited pressures on earnings and a tailwind from valuations) and a third one that sees a more significant economic slowdown (and significant pressures on earnings). The market dynamics will tend to jump from pricing one scenario to the other, resulting in increased volatility.

ON DECK FOR NEXT WEEK:

▪ In Canada, Q4 2022 GDP data will be released on Tuesday. In the US, house prices and more manufacturing data are on the docket. For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2023. All rights reserved.