Recession worries surface

Duncan Presant - Dec 21, 2022

Given the state of the global political and economic environment, investors are being inundated with disquieting information on all fronts.

RECESSION WORRIES SURFACE

November 2022 By Richard J. Wylie, MA, CFA

Vice-President, Investment Strategy

Assante Wealth Management

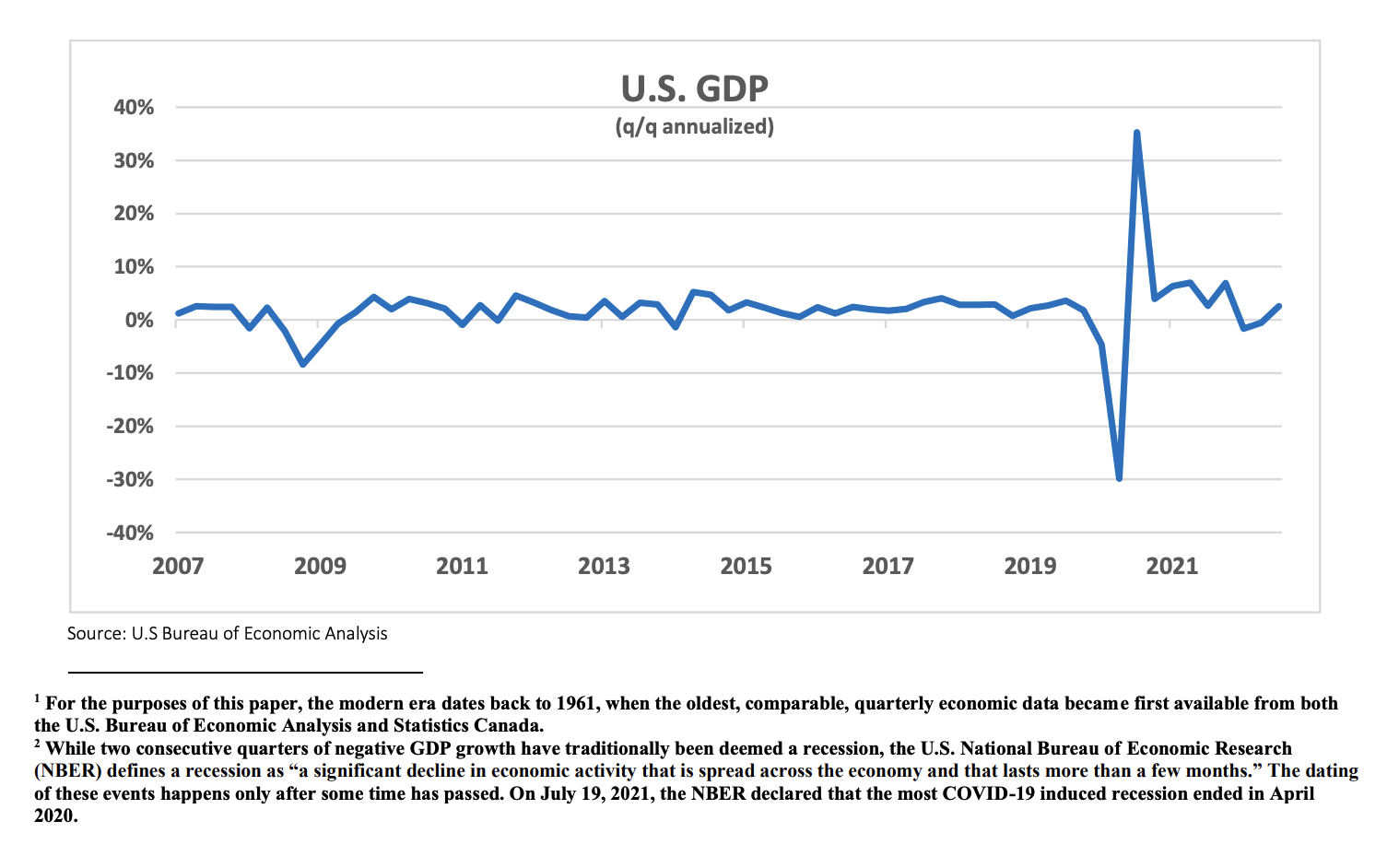

Given the state of the global political and economic environment, investors are being inundated with disquieting information on all fronts. In addition, lingering concerns over COVID-19, as it enters the endemic stage, serves as a reminder of the recessionary shock of early 2020. Still, even as the North American economies saw output recover from the economic lockdowns, fresh recessionary worries have begun to surface. As can be seen in the accompanying graph, the recession associated with the pandemic produced unprecedented economic turmoil. Quarterly, back-to-back, declines in U.S. GDP in the first half of 2020 produced a cumulative 9.6% drop in economic output. This was the largest output loss of the modern era. In fact, the largest prior cumulative decline was 3.8%, which occurred during the financial crisis. More recently, the U.S. Bureau of Economic Analysis reported two consecutive quarters of negative GDP growth, the traditional threshold for a recession2 . At this juncture, output declined a relatively modest cumulative 0.6% over the first half of 2022. As well, preliminary figures also show that the economy expanded at an annualized 2.6% in the third quarter of 2022.

