Market Pulse - The week in review - July 3rd 2023

Duncan Presant - Jul 05, 2023

Major central bankers met at the annual European Central Bank conference in Sintra, Portugal.

THIS WEEK’S RECAP:

▪ Major central bankers met at the annual European Central Bank conference in Sintra, Portugal. The keynote panel included leaders from the US, EU, UK and Japanese central banks, and the message was rather unified and clear (excluding Japan): interest rates will remain higher for longer. Although each jurisdiction is confronting distinct challenges, they are collectively striving to address the common issue of inflation. Japan, however, has been grappling with chronically low inflation for many years, which has made them more inclined to tolerate price pressures despite facing inflationary forces.

▪ Canada inflation watch: May Consumer Price Index (CPI) recorded a YoY increase of 3.4%, which is 1% lower than the previous month's figure. This decline is largely attributed to base effects, as high fuel costs from the same period last year are no longer included in the annualized calculation. Overall, key categories within the CPI improved, indicating that broad inflation is indeed trending lower. This development should provide some comfort to the Bank of Canada as they approach their rate decision on July 12th

▪ China stands out among major economies due to its relatively stable prices. Instead of grappling with inflationary concerns, China's primary focus is achieving a growth rate of 4.5-5%. Despite a robust start to the year, various economic indicators suggest a slowdown in the second quarter. To boost economic activity, the People's Bank of China (PBOC) has adopted a more accommodative policy stance. However, investors are particularly interested in how the government will target policy adjustments on the fiscal front to stimulate growth. This aspect will be a significant narrative to monitor in the coming weeks and months.

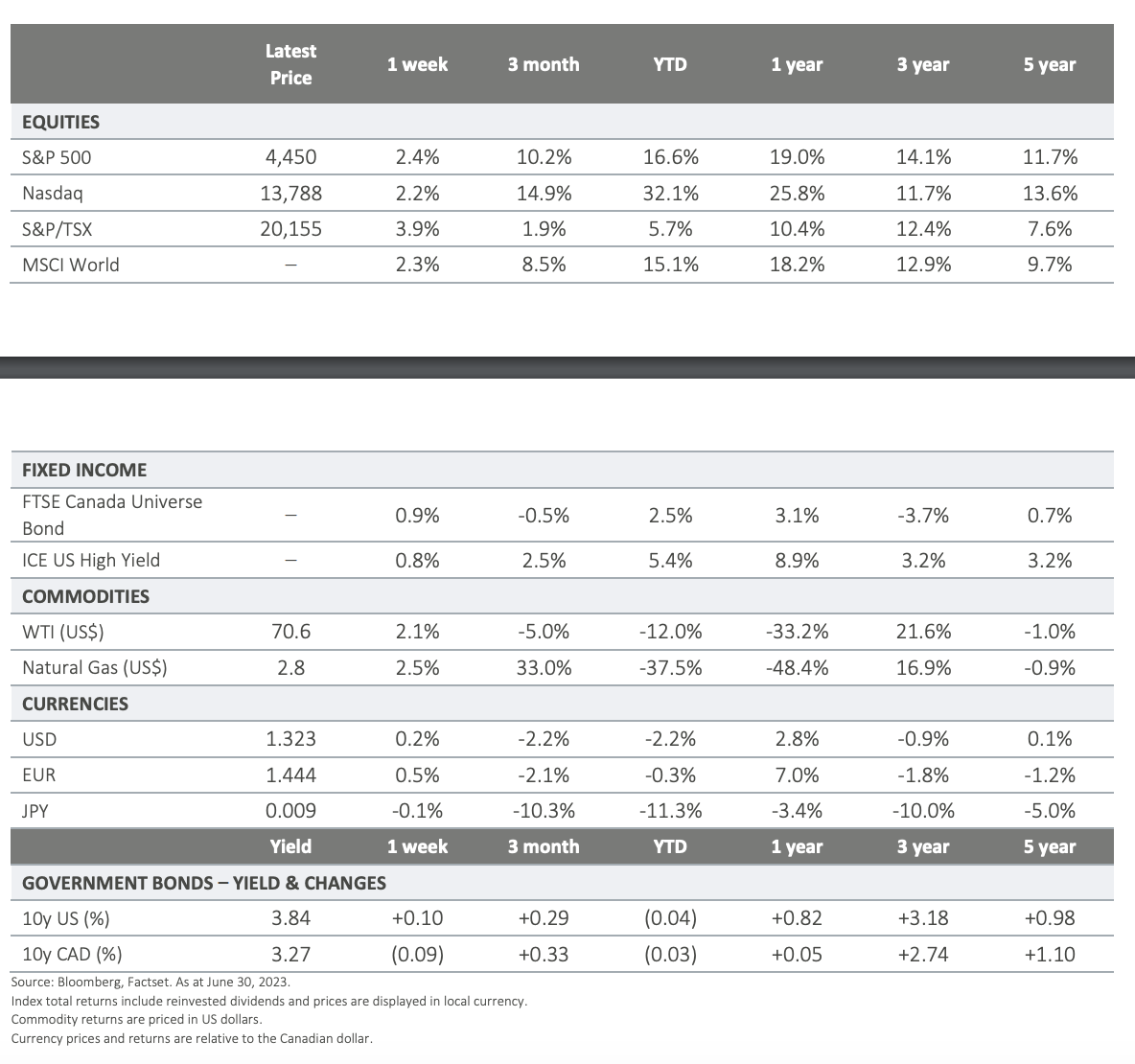

▪ As the month and quarter drew to a close, market activity was subdued. However, notable reactions, particularly in fixed income, were observed in response to high-frequency data and economic data revisions that would typically elicit minimal response. As we enter the calmer summer months, it serves as a reminder to anticipate outsized reactions on data releases across various asset classes.

ON DECK FOR NEXT WEEK:

▪ Despite it being a holiday shortened week, the US will provide updates on manufacturing and services activities, and along with Canada, will report on June employment Friday.

▪ Looking ahead, the Q2 earnings season starts in earnest next week. First up will be US banks, an important barometer both for earnings, and the health of the economy.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS. This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties andCI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. CI Global Asset Management is a registered business name of CI Investments Inc. © CI Investments Inc. 2023. All rights reserved.