Market Pulse - The week in review

Duncan Presant - Oct 26, 2022

September’s Canadian inflation readings came in higher than expected but lower than previous months adding to the evidence that we have probably seen the peak for both the headline and core measures. This is in contrast with the US where inflation is

THIS WEEK’S RECAP:

▪ September’s Canadian inflation readings came in higher than expected but lower than previous months, adding to the evidence that we have probably seen the peak for both the headline and core measures. This is in contrast with the US where inflation is still reaching new highs and is consistent with the fact that the Canadian economy is more sensitive to increases in interest rates.

▪ This interest rate sensitivity is especially apparent in the housing market where the latest reading shows a significant drop in prices and sales from the peak earlier this year. While US mortgage borrowers are relatively insulated from rate hikes given the use of 30yr fixed rates, Canadian mortgages have much shorter resets and the impact of higher rates will impact borrowers as they renew.

▪ While we believe the US and Canadian economies will be able to adapt on normalized levels of interest rates, managing the shock that such a rapid and important normalization of short-term rates is causing is much more challenging. We expect to see wider signs of an economic slowdown emerge, which will eventually cause central banks to end the rate normalization. The issue is that that labor metrics lag the economic slowdown which lags rate hikes and that central bankers will continue to focus on inflation readings and jobs. The risk that rate hikes go too far too quickly is therefore quite high.

▪ The political and fiscal drama unfolding in the United Kingdom continues,with Prime Minister Truss resigning after only 44 days, the shortest tenure ever in British politics history. In a context of rising government borrowing costs, markets have clearly signaled limited appetite for uncontrolled fiscal spending. While the message was directed to 10 Downing Street, other governments should take note.

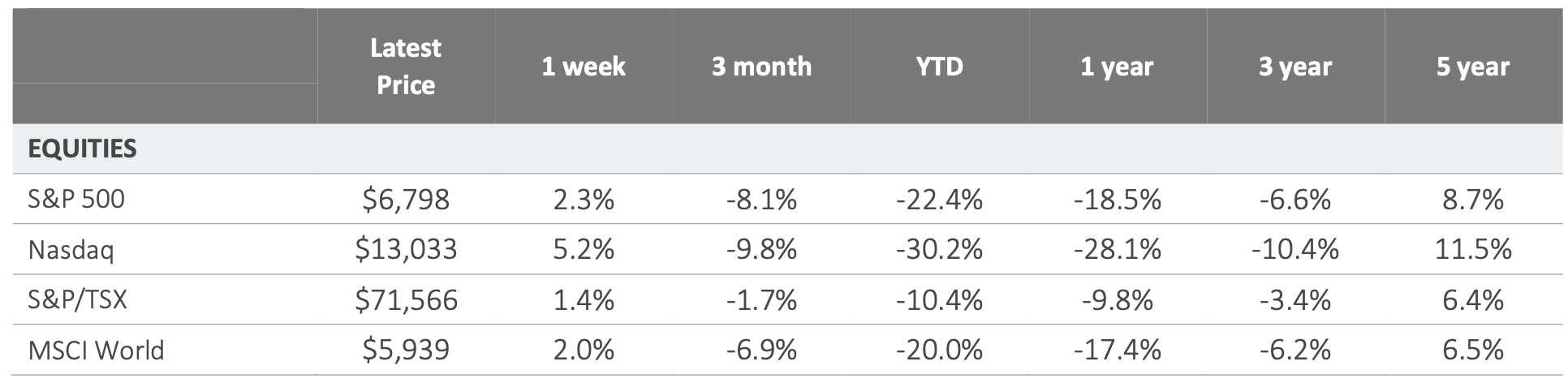

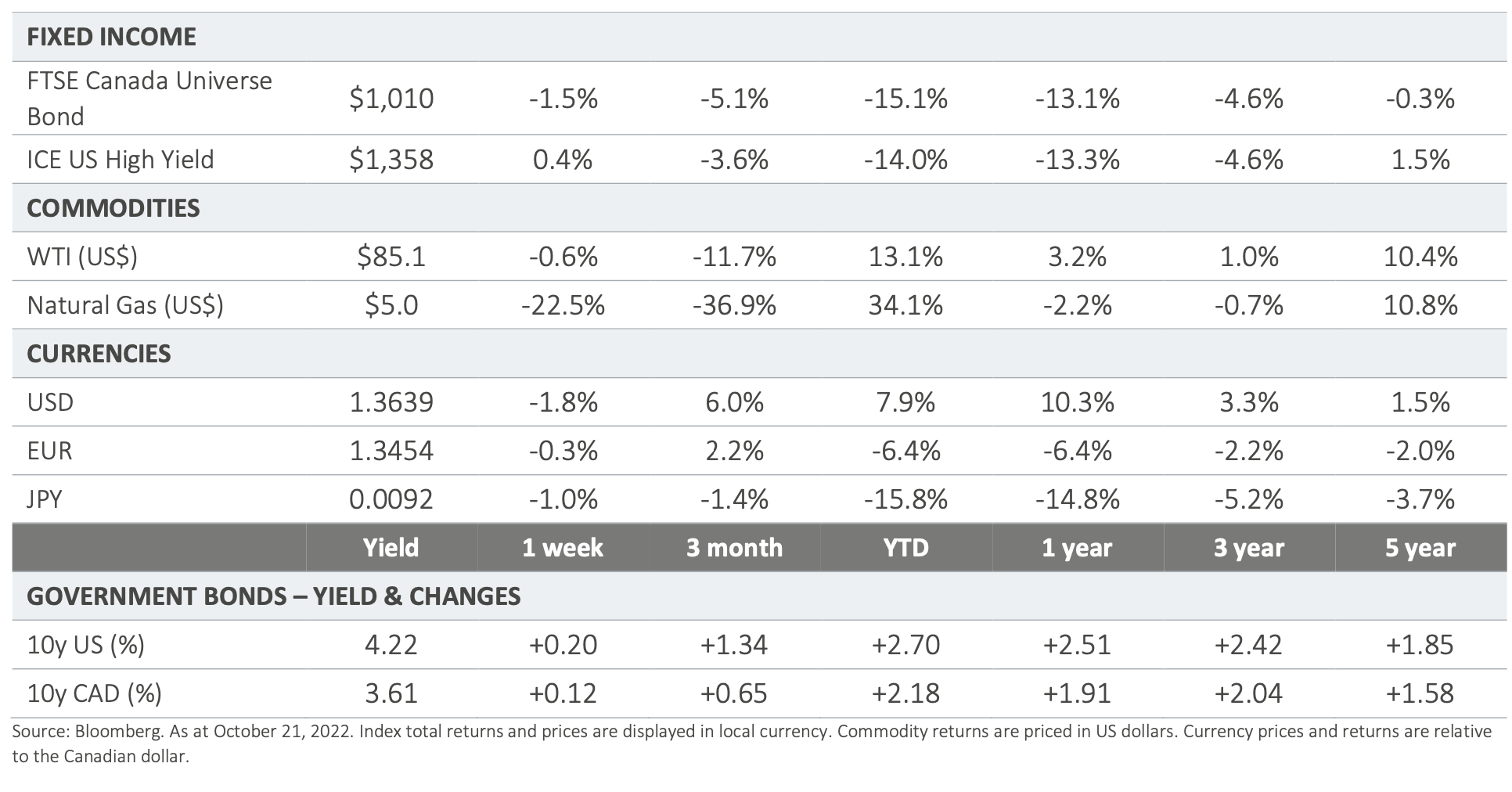

▪ The main market development this week was on the sovereign debt side. After closing above 4% on October 14th, 10y US Treasuries yields have continued their upward movement and have now crossed 4.25%, a level not seen in 15 years. Despite that impressive move,equities had a positive week,but with very volatile price action. This is consistent with our view that extremely negative positioning and sentiment could offer some support to equity markets despite the overall challenging environment.

ON DECK FOR NEXT WEEK:

▪ On Wednesday, the Bank of Canada will once again increase its target rate,with markets currently expecting a 75 basis point increase, bringing target to 4%. This is getting close to the expected cycle peak of 4.5%. Beyond the rate decision, we will be looking for any signaling from the Bank on future moves.

▪ On the data front,we will get Canada and USGDP numbers,several sentiment related indicators as well as the USPCE inflation numbers. We expect these releases to reinforce the current macro picture: stubborn inflation with more challenges on the growth and sentiment front. We expect inflation readings to decelerate significantly but given the transmission lags, this might still take a few months to materialize.

▪ Finally,the European Central Bank is also expected to increase rates by 75 basis points when it releases its decision on Thursday. Europe’s situation is complex. The energy landscape reconfiguration that is forced by the Russia-Ukraine conflict will have long-lasting impacts. Hiking rates in the face of very high inflation is the right reaction but will add to the long list of reasons why Europe’s economic growth will be increasingly challenged.

For more information, please visit ci.com.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

CI Global Asset Management is a registered business name of CI Investments Inc.

© CI Investments Inc. 2022. All rights reserved.