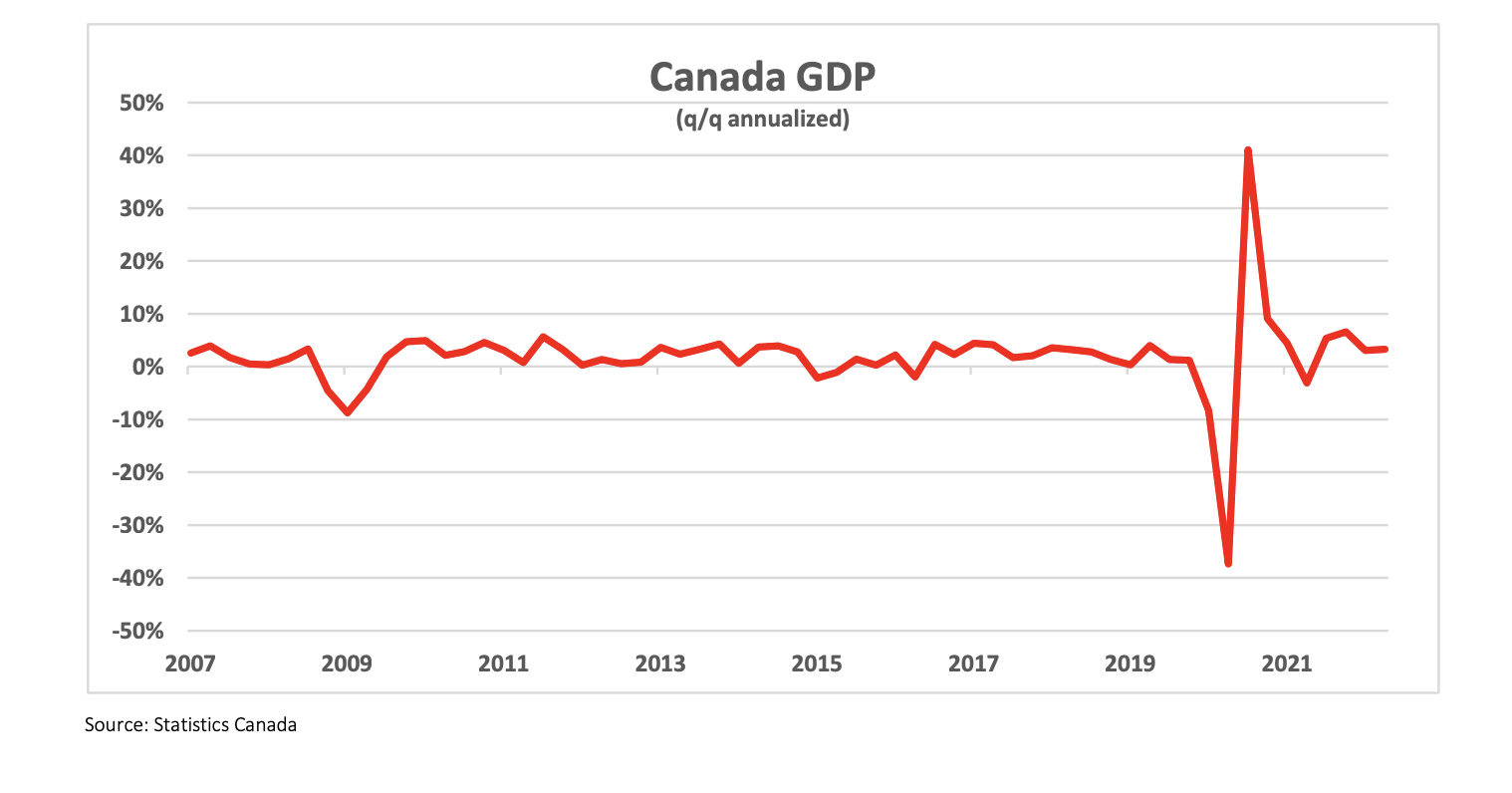

Domestically, a similar story has played out in the early stages of the pandemic. As can be seen in the accompanying graph, quarterly contractions in Canadian GDP in the first and second quarters of 2020 produced a cumulative 13.0% decline in economic output. This was also the largest output loss of the modern era for Canada. As was the case in the U.S., the largest prior cumulative decline (2.5%) also occurred during the financial crisis. Unlike the U.S., however, Statistics Canada reported two quarterly gains in GDP growth of 3.1% and 3.3%, respectively. While a domestic recession has clearly not begun, a recent spate of soft data leaves the question in place.

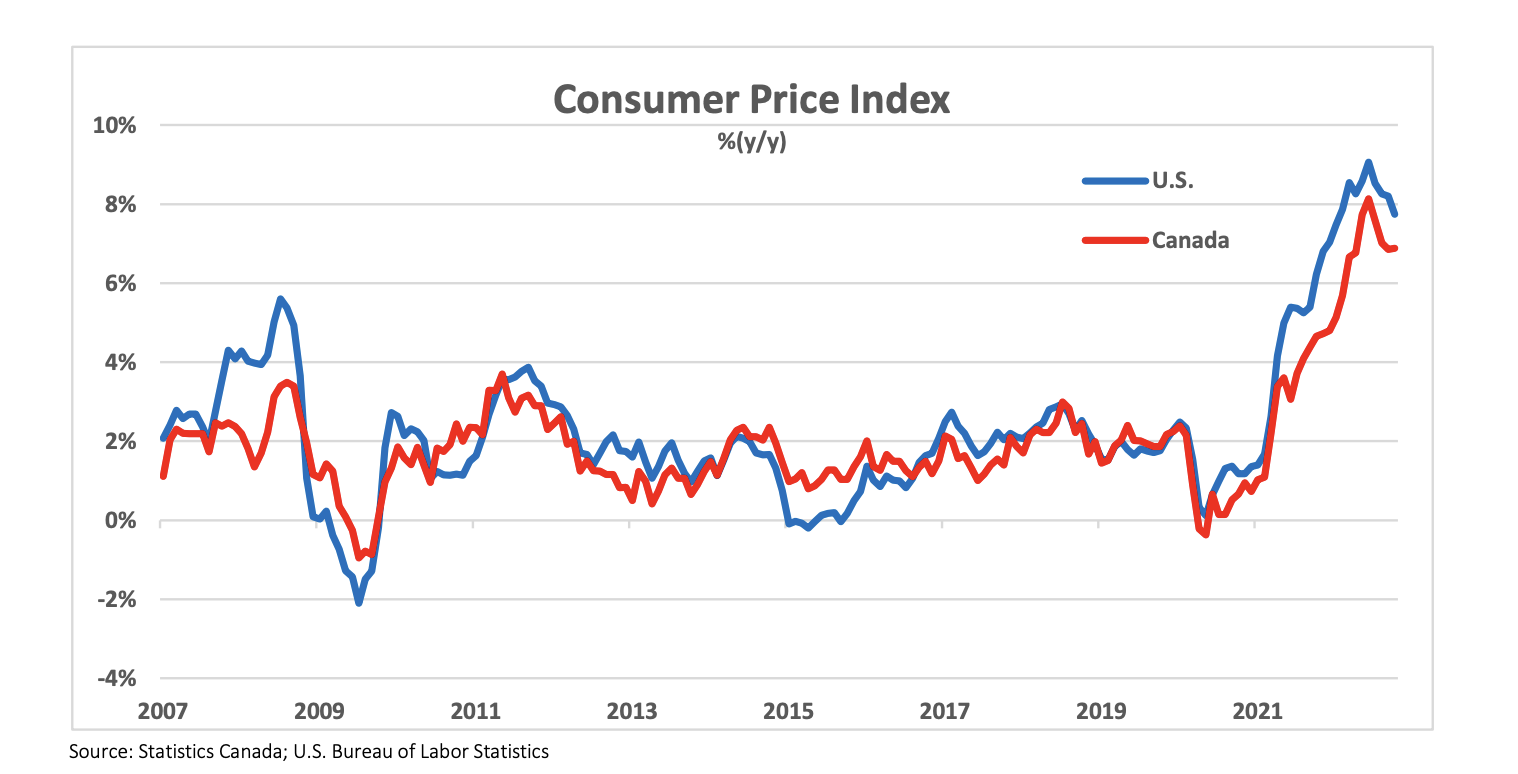

Inflation and Interest rates After an extended period of near-zero interest rates, dramatic changes are now evident. Concerns that deflation would result from the shuttering of economic activity during the pandemic gave way to the reality of significant inflationary pressures. Supplychain disruptions, coupled with unprecedented fiscal and monetary stimulus, produced consumer price pressures that had not been seen in decades. Statistics Canada reported that its Consumer Price Index (CPI) had climbed 8.1% year-over-year in June 2022, the largest increase since January 1983. Similarly, the U.S. Bureau of Labour Statistics announced that its CPI had increased 9.1% year-over-year in June 2022. This was the fastest pace of U.S. inflation since November 1981. While many market participants had called for a tightening of monetary policy early in 2022, both central banks appeared reluctant to act.

Inflation and Interest rates After an extended period of near-zero interest rates, dramatic changes are now evident. Concerns that deflation would result from the shuttering of economic activity during the pandemic gave way to the reality of significant inflationary pressures. Supplychain disruptions, coupled with unprecedented fiscal and monetary stimulus, produced consumer price pressures that had not been seen in decades. Statistics Canada reported that its Consumer Price Index (CPI) had climbed 8.1% year-over-year in June 2022, the largest increase since January 1983. Similarly, the U.S. Bureau of Labour Statistics announced that its CPI had increased 9.1% year-over-year in June 2022. This was the fastest pace of U.S. inflation since November 1981. While many market participants had called for a tightening of monetary policy early in 2022, both central banks appeared reluctant to act.

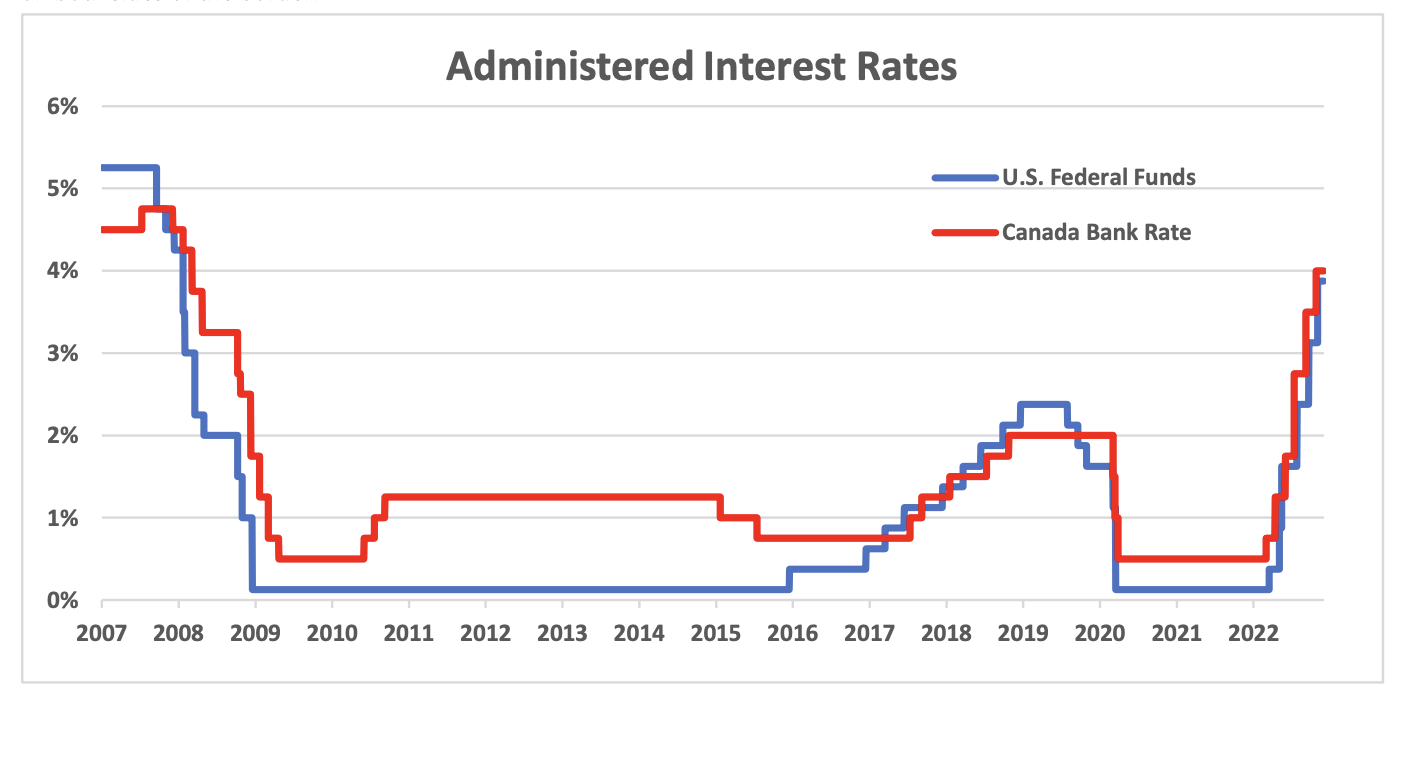

The Bank of Canada began its tightening cycle by raising administered interest rates by 25 basis points (a basis point is 1/100th of one per cent) on March 2, 2022. The now 350 basis point cumulative increase is now the largest set of interest rate increases since November 1987 to May 1990, before the current policy announcement window system came into effect. In the U.S., a first tightening move on March 16, 2022 also evolved into a cumulative tightening of 3.75%. Higher interest rates are still expected on both sides of the border.

