Guided Planning Solutions - Summer 2023

James Schofield - Aug 21, 2023

We’ll provide an overview of 2023 so far, looking at economic signals for the rest of the year, home country bias and why bonds are a better investment now than last year, with concluding thoughts on managing cash in a high interest rate climate.

We hope you’re enjoying the summer, despite the extreme weather events we’ve seen over the last few weeks. This is a great time to golf, work on home projects, relax by the lake, and catch up on the economy and markets with our Guided Planning Solutions! In this edition, we’ll provide an overview of 2023 so far and look at what the economic data is signaling for the rest of the year, from there we’ll take a closer look at home country bias and why bonds are a better investment now than they were a year ago. We’ll conclude with some thoughts on managing cash in a higher interest rate environment – grab yourself a lemon iced tea, find a comfy spot in an air-conditioned room, and let's dive into our latest GPS!

R is for rally, not recession:

Let's start with some positive news – Global stock markets have been on fire in the first half of 2023! In Canada, the TSX rose 4% climb, while in the U.S., the S&P 500 soared 13.2%. The technology-heavy Nasdaq index was the star performer, skyrocketing a whopping 28.7%. Globally, the MSCI World index is up 11.4%[i] and it’s not just markets that are looking good. We’re seeing cooling inflation, a tighter job market, and central banks taking a more cautious approach to rate hikes compared to last year. All these factors paint a rosy picture for the investment landscape. The idea of a “soft landing,” where economic activity slows without triggering a full recession, is gaining traction. So, let’s dive into sector performance, inflation, and the labor market before discussing where we might be headed next.

The Magnificent Seven

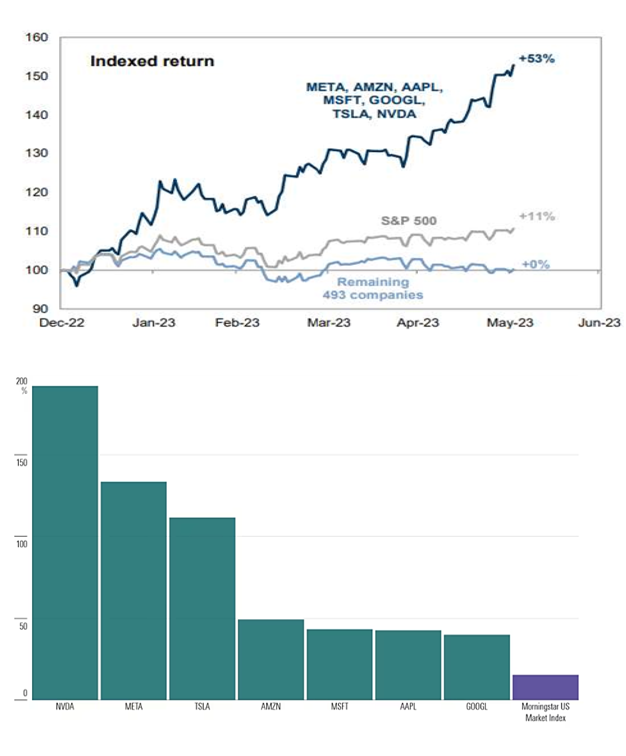

As many of your portfolios are heavily allocated in the US, we’re using the S&P 500 index in figure 1, below.

In the first half of 2023, the S&P's stellar performance was largely driven by, what we call, the "Magnificent Seven" – seven mega-cap stocks[ii]: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Here are their returns at the halfway mark of 2023: Apple shot up 46%, Microsoft climbed 40%, Google saw a 25% increase, and Amazon surged by an impressive 52%. But the real stars were Nvidia, soaring by a jaw-dropping 179%, Tesla racing ahead by 109%, and Meta with a remarkable 134% return. These companies have wowed investors with their investments in Artificial Intelligence. Nvidia's stock rally can be attributed to the surging demand for its chips, used to train AI programs like OpenAI's ChatGPT. Meanwhile, Microsoft, Alphabet, Apple, and Meta have all embraced AI tools for their products and services, further boosting investor excitement.

Since the end of May, the U.S. stock market rally has expanded, suggesting positive returns across more companies and sectors. This broader rally increases confidence in a soft landing. It could mean that investors who sat on the sidelines in the first half of 2023 are starting to get comfortable with investing again, fearing they’ve miss out on the Magnificent Seven, they’re hoping to purchase stocks that are still undervalued! Though your portfolios own a piece of each member of the magnificent seven, you own smaller proportions compared to the S&P 500. We feel good about this relative under allocation, going forward.

Figure 1

Inflation:

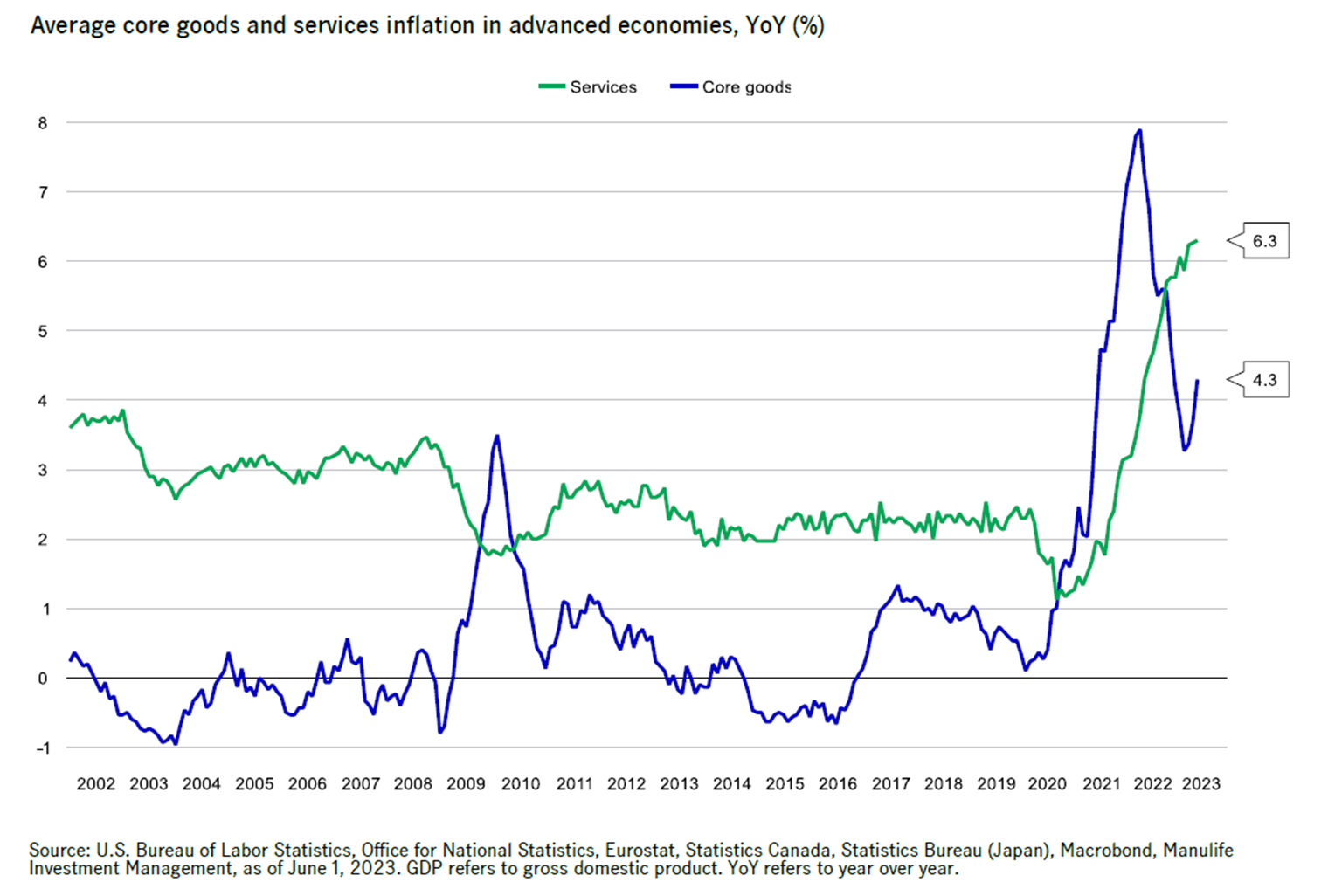

Inflation has risen over the past 2.5 years due to soaring goods prices. However, factors contributing to the surge, like energy, food, and shipping costs, have eased this year. Thus, inflation inches closer to three percent.

The recent drop in inflation since last summer largely results from base-year effects. This means current year inflation rates are compared to elevated prices from the previous year. For instance, crude oil and wheat prices surged nearly 60% YoY a year ago but are now down about 20% and 45%, respectively.

Expectations are for inflation to remain relatively stable this year, with a return to the two percent target being challenging. Elevated inflation puts central banks in a bind. They might raise interest rates too aggressively, risking recession, or maintain high rates longer than the market expects. The worry is that the FED and Bank of Canada might continue tightening until an economic fault line emerges.

