Family Matters: Intergenerational Wealth Transfers

Duncan Presant - Mar 12, 2024

With the transition of the baby boomers – the largest age cohort in Canada1 – to retirement, many are thinking about their retirement and estate plans and options to transfer wealth across generations.

With the transition of the baby boomers – the largest age cohort in Canada1 – to retirement, many are thinking about their retirement and estate plans and options to transfer wealth across generations. This has led to what is referred to as “The Great Wealth Transfer,” the ongoing transfer of wealth that will see approximately $1 trillion passed on by baby boomers to Gen Xers and millennials by 2026, the largest intergenerational transfer of wealth in Canada’s history.

The current economic climate has also inspired gifting as many Gen Xers and millennials struggle to make ends meet given soaring inflation and high borrowing costs. Many parents and grandparents have turned their thoughts to “gifting while living” instead of at death to help family members meet current demands while enjoying the benefits of seeing their kids and grandkids enjoy the assets.

Attribution Rules

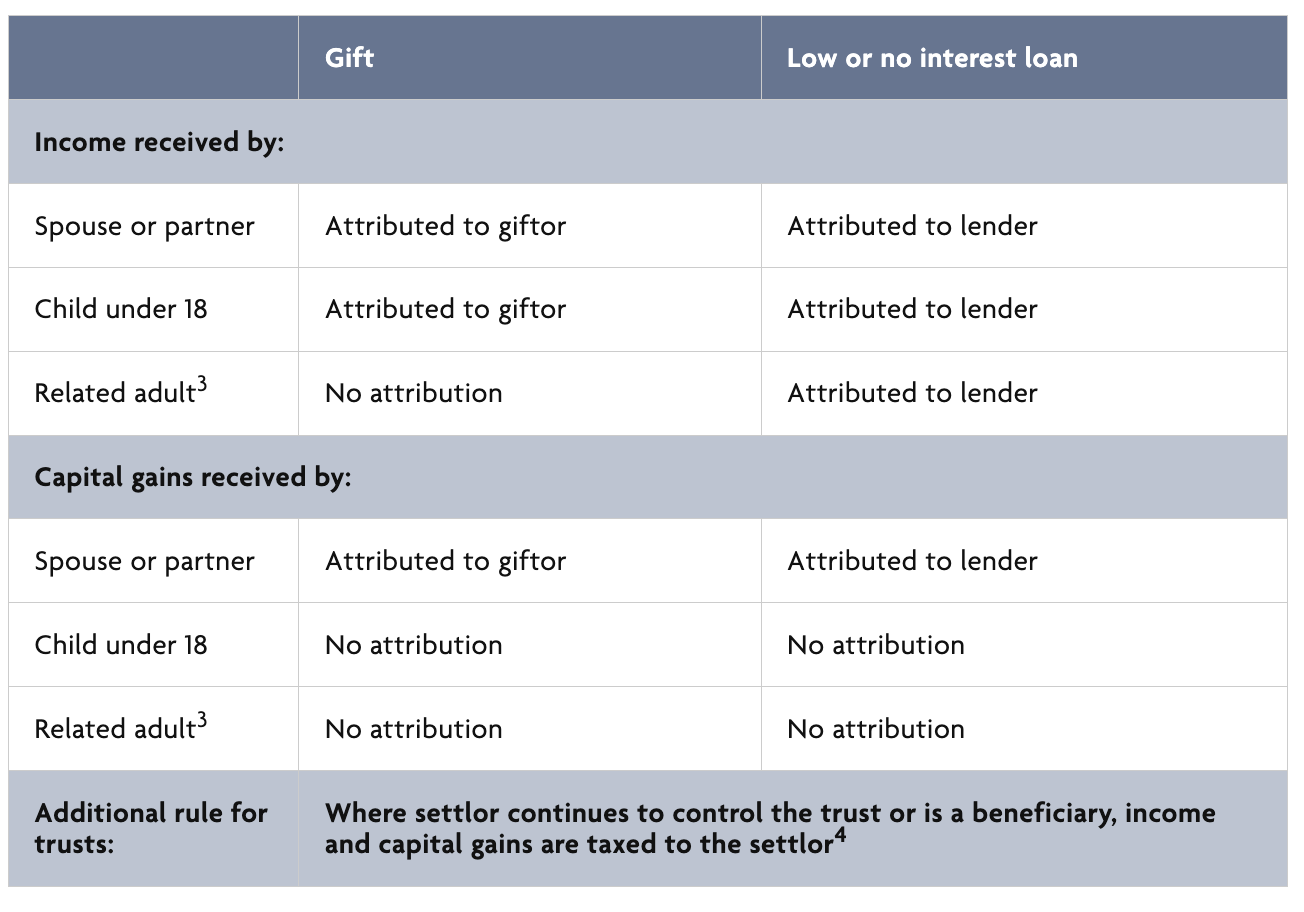

When thinking about in-family asset gifts, consideration should be given to attribution rules designed to prevent certain income- splitting transactions within a family. Several attribution rules within the federal Income Tax Act (ITA) are aimed at individuals, corporations, and trusts. For this article, we will focus on transfers involving individuals and trusts and how the attribution rules might impact certain gifting arrangements.

Where assets are gifted to a related minor (e.g., child, grandchild, niece, or nephew), future income from the gift is generally taxed in the hands of the gifting parent or grandparent until the year the child or grandchild reaches the age of 18. Beyond age 18, attribution does not apply to future income. Capital gains earned post-transfer are normally taxed to the child or grandchild regardless of age. Subject to certain exceptions, these rules also apply to gifts via a trust. The following table discusses the rules for gifts and low or no interest loans to family members.

The attribution rules cease at death, so are generally only a concern for gifts while living. Understanding how the attribution rules apply to in-family transfers can help define when and how to structure gifts to maximize benefits.

