Personalized Investment Advise

When it comes to investing, it is a personalized approach that pays the greatest dividends. We can help you prepare a sophisticated investment strategy that is specifically tailored to your objectives and risk tolerance.

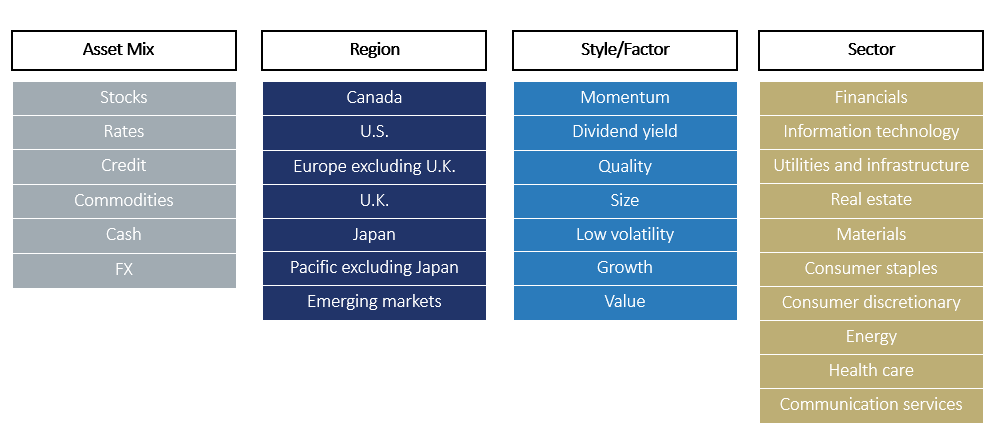

Our starting point is asset allocation, which involves dividing your investments among different assets, such as stocks, bonds, and cash. The asset allocation decision is a personal one and the allocation that works best for you changes at different times in your life, depending on how long you have to invest and your ability to tolerate risk. In our view, asset allocation is the principal determinant of investment results, over and above the selection of individual investments. Of course, we are always looking for opportunities in the market in order to make tactical decisions that complement your strategic asset allocation.

Once your appropriate asset mix has been determined, we help to choose a portfolio that matches your asset allocation profile. As a Davis Nerman Wealth Group client, you have exclusive access to a number of customized CI Assante actively managed solutions. With active management from portfolio managers around the world, these leading solutions combine investment expertise with wealth planning strategies. In addition, you will gain access to thousands of investment options through companies like CI, Mackenzie, Dynamic, Fidelity and dozens of others.

We are also constantly looking for opportunities to grow your wealth through alternative investment opportunities and sustainable or "ESG" investments. See below for additional information on both of these opportunities.

While asset location is fundamental to our process, we also believe that it must viewed through many lenses: