[Fall 2024 GPS] Corporate Tax Changes in 2024

James Schofield - Nov 04, 2024

The 2024 federal budget introduced capital gains tax changes that came into effect in June this year. How do these changes affect corporations?

The 2024 federal budget introduced changes to capital gain taxes to take effect on June 25, 2024. As a result of these changes, the capital gains inclusion rate increased from 50% to 66.67% on capital gains over $250,000 annually for individuals and the same increase for any capital gains for corporations. In our previous GPS, we discussed the individual capital gain tax changes; in this edition, we will turn our attention to the corporate side.

As a reminder, corporate investment income is taxed as passive income for corporations at fixed rates that vary by province and territory. Unlike personal income, passive corporate investment income is not subject to graduated tax rates. The corporate tax rate on investment income is typically equal to or greater than the highest personal marginal tax rate, exceeding 50% in numerous provinces.

Before June 25, 2024, 50% of capital gains were subject to taxation (taxable capital gain), the other half of the capital gains, were allocated to the capital dividend account (CDA). No funds are deposited into the CDA. It is a conceptual account that tracks the non-taxable balance of all capital gains. Corporations may choose to distribute a capital dividend, limited to the balance in the Capital Dividend Account (CDA), allowing the shareholder to receive a tax-exempt dividend.

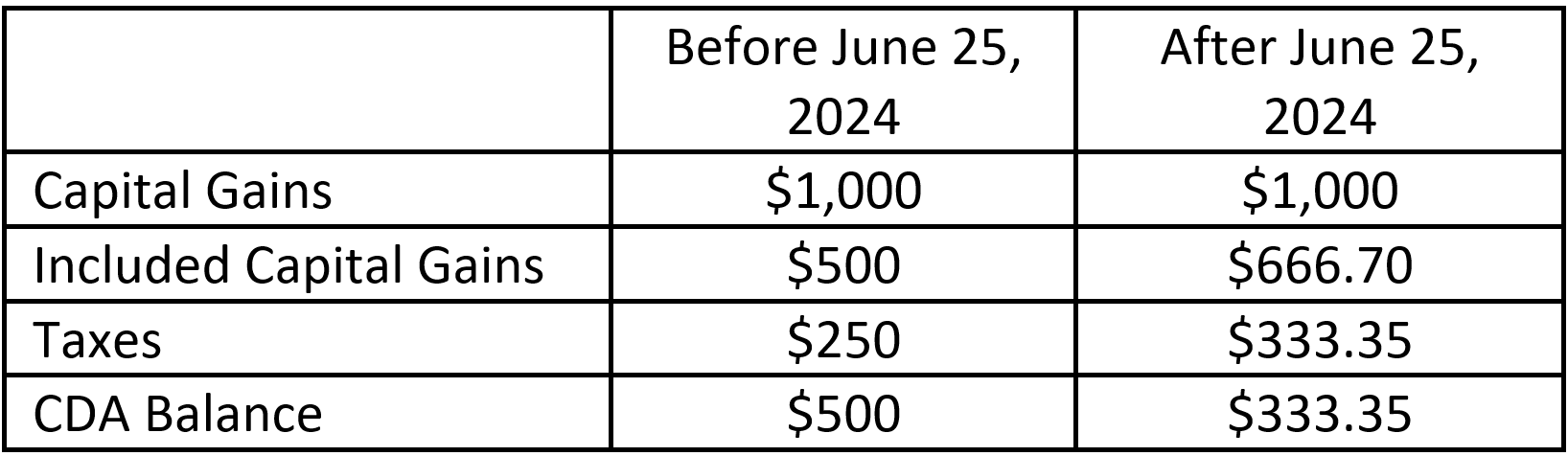

After June 25, 2024, the computation of CDA decreased from one-half (50%) to one-third (~33%). Below is an example of how the capital gain taxes and the CDA balances will be calculated before and after June 25, 2024. The calculations below assume the corporation has an investment account with realized capital gains of $1,000 and a zero starting CDA balance.

Despite the increase in the capital gain inclusion rate, capital gains remain the most tax efficient type of investment income inside a corporation. There are several planning strategies to minimize the effect of these changes, such as, tax-loss harvesting, and incorporating strategic timing of investments sales.