Market Pulse - The week in review

Duncan Presant - Mar 08, 2023

▪ Chinese manufacturing activity moved back into expansionary territory in February, to which global markets responded very positively. China’s National People’s Congress begins on Sunday where they are expected to reestablish an annual growth target

THIS WEEK’S RECAP:

▪ Chinese manufacturing activity moved back into expansionary territory in February, to which global markets responded very positively. China’s National People’s Congress begins on Sunday where they are expected to reestablish an annual growth target rate of 5.5-6%, a very important piece to the global economy.

▪ In Canada, on the economic front, GDP for December missed expectations by a small margin, coming in at -0.1%. The economy is slowing, though in a very unbalanced fashion as labour has held in well thus far despite a downturn in business spending. On the reporting front, Canadian banks had another round of strong results largely driven by their trading businesses on the back of a volatile quarter in fixed income markets. Most of the banks’ shared a cautious tone on the economy in coming quarters.

▪ In Europe, preliminary estimates for February inflation reflect how difficult a task lays ahead for the European Central Bank, where considerable interest rate increases are still expected. Like other Western economies, labour costs remain uncharacteristically elevated.

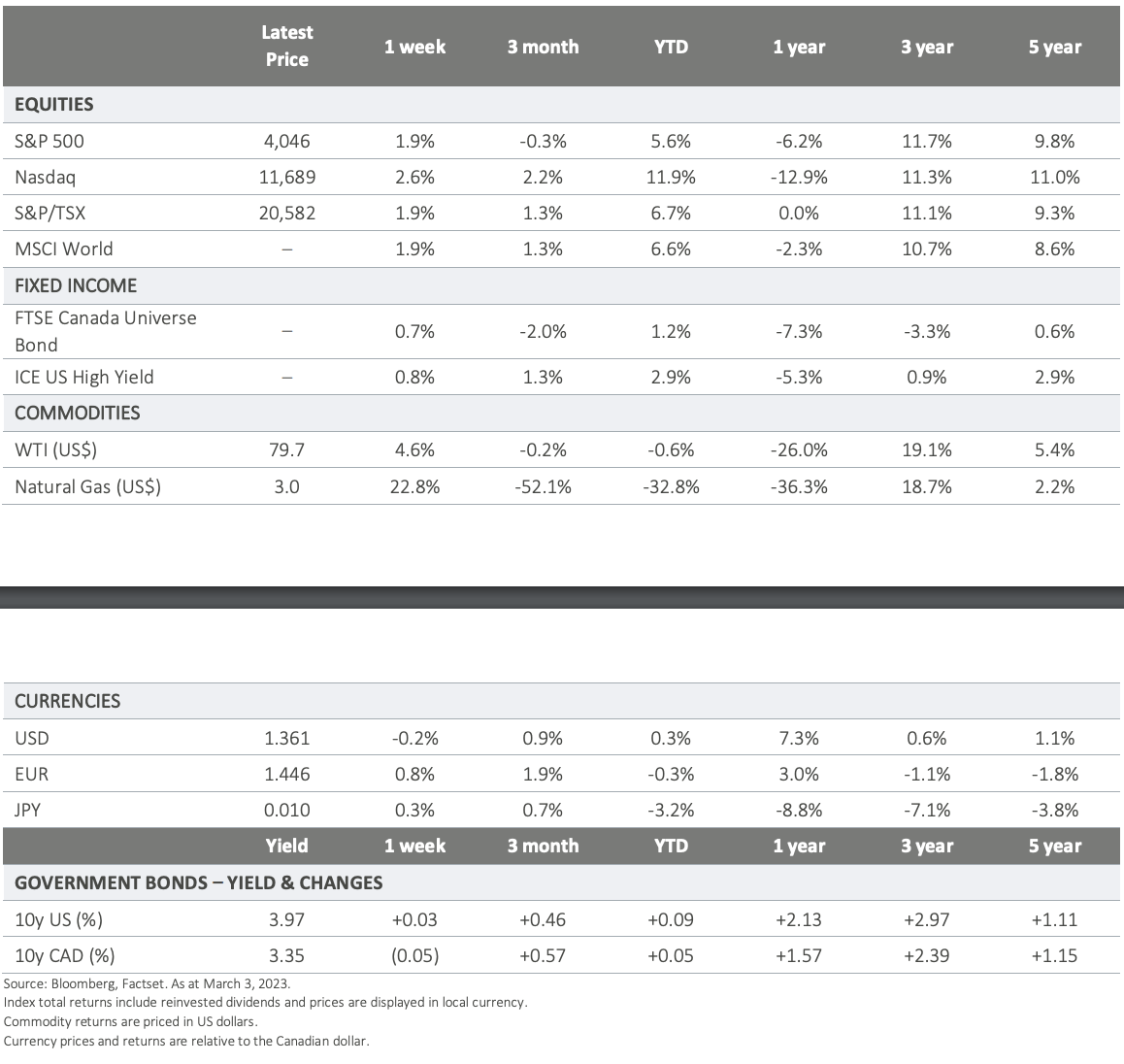

▪ In the US, the economic data was a mixed bag this week as were the reactions across asset classes. US bond yields reflect concerns of stubborn inflation, driven by labour costs. The US 10 yr yield rose another 15bps this week and crossed back above the 4% threshold. Equities were more stable this week, but this follows several weeks of weakness; stubborn inflation is not good for stocks, but a resilient economy offsets some of that.

ON DECK FOR NEXT WEEK:

▪ Several central banks have policy setting meetings, including the Reserve Bank of Australia, the Bank of Canada on Wednesday, and the Bank of Japan. We do not expect the Bank of Canada to change their target interest rates as they continue to monitor incoming economic data and allow time for prior rate hikes to slow economic activity.

▪ Friday morning will bring a key event with both Canadian and US employment updates for February being released. Job activity has been exceptionally resilient on both sides of the border. Markets along with policymakers will be watching these results very closely to see whether a slowdown is in fact materializing.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2023.

All rights reserved.