Figure 2

Labour Market:

In Canada, the labor market is easing, with the unemployment rate rising and wage growth slowing. While, in the U.S., the unemployment rate remains near 60-year lows, and the labor market has shown resilience. However, signs of softening, such as fewer job openings and job quits, are emerging. Rooting for a weaker labour market doesn’t feel right, but since mid-2021, we’ve had way more jobs than workers to fill them, and this was part of the reason for the spike in inflation.

Though the imbalance has lessened, companies still hesitate to lay off workers due to difficulty in finding replacements. Instead, they reduce working hours to navigate economic weaknesses. Hence, ‘Number of jobs’ might not be the best gauge of economic strength during the next recession.

Bottom Line:

The year started better than expected for developed economies, with the service sector showing resilience. As a result, fears of an immediate recession have subsided for now. The relief rally in global stocks is likely to continue as inflation falls, growth remains low, but steady, and earnings rebound.

Tackling Home Country Bias

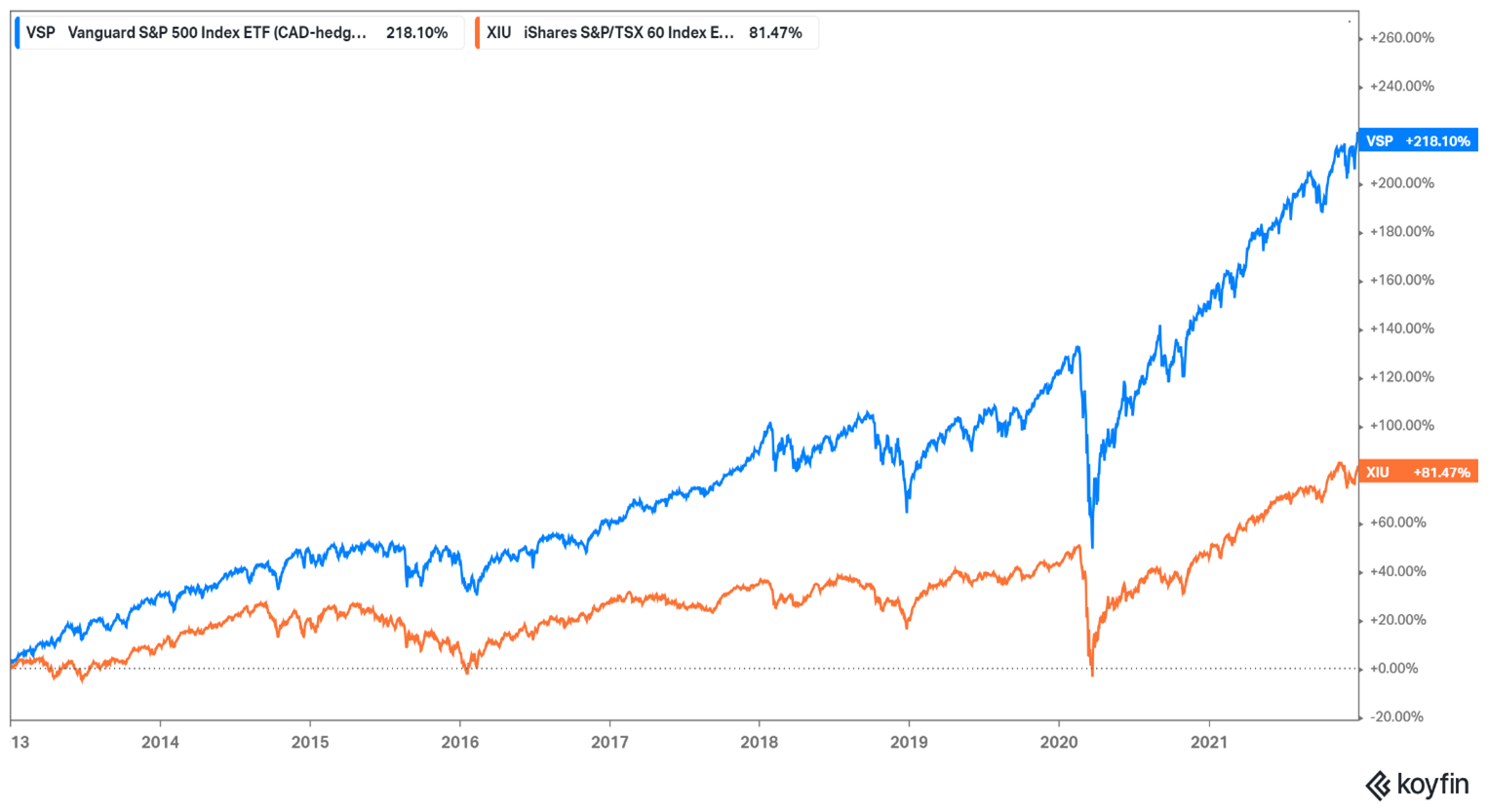

Your Assante portfolios are globally diversified, balanced and designed to meet a specific target long-term rate of return. Global diversification offers better risk adjusted returns, though it can look like a mistake over shorter periods of time. For example, in 2022, after the war broke out in Europe, Canada's market surged due to oil price spikes, while the S&P 500 lagged. But remember, Canada's market is highly cyclical and lacks sector diversification. Canadian stocks are just 3% of global equity. Since 2021, the TSX rose 26% vs. the S&P 500's 19%. Yet, from Dec 2012 to Jan 2021, the S&P returned 218% vs. TSX's 81%!