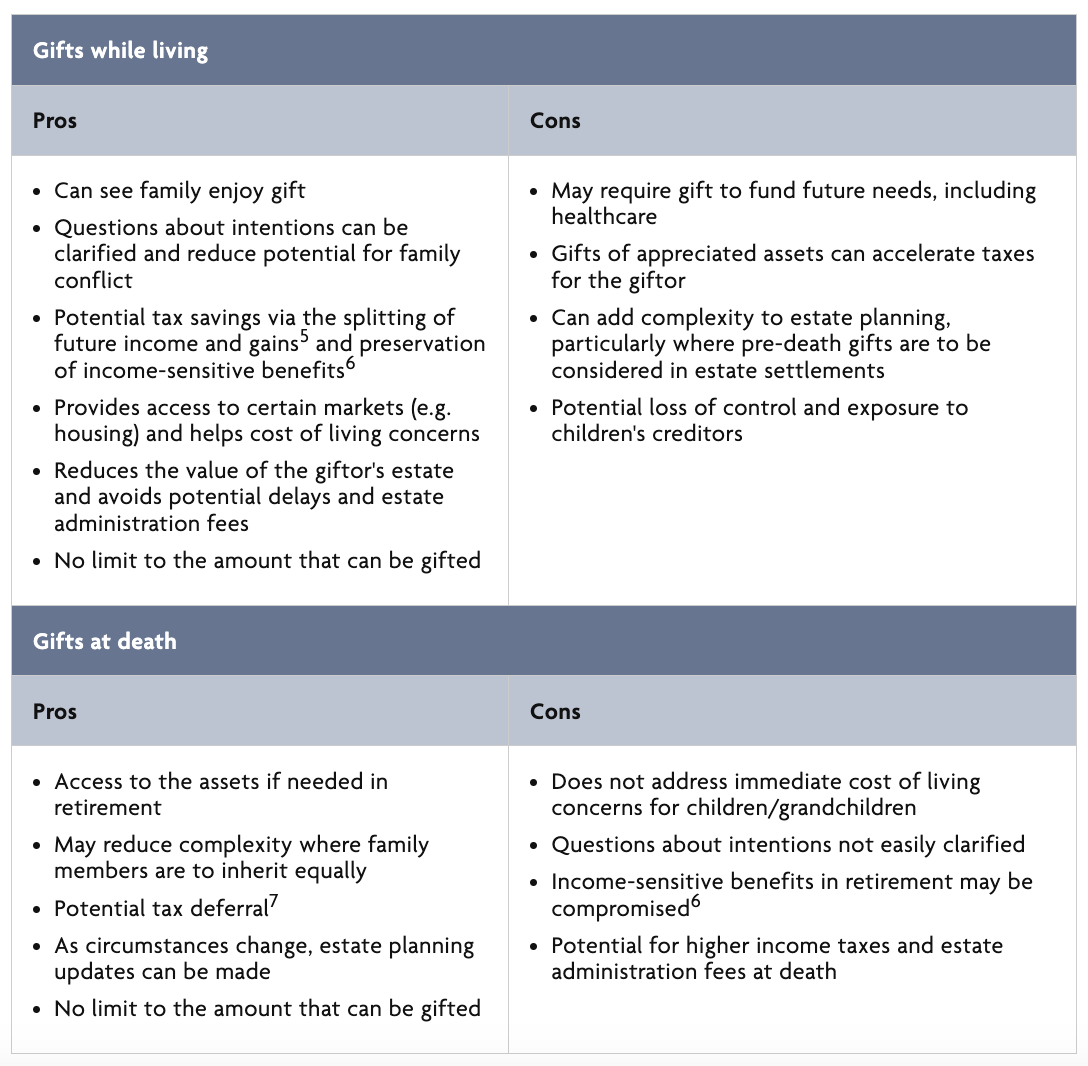

Gifts While Living Versus at Death

With high housing costs, soaring inflation and tricky job markets, many parents and grandparents are leaning towards gifting while living instead of (or in addition to) gifts at death. While no one solution fits for all families, the pros and cons of each option can help determine the best fit.

Gifting While Living: Common Strategies

There are strategies families can consider for inter vivos transfers. Some of the most common include:

Gifts to minors: While the attribution rules apply to income from gifts to related minors, they do not apply to capital gains. This creates an income-splitting opportunity for gifts to minors where the gift will be used to earn capital gains from capital appreciating assets. Non-dividend paying stocks or corporate class mutual funds that generate primarily capital gains or capital gains dividends can be a solution. Contributions to RESPs can also be a way to share wealth tax-efficiently with minors.

Gifts to adults: Gifts to adults (including children and grandchildren) are not subject to the attribution rules and, depending on the tax brackets of all involved, benefit from a tax-efficient sharing of wealth. Giftors should be cautious with gifts in-kind; where appreciated capital assets are gifted, capital gains tax can arise at that time, accelerating a tax bill for the parent or grandparent. This form of gifting can give children access to certain markets (e.g., housing) and can allow for their contribution to registered plans, including RRSPs, TFSAs and FHSAs.

Where parents or grandparents wish for pre-death gifts to be considered in the distribution of estate assets at death – perhaps to equalize gifts for all children – they can speak with their lawyer about including a “hotchpot” clause in their will. A hotchpot clause adds the value of pre-death gifts to the value of the parent or grandparent’s estate to determine amounts to which estate beneficiaries will be entitled.

Gifts via inter vivos trusts: There may be cases where a parent or grandparent does not want to gift assets directly to a child; the child may have disabilities that make it challenging to manage assets, have spendthrift behaviours or creditors, or is part of an unstable marital relationship. In these cases, the parent or grandparent might wish to gift the assets indirectly via an inter vivos (or living) trust.

