Market Pulse - The week in review

Duncan Presant - Apr 12, 2023

Led by Saudi Arabia, OPEC+ made a surprise announcement of a major cut in oil production, reducing it by 1.1 million bpd.

THIS WEEK’S RECAP:

▪ Led by Saudi Arabia, OPEC+ made a surprise announcement of a major cut in oil production, reducing it by 1.1 million bpd. This move was in response to the drop in oil prices in March, which hit their lowest levels since late 2021. The implications of that decision will be far-reaching, with the potential to drive up prices (inflationary) and weigh on economic activity. Inventories have been building since January, and the recent announcement that the US would delay plans to replenish their special petroleum reserves may have played a role in the OPEC+ decision.

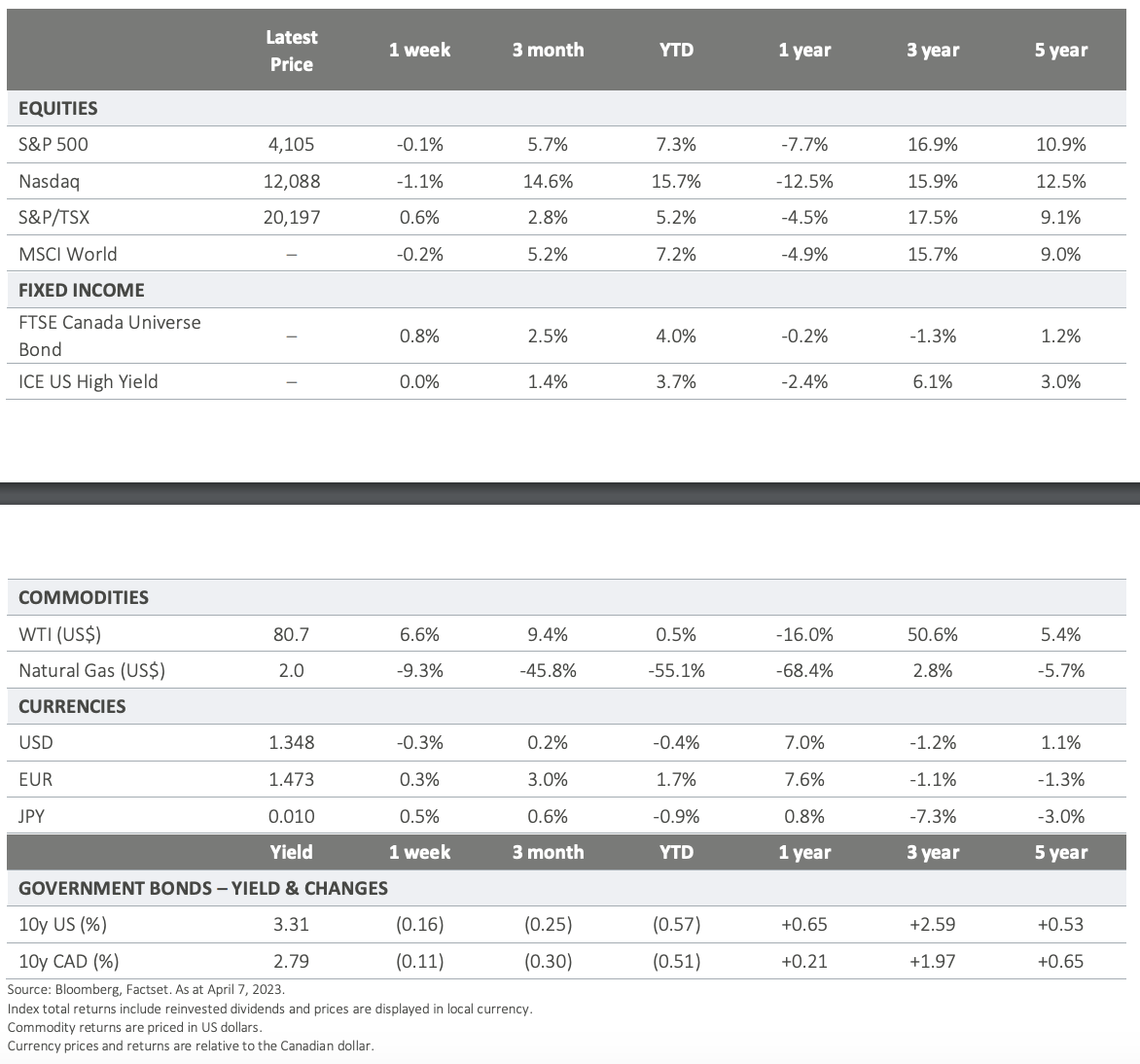

▪ The most recent set of leading indicators for the US economy, released this week, indicate a deceleration in manufacturing and services. The subcomponents that provide a forward-looking perspective, such as Backlog of Orders and New Orders, were weaker in March. These trends increase concerns about an upcoming economic slowdown. Although oil prices are 8% higher over the week, bond yields have continued their decline, with US 10- year Treasury reaching 3.25%, a level not seen since last September; bond markets are more concerned about the impact of the slowdown than the inflation impact of the OPEC+ production cut.

▪ The Canadian employment picture remains exceptionally strong with another 35,000 new jobs added in March. Since September 2022, the labour force has grown (net new jobs) by +370,000. A staggering number considering the aggressive pace of monetary policy tightening that occurred in 2022. The question going forward is whether the economy can sustain this record level of unemployment, currently sitting at only 5%. The US employment number will be published Friday morning (this note was written on Thursday due to the Good Friday Holiday).

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS: This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. ©

CI Investments Inc. 2023. All rights reserved.