Market Pulse - The week in review - April 8th

Duncan Presant - Apr 10, 2024

In March, the pace of employment in Canada decelerated, leading to an increase in the unemployment rate to 6.1% (+1% from a year ago), even as hourly wages stayed high.

THIS WEEK’S RECAP:

▪ In March, the pace of employment in Canada decelerated, leading to an increase in the unemployment rate to 6.1% (+1% from a year ago), even as hourly wages stayed high. In contrast, the US job market remains robust, with the addition of +300,000 new jobs and a steady unemployment rate of 3.8%. This contrast highlights the diverging paths of the Canadian and US economies and supports our expectation that Canadian interest rates are likely to be reduced earlier than those in the US.

▪ The Bank of Canada's latest Business Outlook and Consumer Expectation surveys reveal a more optimistic economic outlook and a gradual decrease in inflation expectations among businesses and consumers. Businesses are feeling a bit more positive and less worried about a recession, but their investment plans are at their lowest since 2020 due to less severe supply issues and high interest rates, even as worries about labour shortages and high wage growth expectations persist. Meanwhile, consumers are slightly more upbeat about the economy and less affected by inflation or interest rates than before, although many still plan to cut spending due to concerns over future inflation and interest rates.

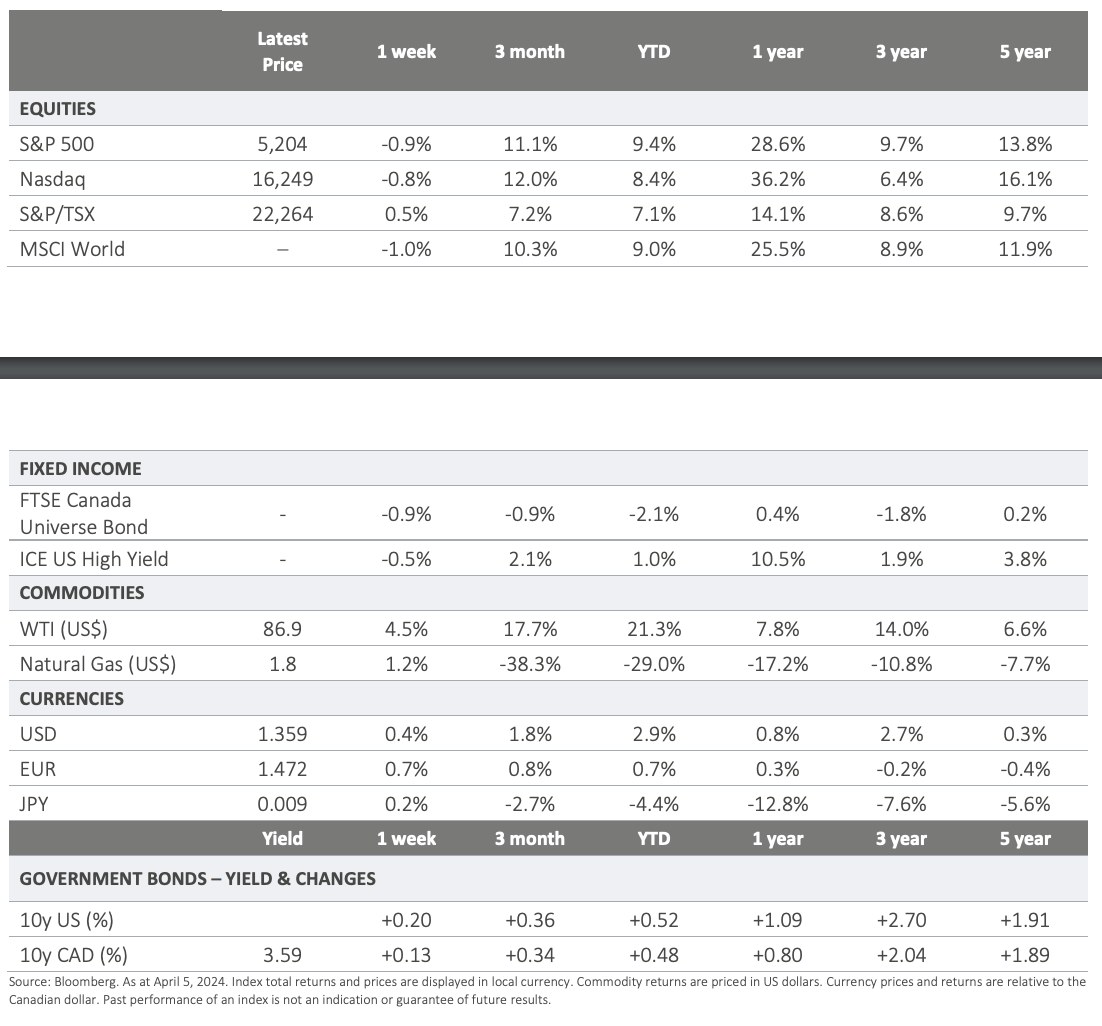

▪ Fuel prices have been climbing, with West Texas Intermediate (WTI) oil seeing a nearly 8% surge recently. Several contributing factors are to blame, including OPEC+ deciding to maintain its current production levels and the rising geopolitical tensions in the Middle East following an attack on an Iranian consulate in Syria. On the home front, the situation is worsened by the Canadian carbon tax increase that kicked in on April 1st, further inflating pump prices.

▪ Inflation rates in the Eurozone took a slight dip, surpassing expectations for both headline and core rates. CPI decreased to 2.4% from 2.6% while core inflation, which strips out the fluctuating costs of food and energy, also dropped to 2.9% from 3.1%. While services price inflation remains unchanged at 4%, the overall progress towards the 2% inflation target confirms a rate cutting cycle is increasingly near. While the story is similar in Canada, the U.S. is experiencing a slower path to more stable prices.

▪ In March, China's manufacturing sector experienced growth for the first time in six months. The manufacturing purchasing managers' index reached 50.8, signifying expansion. However, the data from other Asian economies presented a contrasting picture. Manufacturing activities in Japan, South Korea, and Taiwan faced contraction during the same period, largely attributed to weakened domestic demand.

ON DECK FOR NEXT WEEK:

▪ The Bank of Canada is gearing up for a key decision on Wednesday regarding potential interest rate cuts. Although there appears to be a justifiable basis for initiating the easing process immediately, Bank officials might opt to delay, preferring to gather more data over the next few months. This cautious approach could lead to a decision to lower rates at their following meeting in June.

▪ The big event in the US will be the release of the Consumer Price Index (CPI) for March on Wednesday morning, an important inflation measure for markets and the Federal Reserve.

▪ The European Central Bank (ECB) is scheduled to meet on Thursday, and it's facing a scenario akin to Canada's, with inflation edging back towards the 2% target amid a sluggish economic environment. Although there's an anticipation of lower rates, the ECB is expected to postpone any adjustments to its policy, likely waiting until the following meeting to initiate easing measures.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2024. All rights reserved.