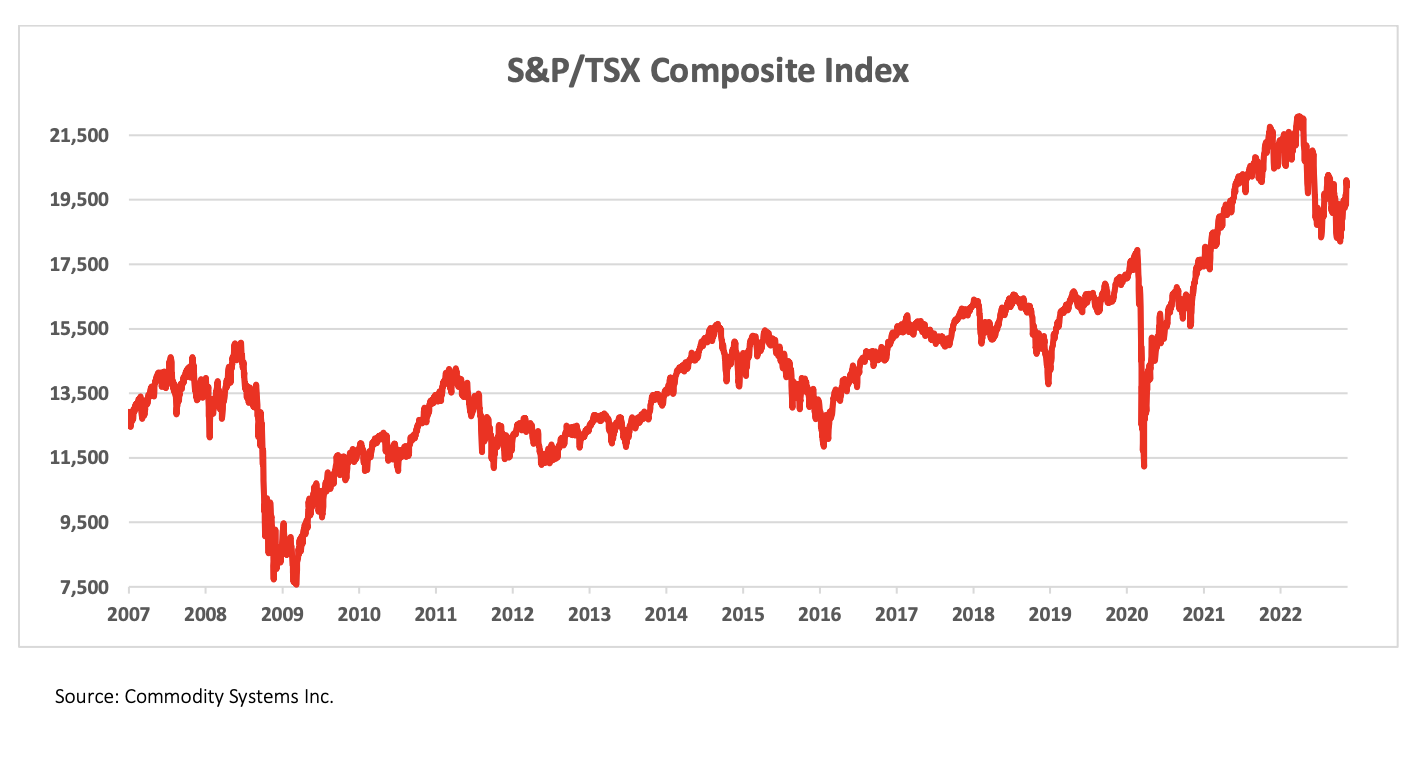

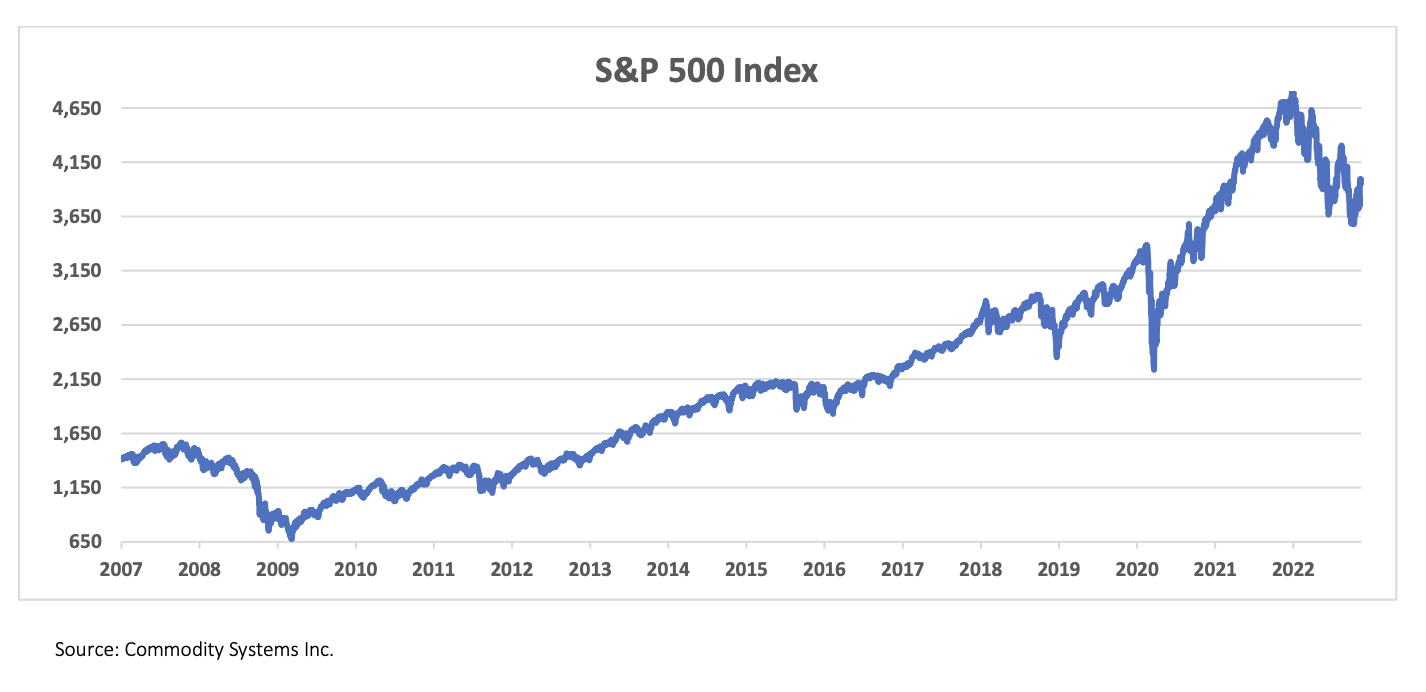

Equity markets Not surprisingly, markets have reacted negatively to the weakening economic environment. Canada’s benchmark S&P/TSX Composite index hit an all-time high close of 22,087 on March 29, 2022. This represented a 96.7% gain from the low recorded approximately two years earlier on March 23, 2020. By May 11, 2022, faltering investor sentiment had pushed the market to the correction threshold3 , as it closed at 19,837. Even though the October 12, 2022, close of 18,206 did not quite breach “bear” territory, that risk remains. Market action in the U.S. has been similar. One primary difference is that the U.S. set an all-time high earlier in 2022. On January 3, 2022, the S&P 500 closed at 4,796, an all-time high. This stood as a 114.4% advance on the March 23, 2020 low. The S&P 500 broke through the “correction” threshold on February 22, 2022 and moved into “bear” territory on June 13, 2022. The most recent low close of 3,585 on October 12, 2022 represents a 25.4% decline over the 10-month period. Equity markets tend to move ahead of the business cycle. The lingering “recession” uncertainty can be expected to cloud market sentiment for some time yet.

CONCLUSIONS

CONCLUSIONS

• Sharp increases in inflationary pressures and subsequent interest rates hikes have and will continue to dampen economic activity. The ability of central banks to return monetary policy to a place of greater stability remains in question.

• A significant move down in the equity market typically precedes a recession. However, such a move is not a guarantee that a recession will follow, and Canada may be able to avoid an economic contraction over the near term.

• Investors that have put cash to work during slower economic periods or when markets have posted a significant retreat have traditionally reaped the rewards when the inevitable rebound occurred. Taking advantage of professional advice and a disciplined approach can help dampen the emotional response that can accompany a softening in the economy.

The information contained herein consists of general economic information and/or information as to the historical performance of securities, is provided solely for informational and educational purposes and is not to be construed as advice in respect of securities or as to the investing in or the buying or selling of securities, whether expressed or implied. This document may contain forward-looking statements. These statements reflect what CI Assante Private Client, and the authors believe and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. Neither CI Assante Private Client nor its affiliates, or their respective officers, directors, employees or advisors are responsible in any way for any damages or losses of any kind whatsoever in respect of the use of this document or the material herein. You should seek professional advice before acting on the basis of information herein. CI Assante Private Client is a division of CI Private Counsel LP. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. This document may not be reproduced, in whole or in part, in any manner whatsoever, without the prior written permission of CI Assante Private Client.© 2022 CI Assante Private Client, a division of CI Private Counsel LP. All rights reserved.