Market Pulse - The week in review - May 30th 2023

Duncan Presant - May 30, 2023

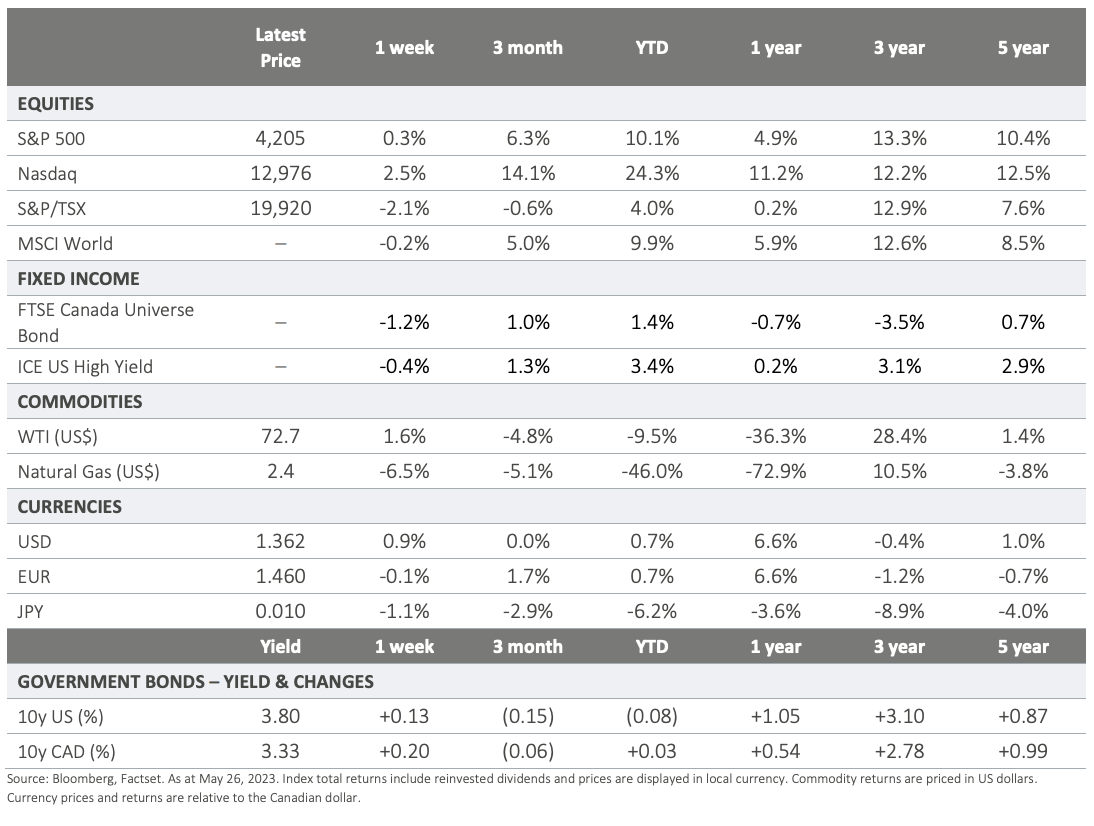

The rise in US yields can be attributed to concerns regarding a potential debt default and a stronger-than-expected economic backdrop.

THIS WEEK’S RECAP:

▪ The rise in US yields can be attributed to concerns regarding a potential debt default and a stronger-than-expected economic backdrop. Since mid-May, the US 10-year Treasury yield has increased by +45 bps to 3.85%, while the 2-year Treasury yield has risen by +70 bps, reaching above 4.6%. This has caused stress in various financial assets as the Xdate, the point when the US Treasury may run out of funds to meet government obligations, approaches. It is likely that US lawmakers will reach a resolution in the coming days, as indicated by President Biden's comments. However, there may still be ongoing stress and volatility in the markets until it is finalized.

▪ The UK Consumer Price Index (CPI) exceeded expectations, with both the headline and core measures surpassing consensus by approximately 50 bps. The data also outperformed the Bank of England's (BoE) forecast, which was already higher than both consensus and market expectations. We expect the Bank will be forced to continue raising interest rates, potentially by upwards of 1%, split across their next few meetings. This would ultimately take their overnight rate to 5.5% (the highest among developed market Central Banks).

▪ PMI’s, the latest leading economic indicators from European Union (EU) and the United Kingdom (UK) suggest a decrease in positive momentum. Manufacturing continues to be weak, and there hasn't been significant progress in the service’s sector either. This data raises doubts about how much the EU/UK's economic growth engine has advanced compared to other developed regions.

▪ German business expectations are declining (IFO survey results), indicating that the positive momentum observed earlier in the year is fading. Additionally, this week it was confirmed that the EU's largest economy has experienced consecutive quarters of economic contraction, a concerning sign for the eurozone’s near-term economic health.

▪ Canadian banks have started to release their quarterly earnings reports. The results have been varied, leaning towards disappointing, particularly in their capital market divisions where slowdowns have been observed. Additionally, most banks have significantly raised their provisions for potential loan losses, which is a common measure taken in anticipation of a potential economic downturn.

▪ While the AI revolution may not have fully taken over yet, there is a significant demand for computer chips that power AI capabilities. This was evident in the recent earnings release of Nvidia Corp, a prominent US chipmaker, which highlighted the high demand for their technology.

▪ Japanese equities have experienced a resurgence, with local stock indices reaching their highest levels in 33 years. This growth is primarily driven by increasing demand from foreign investors.

ON DECK FOR NEXT WEEK:

▪ Eyes will remain fixated on Washington as the debt ceiling negotiation drama unfolds. June 1 is the ‘X-date’ for the Treasury, while a major rating agency is giving the US until June 15 to resolve this or face a downgrade from their current AAA rating.

▪ On the economic calendar, employment data from the EU and US comes late in the week while Canada will report on GDP mid-week.

For more information, please visit ci.com

IMPORTANT DISCLAIMERS This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2023. All rights reserved.