Market Pulse - The week in review - March 1st

Duncan Presant - Mar 06, 2024

The Canadian economy was slightly stronger than expected last quarter, growing at 1% (annualized).

THIS WEEK’S RECAP:

▪ The Canadian economy was slightly stronger than expected last quarter, growing at 1% (annualized). A decent rise in export activity and a slight increase in consumption helped offset a large quarterly drop in government spending and anemic business investment. Overall, the economy continues to tread water, well below trend-growth while avoiding a more severe recession-like deterioration.

▪ U.S. GDP for the fourth quarter of 2023 was revised to 3.2%, a minor adjustment of -0.1%. However, this revision included positive developments, including a rise in consumption, capital expenditures, and residential investment. Inventory investment slowed, which counterintuitively, may be reason for optimism for Q1 with the potential for larger inventory restocking.

▪ The US personal consumer expenditure (PCE) price index, the Federal Reserve's preferred gauge of inflation confirmed that prices remained sticky in January, with service prices being the main culprit. With the Federal Reserve now firmly in data-watch mode, the importance of February's economic performance is heightened with the first big release coming next Friday in the form of employment and hourly earnings.

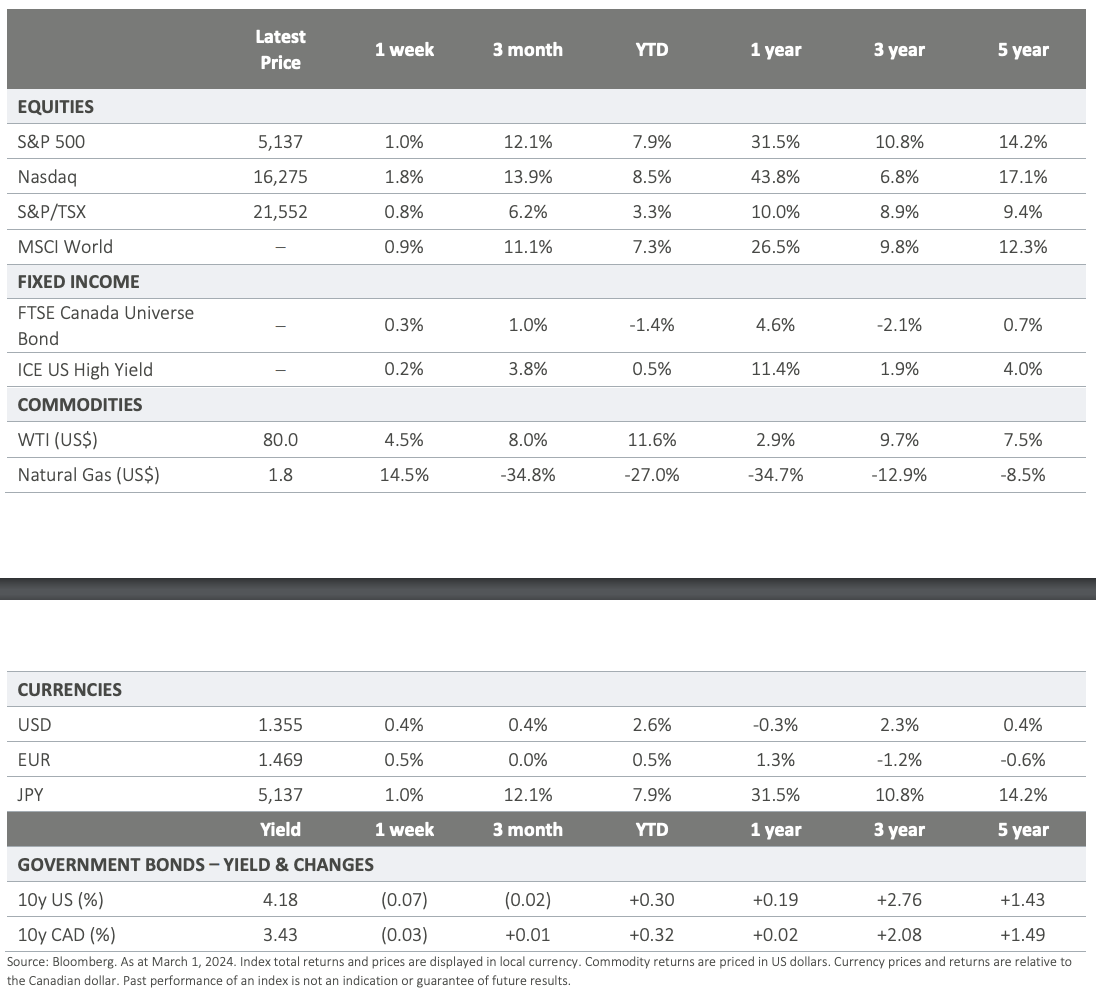

▪ The widening gap between U.S. and Canadian short-term interest rates has led to recent US dollar strength, driving the Canadian dollar to its lowest point this year. Nonetheless, with few catalysts to justify a more pronounced move in the currency, we expect CAD to remain well within the range seen last year for the time being.

ON DECK FOR NEXT WEEK:

▪ The Bank of Canada is expected to keep is target rate unchanged on Wednesday and will likely signal the need for more concrete evidence on the inflation front before committing to lower borrowing costs.

▪ The European Central Bank (ECB) is also expected to remain on hold at their Thursday meeting. Inflation is trending lower in Europe, which may provide them with enough comfort to begin guiding towards rate cuts soon.

▪ A health-check on the labour front for both the US and Canada will be released Friday.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2024. All rights reserved.