Market Pulse - The week in review - June 26th

Duncan Presant - Jun 26, 2023

The United Kingdom is grappling with the challenge of addressing persistently high levels of price and wage inflation.

THIS WEEK’S RECAP:

▪ The United Kingdom is grappling with the challenge of addressing persistently high levels of price and wage inflation. The Bank of England took decisive action, doubling down on market expectations by raising their benchmark interest rate by 50 basis points to 5%. Further rates hikes will likely be required to curb both labour and consumption pressures.

▪ The Bank of Canada released details surrounding their decision to raise rates earlier this month. Their concern stems from the possibility of a reversal in the inflation trend, a common concern amongst advanced economies. They highlighted several recurring factors, including tight labor markets, sluggish progress in reducing core inflation, and unexpectedly robust consumer spending. Rather than signaling a rate hike for July, they chose to act immediately. Their next decision is July 12th and will be highly data dependent.

▪ The recent series of central bank policy announcements has sent a clear message: the battle against inflation is ongoing and far from resolved. There is a noticeable resurgence in consumer demand for goods, elevated prices in the services sector, and an increase in housing activity. Moreover, wage growth remains significantly higher than historical averages. In response, policymakers are prepared to take further measures to tighten monetary policy, or at the very least, they aim to instill confidence that they are actively addressing the issue.

▪ The onset of high inflation has led to increased wage pressures, in part supported by a highly competitive job market. Now, these higher wages are driving consumption. It creates a circular problem that poses a challenge to resolve until inflation drops or job losses mount. While certain employment indicators are showing early signs of weakening, it is too early to conclude that a trend has emerged. We are closely monitoring this situation with great interest.

▪ We expect to see more and more questions on the ability of monetary policy alone to solve more structural issues in the economy by itself (housing and labor market imbalances for example). Given the lags in policy transmission, the risk of a monetary policy mistake where rates are pushed too high to solve issues that have deeper roots and are not purely cyclical is increasing significantly.

▪ After a strong equity performance over the past few weeks, short-term investment sentiment has started to waiver underscoring the lack of conviction amongst global investors right now. Meanwhile, sovereign bond yields were broadly on the rise, adjusting to higher rates at the short-end and an economy that remains more resilient than many have anticipated.

ON DECK FOR NEXT WEEK:

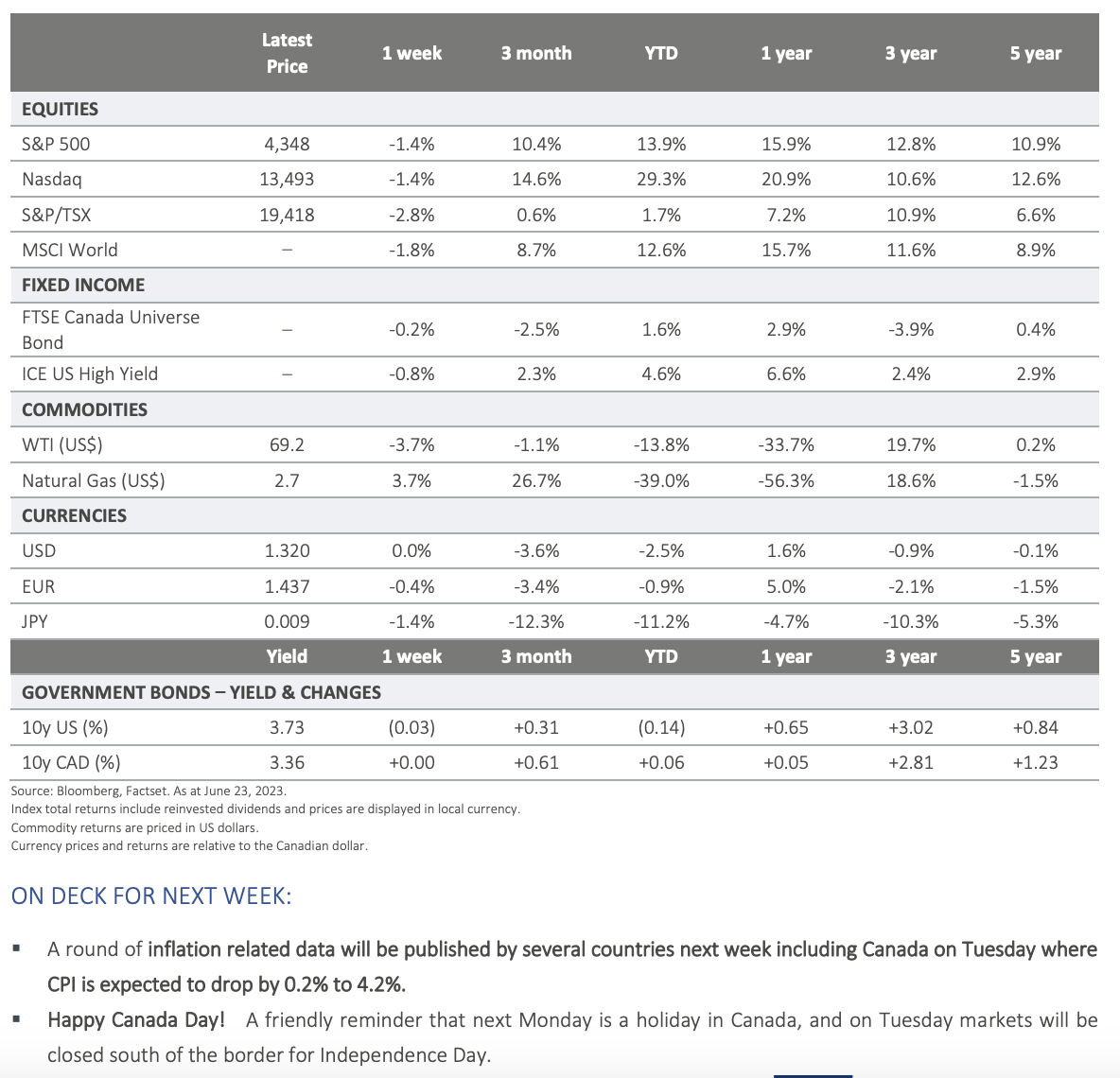

▪ A round of inflation related data will be published by several countries next week including Canada on Tuesday where CPI is expected to drop by 0.2% to 4.2%.

▪ Happy Canada Day! A friendly reminder that next Monday is a holiday in Canada, and on Tuesday markets will be closed south of the border for Independence Day.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties andCI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2023. All rights reserved.