How should I pay myself?

During your working lives, but especially in retirement, you may end up with several sources of income. These may include an incorporated business, different types of investments accounts, real estate, pension, CPP, OAS, etc. Determining how you pay yourself with all of these different choices can be complex and confusing. One of the most common questions we get is, how should I pay myself? We can help to prepare a customized income plan in order to determine how to save the most tax from year to year and ultimately keep your investments growing for longer.

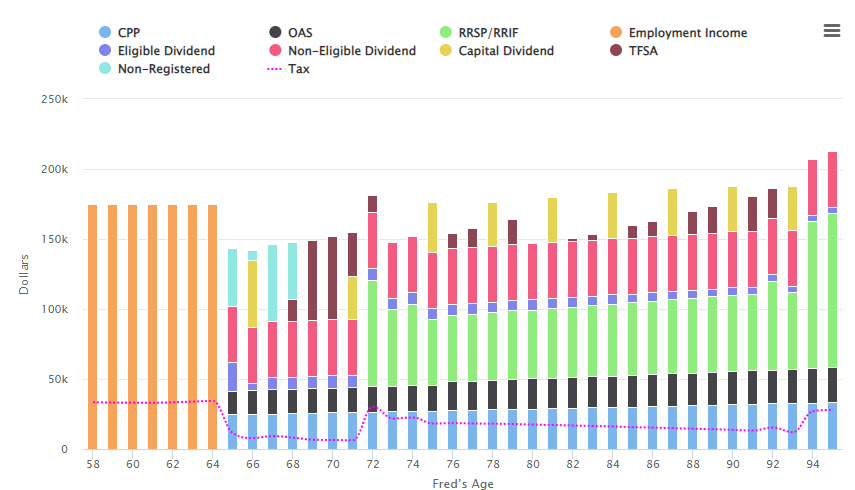

Example Income Plan