Big Tech vs Everyone Else

James Schofield - Mar 26, 2024

A quick review of the big tech stock performances in 2024.

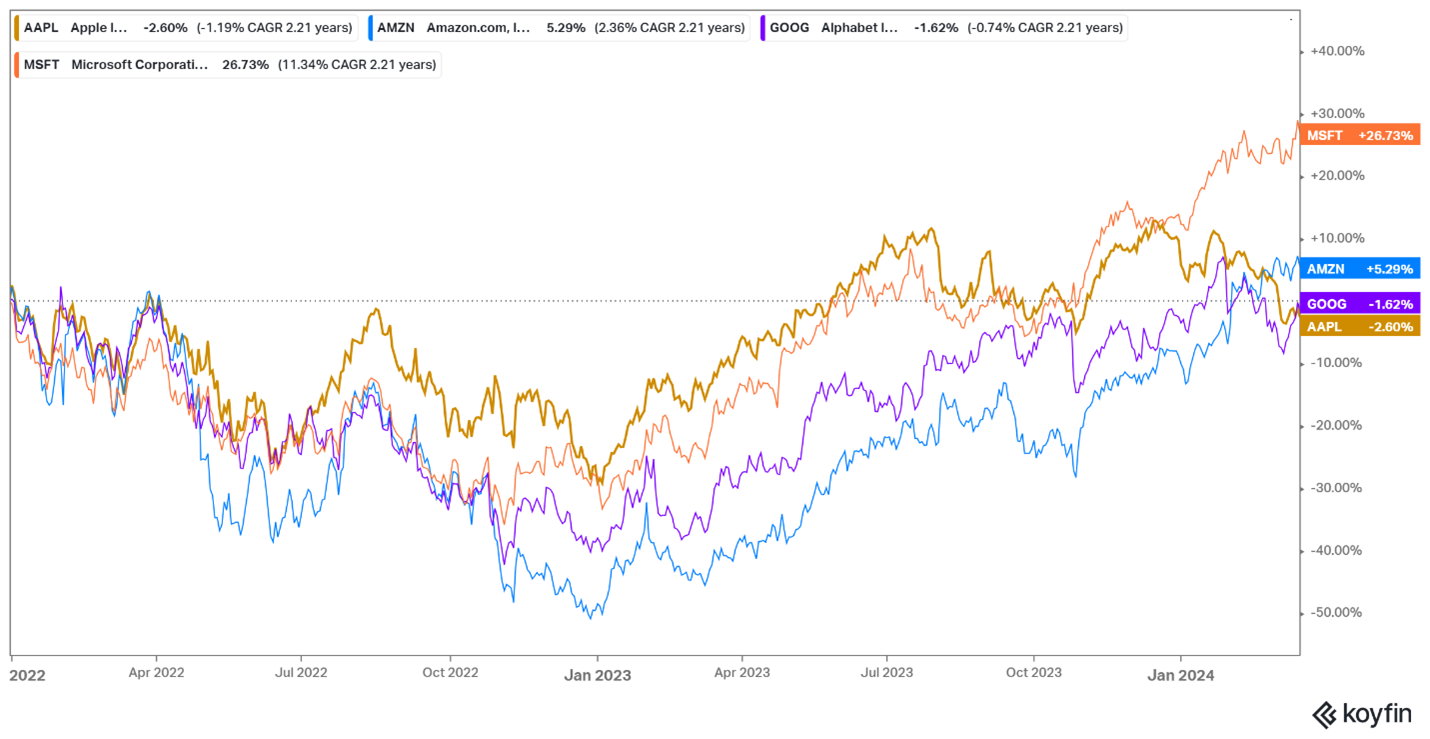

As inflation continues to fall, albeit more slowly since the beginning of 2024, the big question on investors’ minds is, will the Federal Reserve cut interest rates? It’s hard to believe a rate cut is imminent based on the current economic data. Unemployment in the US continues to hover near all-time lows, economic growth continues to exceed expectations, and inflation has been stubbornly close to 3%. For stocks, 2024 has been a continuation of 2023, with large tech companies leading the S&P 500 to new all-time highs. In our Spring 2023 GPS we mentioned some of the top holdings in your portfolios and that we thought they could get back to their 2021 highs; in some cases, they’ve already surpassed those highs (see Microsoft below).

Shareholders of Apple, Amazon, Alphabet and Microsoft have been rewarded with fantastic returns over the last two decades. Although the growth of their shares has been backed up by their profitability, investors’ expectations are high and we’re now seeing a much larger gap in valuation between the largest companies in the market and the rest.

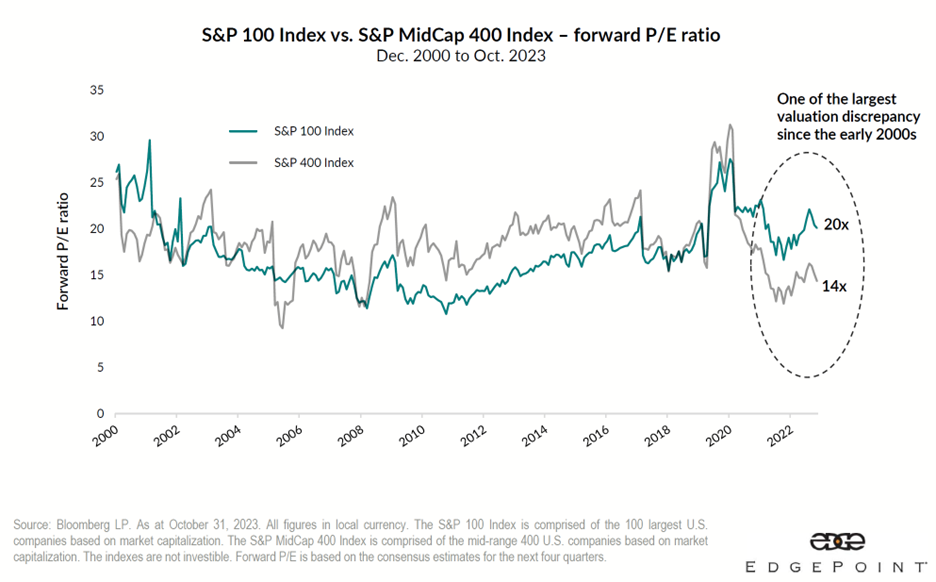

Price to earnings is only one measure of value, but a gap this wide tells us that expectations for the largest companies in the world may be getting ahead of themselves (for the top 10, the ratio is closer to 30 x!). Meanwhile, the market is not expecting much from medium and small companies as they are valued below 15 x their expected earnings.[i] Having been through more than 10 years of the largest companies dominating the market, it’s easy to forget that large cap stocks can go through extended periods of underperformance. The chart below shows the return of the S&P 500 vs. the Russell 2000 (a proxy for small and medium sized companies) from January 1, 2001, to Jan 1, 2011. This is often referred to as the lost decade for US equities and helps make the case for diversifying into smaller companies.

We continue to maintain a balanced approach, diversifying across different asset classes, countries, and industries. The largest tech companies have been relative beneficiaries of higher interest rates. They have more cash on their balance sheets, and therefore, less need to borrow at the prevailing interest rates, but if/when rates come down, smaller companies should shine and have the potential to do so even in the current environment. Though we tilt toward large companies, your portfolios are more balanced than the S&P 500. We don’t expect Apple, Amazon, Google, or Microsoft to crash, but even if they take a breather, other companies in your portfolio can help carry the load.

[i] https://yardeni.com/charts/stock-market-p-e-ratios/