A trust is a relationship created when property is transferred by a settlor (e.g., parent or grandparent) to a trustee to hold for the benefit of a beneficiary (e.g., child or grandchild). A settlor can create a trust during his or her lifetime (an “inter vivos trust”) or as a consequence of his or her death (a “testamentary trust”).

Where a beneficiary does not have control over when or how trust assets are paid to him or her, it allows for greater control of the assets managed and paid by the trustee as defined by the trust’s settlor. For example, if specified by the trust terms, a trustee can pay assets from the trust over time instead of granting full access via a lump sum to a beneficiary child or grandchild.

Where the trust is settled during the settlor’s lifetime, it allows the assets to bypass the settlor’s estate, avoiding complex estate settlements and, where applicable, estate administration fees upon death. However, except for certain spousal, self- benefit, alter-ego, and joint partner trusts, appreciated assets transferred to the trust would normally trigger capital gains tax on the transfer. Parents and grandparents can speak with their lawyers about the pros, cons and options related to setting up an inter vivos trust and should be mindful of new trust reporting rules that can add to the cost of running a trust. Also, depending on the parties involved, settlors should keep in mind that the attribution rules typically apply even if assets are to be transferred via a trust.

Fair market value exchanges: Parents and grandparents may choose to sell assets to their children or grandchildren instead of an outright gift. Benefits of this strategy include the receipt of assets that can be used to fund retirement or any tax liability resulting from the sale of the assets. Fair market value (FMV) sales avoid the attribution rules and allow for future income- splitting. Where children do not have sufficient assets to pay full FMV upfront, parents can claim a capital gains reserve8 allowing for the realization of capital gains – and capital gains taxes – over a period of up to five years9.

Parents and grandparents should be careful with sales at less than FMV. Doing so can result in double taxation as the parent would be deemed to sell the asset at FMV while the child would establish an adjusted cost base (ACB) based on the price paid. Alternatively, families may consider a FMV sale with the proceeds payable over time, with the option to forgive an outstanding balance on death of the parent or grandparent. If the sold assets are used to earn income, attribution may apply to the income, but interest charged on the unpaid amount at the CRA prescribed interest rate could avoid the attribution rules.

Loans: Loans can effectively transfer assets to children or grandchildren to allow them to manage cost of living challenges. Attribution can apply if it can reasonably be considered that one of the main reasons for making the loan was to reduce or avoid tax. To avoid attribution of future income, interest should be charged on the loan at the CRA prescribed interest rate. If the loan will not be used to earn income, interest on the loan is not required. A loan with a parent or grandparent as a secured creditor can be an effective way to provide help while achieving a level of creditor protection where the parent or grandparent ranks ahead of other creditors. Loans can be forgiven at death, and the outstanding balance of the loan at that time can be included in a hotchpot clause to allow for equal gifts amongst estate beneficiaries.

Gifts at Death: Common Strategies

Common strategies for gifting at death include the following:

Having a will: A will allows a testator to define how his/her assets should be distributed at death. When an individual dies without a will (known as dying “intestate”), the jurisdiction where the testator lived at the time of death normally defines how the deceased’s estate would be distributed through intestacy legislation. While, in many cases, those closest to the deceased would benefit through intestacy, dying without a will can present challenges including:

future changes in legislation which might not align with wishes;

property being transferred to beneficiaries who are not able to effectively manage assets (e.g., beneficiaries with certain disabilities, beneficiaries who demonstrate spendthrift behaviour, and minors), and;

conflict between a spouse and children as children are normally entitled to estate assets under intestacy rules10.

Outlining wishes in a will helps to avoid these challenges.

Gifts via testamentary trusts: Similar to inter vivos trusts, testamentary trusts allow a settlor to transfer assets to a trustee for the benefit of a beneficiary, which may be an appropriate solution where management and/or control of assets is important post-death. Unlike an inter vivos trust, which is established before death, a testamentary trust is established upon the settlor’s death, which makes the assets subject to potentially complex estate settlements, creditors of the estate and estate administration fees. However, gifting in this manner allows access to the asset(s) throughout retirement, which can be important in periods of increasing healthcare costs. Parents and grandparents can consider gifting to children and grandchildren through a testamentary trust to protect assets and manage distributions from the trust. Generally, assets can be transferred to the trust through the deceased’s estate as per instructions in a will or by contract-level designations for registered plans11 or insurance contracts. Like inter vivos trusts, parents and grandparents should be mindful of new trust reporting rules, which can add to the cost of running the trust.

Named beneficiaries on registered plans and insurance contracts: Where permitted in the jurisdiction where the contract holder resides11, naming a child or grandchild beneficiary on a registered plan or insurance contract can expedite the transfer of assets at death and bypass the estate of the deceased for purposes of estate administration fees. Where a parent or grandparent would like to achieve these benefits but not gift the assets directly to a beneficiary, it is possible to direct the assets to a testamentary trust to allow for control and managed distributions over time. An estate planning lawyer can help draft the trust terms for such a trust.

For RRSPs and RRIFs, annuitants are reminded that tax-deferred rollovers to children and grandchildren are not possible unless the child is financially dependent and has a disability. Thus, annuitants should plan for the tax liability incurred by their estate when directing RRSP and RRIF assets to anyone other than a spouse, common-law partner, or child with a disability.

Tax-deferred rollovers at death: With limited exceptions12, the transfer of assets to children and grandchildren normally occurs at FMV without the opportunity to defer taxes at that time. This is generally true for both registered (e.g., RRSPs and RRIFs) and non-registered assets and includes transfers at the time of death13. With RRSPs and RRIFs, tax-deferred rollovers to financially dependent children and grandchildren are possible, provided the child/grandchild has a mental or physical disability and transfers the assets to their own RRSP, RRIF, RDSP or registered annuity14. Also, should the child/grandchild be financially dependent but not have a disability, the date of death value of the parent’s RRSP or RRIF can be taxed to the child in the current year (as opposed to the deceased parent or grandparent). While not tax-deferred in this situation, where the child or grandchild has a lower income than the deceased, tax savings can be achieved.

