Market Pulse - The week in review - March 15th

Duncan Presant - Mar 22, 2024

The U.S. Consumer Price Index (CPI) came in at 3.7% annualized, down from 3.9% in January. Most categories showed marginal improvement, with the exception of an increase in transportation costs, specifically insurance and airline prices.

THIS WEEK’S RECAP:

▪ The U.S. Consumer Price Index (CPI) came in at 3.7% annualized, down from 3.9% in January. Most categories showed marginal improvement, with the exception of an increase in transportation costs, specifically insurance and airline prices. Overall, the first read on February price inflation was somewhat reassuring after January's uptick, and while inflation is still too high for the Federal Reserve to lower rates, the January blip appears to be just that, a blip.

▪ The U.S. economy is performing exceptionally well, leading to notable gains in productivity. This improvement in productivity in theory justifies higher sustained wage growth, and suggests existing monetary policy may not be as restrictive as previously thought based on the productivity gains. This would imply that the eventual target for interest rates in a forthcoming cutting cycle might be higher than initially thought. This economic viewpoint is gaining some traction and prompting a rethink of the long-term outlook for short-term interest rates.

▪ The Federal Reserve is scheduled to convene next week and are expected to uphold the existing policy rate while reaffirming their commitment to a data-driven approach. Although the prospect of a rate reduction in April is unlikely, a cut in June remains a possibility. Additionally, the meeting will include an update on each committee member's shortterm interest rate projections, a factor that could potentially influence market dynamics significantly if there is a marked deviation from previous forecasts. The most recent update in December indicated a median projection of 75 bps reduction in 2024. They are also expected to downsize the pace of quantitative easing.

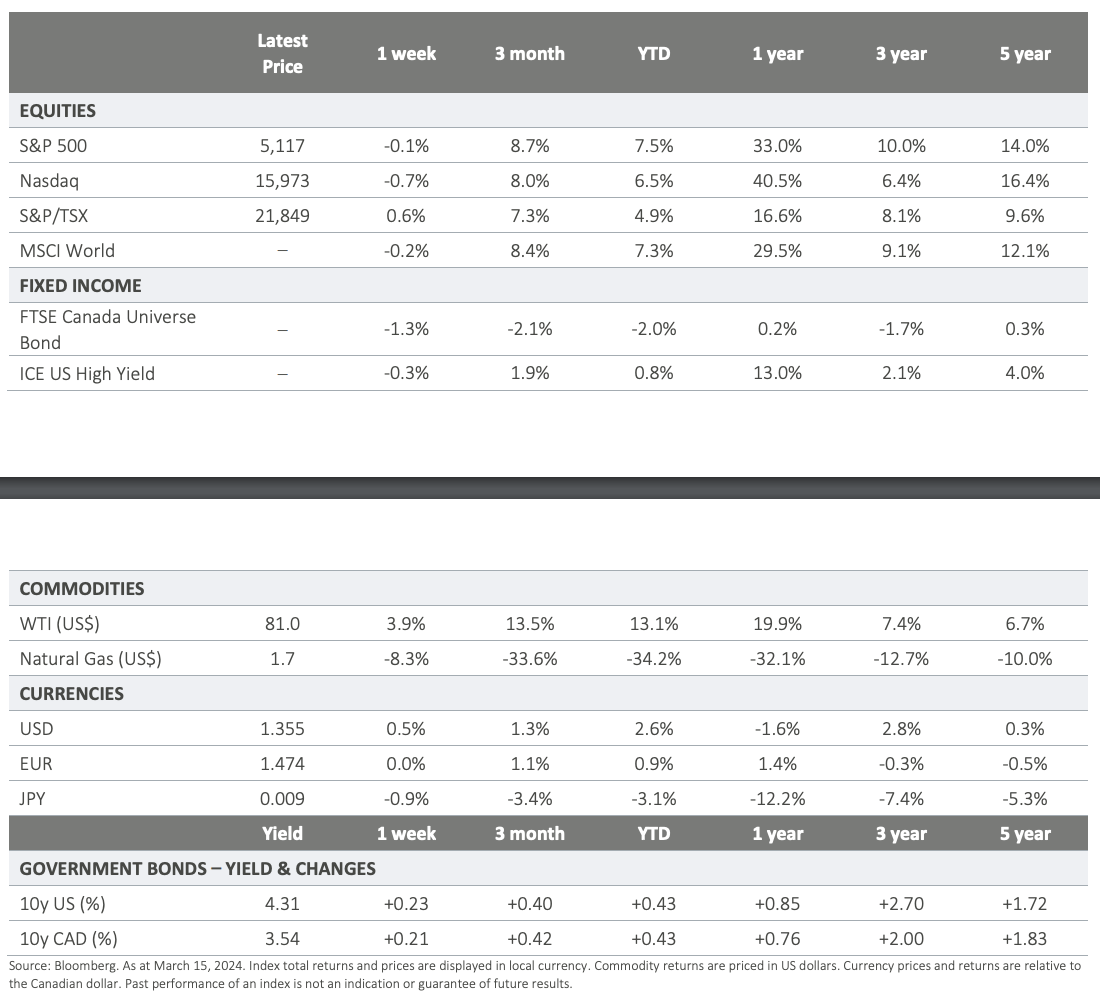

▪ Oil prices rose again, hitting a six-week high over $84.50 a barrel, after the International Energy Agency shifted gears from predicting a surplus to warning about a year-long supply shortfall, especially as US crude inventories dwindled and OPEC+ plans to manage production levels.

ON DECK FOR NEXT WEEK:

▪ The Bank of Japan has held their overnight rate at -0.1% since 2016. They are expected to finally exit negative interest rate policy at either of this Tuesday's meeting, or their following meeting set for April.

▪ There are several other key central bank meetings through the week. Though all are expected to maintain current target rates, we will be listening closely for any shift in messaging (forward guidance). The Reserve Bank of Australia (RBA) meets Tuesday (local time), the Federal Open Market Committee (FOMC) is Wednesday, and the Bank of England meets Thursday.