Market Pulse - The week in review. - Dec. 4th

Duncan Presant - Dec 04, 2023

Canada's economy declined by 1.1% (annualized) in Q3, considerably weaker than expected. Slower exports and inventories were the main drag on the economy, while government spending and investment in residential structures improved.

THIS WEEK’S RECAP:

Canada's economy declined by 1.1% (annualized) in Q3, considerably weaker than expected. Slower exports and inventories were the main drag on the economy, while government spending and investment in residential structures improved. On the positive side, Q2 GDP was revised higher from -0.2% to +1.4%. The bottom line is the economy has slowed and looks poised to continue.

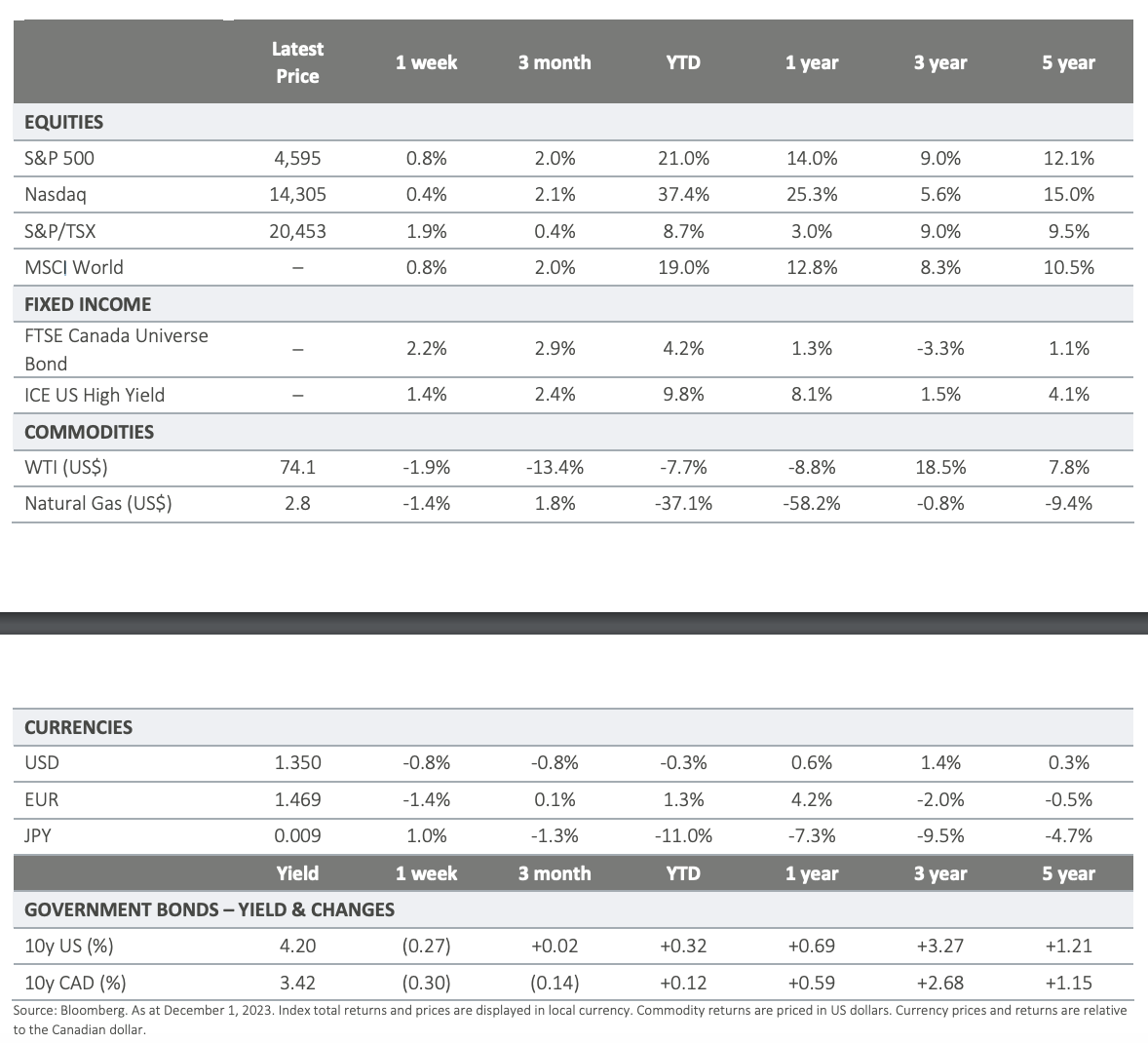

Has the market become overly exuberant? Asset prices are adjusting, as both bonds and equities rally, in anticipation of a material pivot in central bank policy. Dovish comments from the Federal Reserve mid-week added fuel to the fire when a senior official commented that interest rates can be lowered if inflation returns towards the 2% target, regardless of whether the economy remains strong or not, possibly within 3-6 months.

The season of holiday shopping kicked off last week with Black Friday and Cyber Monday sales. Credit card and payment data showed a pickup in overall purchases over the same period last year. However, this comes at a time when retail inventories are running extremely high, and retailers are offering deep discounts to attract shoppers. Overall, US consumption has slowed over the past months, and is as a growing concern for the economy in Q4.

Germany's inflation slowed to 2.3% in November, down from 3.0% in October, with notable declines in energy and food prices, as well as service costs. This follows a similar shift lower in inflation that is playing out across G10 economies, adding to expectations for lower interest rates next year.

ON DECK FOR NEXT WEEK:

The Bank of Canada meets on Wednesday. We expect the overnight rate will be maintained with a dovish shift in tone based on improving inflation dynamics and a slowing economy.

US employment data (November) will be released Friday morning.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc.

© CI Investments Inc. 2023. All rights reserved.