Joint ownership: Adding children or grandchildren as joint owners for non-registered assets15 is commonly engaged as an estate planning strategy to ease administration upon death and/or avoid estate administration fees. Depending on the circumstances, while the strategy may produce the intended results, risks include signing authority requirements pre-death, creditor concerns and the potential for conflict after death if distribution instructions are not made clear. Where joint ownership is being considered as an estate planning strategy, guidance from an estate planning lawyer is strongly suggested. Also, depending on the circumstances, adding a child or grandchild as a joint owner can create a bare trust arrangement, currently subject to the new trust reporting rules which can add to the cost of maintaining the arrangement.

Knowledge Transfers are Equally Important

“Give a fish and feed for a day. Teach to fish and feed for a lifetime.”16 This often quoted saying demonstrates the power of knowledge transfers. While wealth transfer conversations often focus on asset transfers, consideration should also be given to knowledge transfers, which can extend across multiple generations. Knowledge transfers promote dialogue, allow for shared learning and create opportunities to connect resources – all of which are important to the intergenerational wealth planning conversation.

To open this article in a shareable format, click here.

1 Source: Statistics Canada

2 Source: Maclean’s

3 Non-arm’s length relationship (e.g., child, parent)

4 Federal Income Tax Act, section 75(2)

5 Subject to the attribution rules, particularly involving minors and trusts.

6 Examples include Old Age Security (OAS) benefits and the Age Credit for the gifting parent or grandparent.

7 Refers to capital gains taxes triggered by transferring assets at death versus while living.

8 In respect of appreciated capital assets.

9 A 10-year period is available for certain farming and fishing properties and qualified small business corporation shares.

10 Exceptions apply for residents of Alberta and Manitoba where children of the deceased are also children of the surviving spouse.

11 Contract-level designations are generally not available for registered plans in Quebec.

12 The transfer of certain farming and fishing properties can be transferred on a tax-deferred basis to children and grandchildren.

13 The value of TFSAs on the date of death normally transfer tax-free.

14 A Pooled Registered Pension Plan (PRPP) and Specified Pension Plan (SPP) are also eligible plans.

15 Joint ownership with a right of survivorship. Not available in Quebec.

16 Source is unconfirmed, but quote is believed to date back to the late 19th century.

About the Author

Wilmot George Jr., CFP, TEP, CLU, CHS

Vice-President

Tax, Retirement and Estate Planning

Throughout his career, Wilmot has held progressive positions in the areas of tax and estate planning, financial planning, banking, and securities analysis. He has completed numerous courses related to taxation, securities and mutual fund investing, insurance and estate planning. Wilmot received his Bachelor of Arts Degree (with Honours) in Mathematics for Commerce from York University. He also holds the Certified Financial Planner (CFP), Trust and Estate Practitioner (TEP), Chartered Life Underwriter (CLU) and Certified Health Insurance Specialist (CHS) designations. Since 2001, Wilmot has spent his time guiding financial advisors on tax and estate planning matters through presentations, one-on-one consulting and written communication.He has been featured in various financial forums including The Globe and Mail, The National Post, Advisor.ca, and Investment Executive. Additionally, Wilmot has delivered presentations for The Financial Advisors Association of Canada (Advocis), the Society of Trust and Estate Practitioners (STEP) and The Institute of Advanced Financial Planners (IAFP). Away from work, Wilmot enjoys various sports, traveling and spending time with family and friends.

IMPORTANT DISCLAIMERS

This communication is published by CI Global Asset Management (“CI GAM”). Any commentaries and information contained in this communication are provided as a general source of information and should not be considered personal investment advice. Facts and data provided by CI GAM and other sources are believed to be reliable as at the date of publication. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI GAM has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document. Information in this communication is not intended to provide legal, accounting, investment or tax advice, and should not be relied upon in that regard. Professional advisors should be consulted prior to acting based on the information contained in this communication. You may not modify, copy, reproduce, publish, upload, post, transmit, distribute, or commercially exploit in any way any content included in this communication. You may download this communication for your activities as a financial advisor provided you keep intact all copyright and other proprietary notices. Unauthorized downloading, re-transmission, storage in any medium, copying, redistribution, or republication for any purpose is strictly prohibited without the written permission of CI GAM.