Figure 3

Figure 3

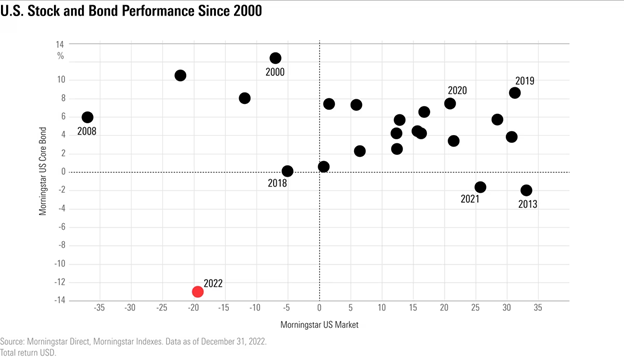

Sticking with 60/40

After 2022's decline, balanced investors questioned bonds' role as downside cushions. It is important to understand that 2022 was an anomaly, and not the norm for bonds. Last year both stocks and bonds declined in tandem for a full calendar year. The graph below shows how much of an outlier 2022 was, but we expect bonds will return to their role of portfolio shock absorber as we near the end of the tightening cycle. Bonds are also offering better yields after several years of low returns. Furthermore, if central banks decide to lower rates, even slightly, bonds can provide excellent short-term returns for portfolios. After enduring 2022's challenges, now is an opportune time for a global balanced portfolio.

Figure 4

What is notable with this graph is that every negative year for stocks was buffered by a positive/or flat year for bonds other than 2022, which highlights how unusual 2022 was.

Optimizing your cash management

One silver lining of a higher interest rate environment is that you can earn a decent return on your cash. Banks have been quick to increase mortgage rates in lockstep with the Bank of Canada, but they’ve been slower to increase rates for depositors (this is how they make money). If you like to keep a lot of cash in your bank savings account, don’t settle for the meager rate that most banks are offering. High-interest funds are now paying over 5%. If you have a variable rate mortgage, it doesn’t make sense to keep large cash reserves earning less than your current mortgage rate (6-7%). A better way to use your excess cash would be to maximize your mortgage payments.

In contrast, if you have a low fixed rate mortgage at ~2%, it only makes sense to pay the minimum. You can outperform this rate by plowing excess cash into a high interest fund until your mortgage comes up for renewal, at which point, you can use your savings to pay a lump sum against your mortgage before renewing at a higher rate.

Another way to use your cash more effectively is to reduce your source withholding tax if you’re expecting a large tax refund. By completing a T1213, you can request that your employer reduce the amount they’re withholding from your pay. If you’re expecting a $20 K tax refund, you’re essentially giving the CRA an interest-free loan until next April. A few years ago, the opportunity cost of this was low, but in 2023 you can either use that extra cash-flow to make additional mortgage payments or earn a risk-free 5%.

Blogs

If you haven't already, please check out our latest blogs, which cover broad areas of interest:

Just Laid Off From Your Tech Job? Here's What to Do Next.

How to Think About Your Flexible Compensation Options

Increased Interest Rates Means It's Time To Revisit Your Cash Management

Before Exercising Your Options, Read This!

We look forward to seeing you all again in the office, but in the meantime, as always, please let us know if there is anything we can do to help or explain things further.

Thanks for reading, and all the Best!

James, Ahmed & Steve.

Assante Capital Management Ltd.

6137293222

James Schofield, B.A., CFP®, CIM | Senior Financial Planning Advisor | Ext. 228| jschofield@assante.com

Ahmed El-Shaboury PhD, CFP®, CIM | Associate Financial Advisor |Ext. 236| aelshaboury@assante.com

Steven Hughes, B.A., CFP®, CLU, CIM | Associate Financial Advisor |Ext. 229| steven.hughes@assante.com

[i] All returns outside of Canada are converted to Canadian dollars

[ii] One way to categorize stocks and companies is by their market capitalization, or their outstanding shares multiplied by the price of those shares. To be considered a Mega-Cap stock, the value of a company’s outstanding shares have to exceed $200 Billion.