ETF Taxation: Phantom Distributions

Duncan Presant - Nov 20, 2023

Similar to traditional mutual funds, ETFs may pay their distributions to investors in cash or may reinvest them in the fund.

Similar to traditional mutual funds, ETFs may pay their distributions to investors in cash or may reinvest them in the fund. Typically, income distributions such as interest, foreign income and dividends are paid in cash on a monthly or quarterly basis. Capital gains are normally paid annually and reinvested in the fund (although income distributions can also be reinvested).

Reinvested distributions are provided to ETF investors in the form of additional units of the fund. However, immediately after the reinvestment, the units are consolidated so that the same number of units is owned by investors both before and after the distribution. Thus, ETF investors would not see an increase in the number of units owned and there would be no change to the net asset value per unit (NAVPU) post-distribution. This is why, with ETFs, reinvested distributions are often referred to as notional or phantom distributions.

Regardless of whether paid in cash or reinvested, ETF distributions are normally taxable for the year received, with the exception of return of capital (ROC) distributions, which are tax-free. Investors would receive a T3 or T5 tax slip from their broker for tax reporting purposes, which would include phantom distributions. The T3 or T5, however, would not distinguish between cash and reinvested distributions. Therefore, to prevent double taxation (i.e., once when reinvested distributions occur, and a second time when related ETF units are sold), the adjusted cost base (ACB) of the investment should be increased to reflect reinvested distributions. This would reduce capital gains (or increase a capital loss) upon sale of the investment. For this reason, investors should be diligent in tracking and increasing ACB values when their ETF distributions are reinvested.

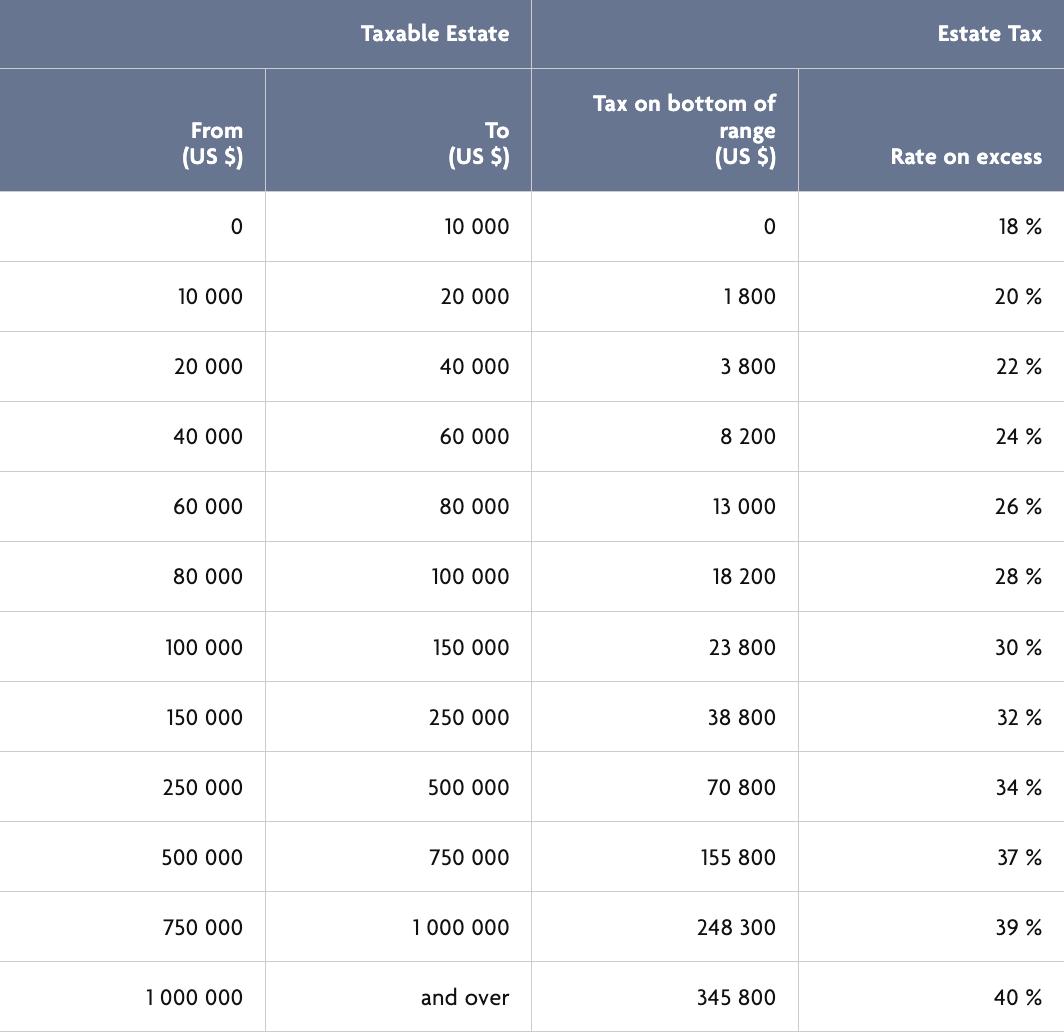

Unlike traditional mutual funds whereby investors trade directly with the fund, ACB tracking for ETFs can be a challenge given that ETFs are traded on a stock exchange among investors. To help with this, ETF providers normally publish their distribution details by issuing news releases, posting the information on their websites and by reporting through CDS Clearing and Depository Services. Brokerages then typically use this information to prepare tax slips for their investors. ETF investors can use the information available to calculate their ACBs as follows:

The following example illustrates how reinvested distributions impact number of units, NAVPU, ACB and fair market value (FMV) amounts for both ETFs and traditional mutual funds.

Jackson purchased 1,000 units of both an ETF and traditional mutual fund, each at a price of $10 per unit. The following table is a detailed look at the impact to both NAVPU and ACB following a reinvested capital gains distribution of $1 per unit.

Jackson should check with his broker to determine how they help with ACB tracking. Using distribution details available through his broker, Jackson should be sure to increase and track the ACB of his ETF units to avoid double taxation when the units are sold.

About the Author

Wilmot George Jr., CFP, TEP, CLU, CHS

Vice-President

Tax, Retirement and Estate Planning

Throughout his career, Wilmot has held progressive positions in the areas of tax and estate planning, financial planning, banking, and securities analysis. He has completed numerous courses related to taxation, securities and mutual fund investing, insurance and estate planning. Wilmot received his Bachelor of Arts Degree (with Honours) in Mathematics for Commerce from York University. He also holds the Certified Financial Planner (CFP), Trust and Estate Practitioner (TEP), Chartered Life Underwriter (CLU) and Certified Health Insurance Specialist (CHS) designations. Since 2001, Wilmot has spent his time guiding financial advisors on tax and estate planning matters through presentations, one-on-one consulting and written communication.He has been featured in various financial forums including The Globe and Mail, The National Post, Advisor.ca, and Investment Executive. Additionally, Wilmot has delivered presentations for The Financial Advisors Association of Canada (Advocis), the Society of Trust and Estate Practitioners (STEP) and The Institute of Advanced Financial Planners (IAFP). Away from work, Wilmot enjoys various sports, traveling and spending time with family and friends.

IMPORTANT DISCLAIMERS

This communication is published by CI Global Asset Management (“CI GAM”). Any commentaries and information contained in this communication are provided as a general source of information and should not be considered personal investment advice. Facts and data provided by CI GAM and other sources are believed to be reliable as at the date of publication.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI GAM has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

Information in this communication is not intended to provide legal, accounting, investment or tax advice, and should not be relied upon in that regard. Professional advisors should be consulted prior to acting based on the information contained in this communication.

You may not modify, copy, reproduce, publish, upload, post, transmit, distribute, or commercially exploit in any way any content included in this communication. You may download this communication for your activities as a financial advisor provided you keep intact all copyright and other proprietary notices. Unauthorized downloading, re-transmission, storage in any medium, copying, redistribution, or republication for any purpose is strictly prohibited without the written permission of CI GAM.

CI Global Asset Management is a registered business name of CI Investments Inc.